Office market investment to be driven by overseas buyers in 2021

Our 2021 Outlook Report has found overseas investors will drive Australia’s office market, increasing their share from 60% to 75% of buyers, particularly due to a greater acceptance of lower returns than domestic buyers

5 minutes to read

Australia's office market will be driven by overseas investors in 2021, with these buyers prepared to accept lower returns in a market that is considered to be one of the safest around the globe, according to our 2021 Outlook Report.

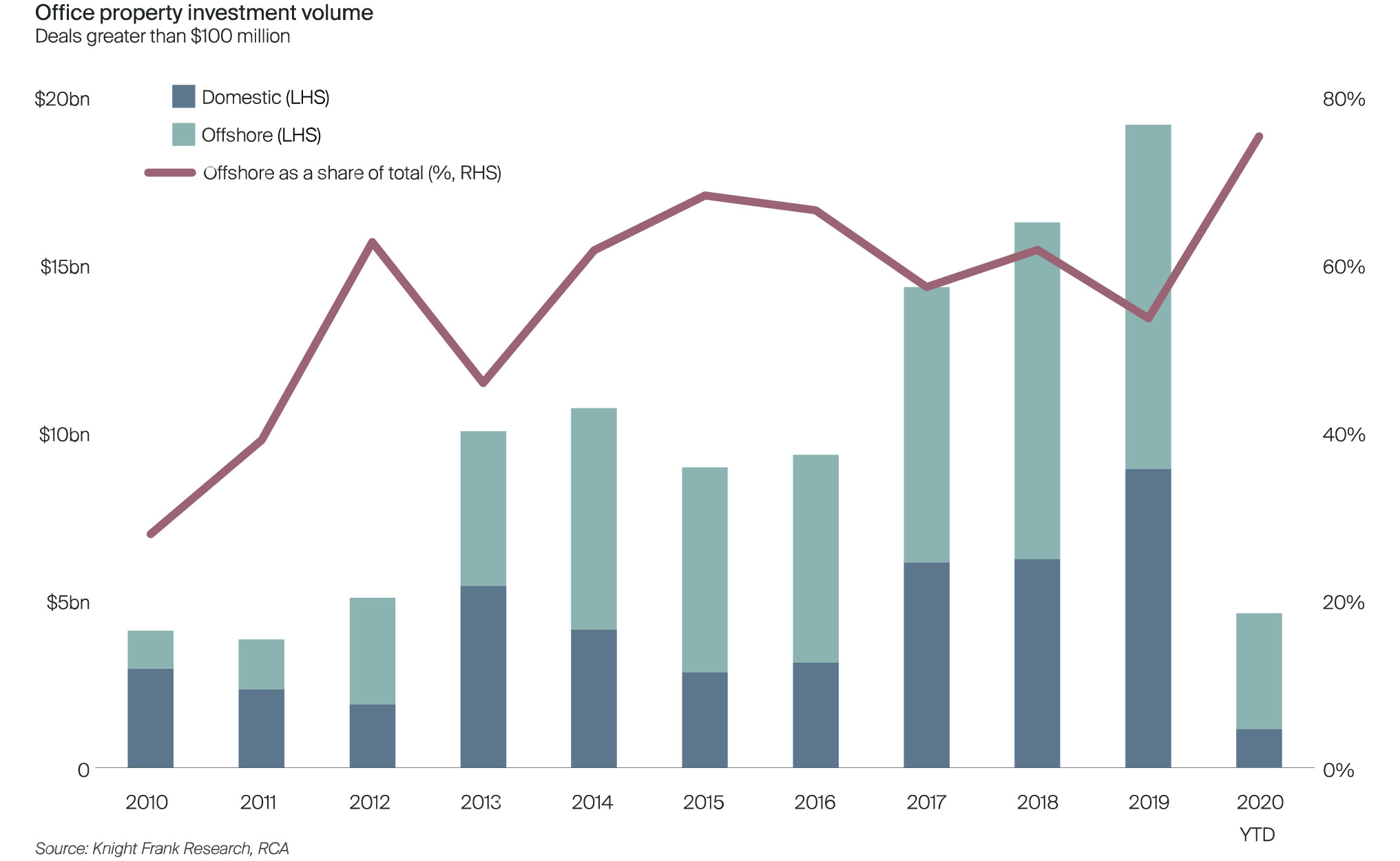

Over the past five years 60% of large office sales ($100 million plus) have been to overseas investors, while 40% were to domestic investors, but moving forward overseas investors are expected to account for a higher share or major acquisitions.

“In a more challenging environment, as we are seeing now, with higher risks to income and less expectation of capital growth, overseas buyers have been strengthening their presence and this will continue in 2021,” said Ben Burston, Partner, Chief Economist.

“Overseas investors have accounted for 75 per cent of investment volumes for office property deals greater than $100 million in value over the year to date, up from 54 per cent in 2019.

“Recent examples include GIC’s joint venture with Dexus to acquire a 50 per cent stake in the Rialto Towers in Melbourne, Deka’s acquisition of 452 Flinders St and the sale of 60 Miller Street in North Sydney to an offshore private buyer.

“We expect overseas investors to maintain or strengthen their presence in 2021, making up at least 75 per cent of buyers for large office sales, if not more.”

Ben said overseas investors were likely to be the more dominant buying group in Australia’s office market in 2021 as they were more prepared than domestic buyers to accept lower returns.

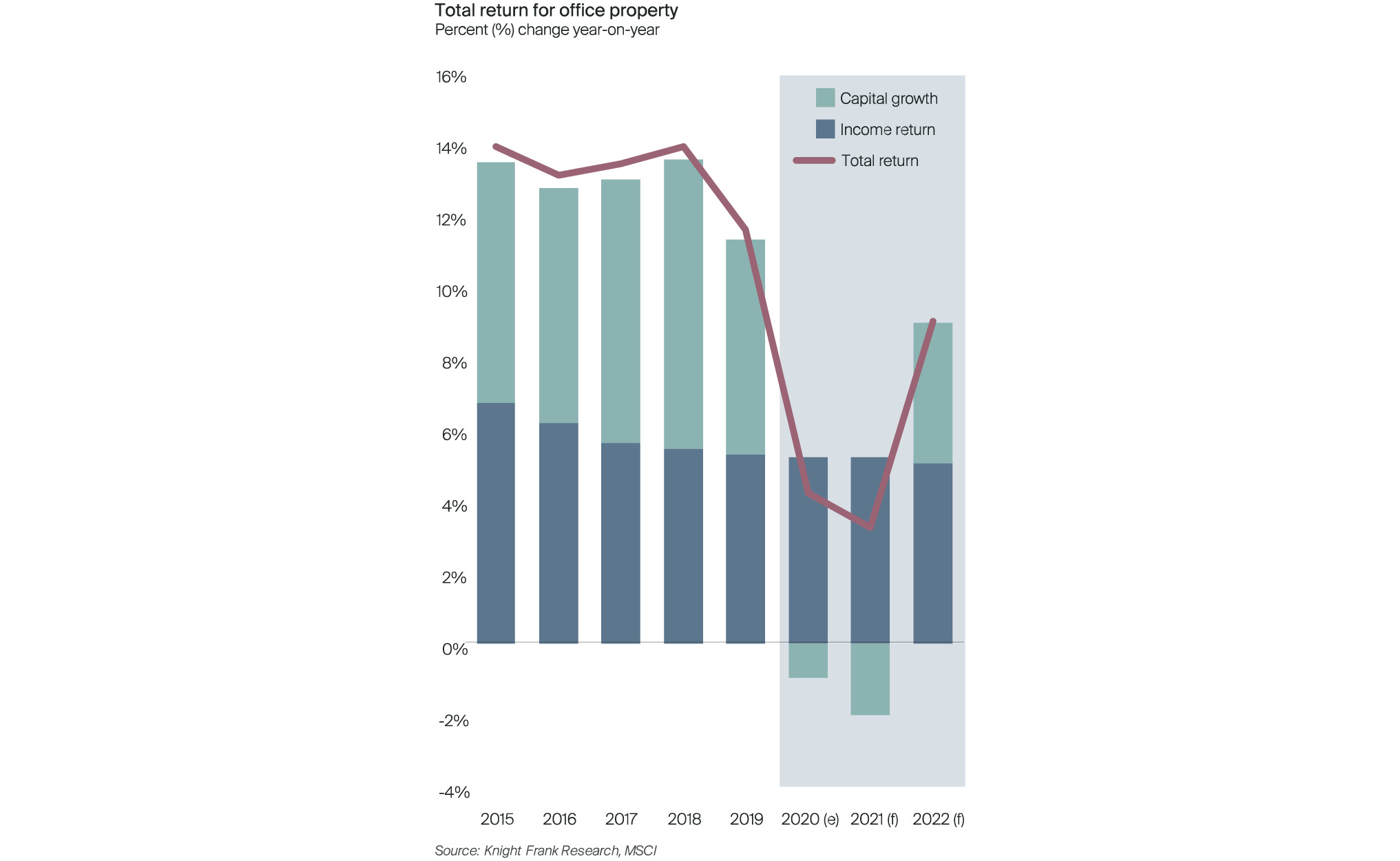

The Knight Frank 2021 Outlook found office market assets were seeing weaker returns this year, with capital growth for office property assets over the year to September slowing to 1.7%, down from 6.0% cent at the end of 2019.

“Australia has been slower to see the dramatic reduction in real and nominal interest rates that other major economies saw post-GFC, and so major global funds are more accustomed to the shift-down in IRRs and income returns that it implies,” he said.

“Overseas family offices will, at times, also be driven more by the desire to diversify and preserve capital over the long term than by return expectations in the near-term, and so can be expected to remain active.

“Australia also looks relatively attractive compared to other global markets facing more difficulty managing COVID-19 and has better prospects of a speedy return to growth.

“As such, an uncertain outlook for occupier markets is unlikely to change their view of Australia when the outlook is equally or more challenging elsewhere.

“On the other hand, domestic investors seeking higher returns will be cautious until the risks to the occupier market ease. And the fact that many domestic REITs are trading at a discount to net tangible asset value makes it less likely that they will be taking on major acquisitions in the near term.”

The Knight Frank 2021 Outlook found office investment performance in the Australian market moving forward was expected to be relatively strong compared with previous downturns, despite a forecast fall in totals returns over the short term, due to the combination of falling rents and broadly stable yields.

“We expect capital growth for office property to weaken further through the rest of the year and into 2021, with expectations of -1 per cent in 2020 and -2 per cent in 2021, leaving total returns a little over four per cent and three per cent respectively, compared to 11.5 per cent in 2019,” said Ben.

“Assuming the economy continues to recover in 2021, asset performance should recover in 2022 as conditions in the commercial property market improve with lag. Capital growth is expected to be around four per cent in 2022, with total return rising to nine per cent.

“During the GFC office capital values fell by around 17%, and the contrast with performance then and now is stark for several reasons. Interest rates were substantially higher at that time, and so investors seeking secure income returns were quick to retreat from property. The market was also more reliant on leverage which pressured owners into selling and did not benefit from the same level of overseas capital inflow that is helping to support pricing now.”

While Australia’s economy continues to rebound from the sharp downturn in the June quarter, Ben said there was still a high degree of uncertainty, leading to a clear premium on income security and divergence between office asset grades as investors look to re-weight and adapt their portfolios.

“This flight to quality and premium on income security will see office yields vary at asset level depending on the covenant strength and length of income,” he said.

“Average prime office property yields have remained relatively stable since the onset of the pandemic, with some tightening in the smaller capital city markets such as Perth where yields are relatively high and no overall movement in Sydney and Melbourne.

“However, there has been more divergence in yields based on income risk in recent months as investors seek longer WALE and higher-quality assets.

“We expect this trend to continue in the near-term with yields likely widening for secondary and shorter WALE assets and tightening for prime assets with long and secure income streams. These two forces will likely roughly offset each other, leaving average yields broadly stable over the next 12 months or so.

“Beyond that, we expect yields to continue to tighten underpinned by low interest rates and sustained investor demand.

“Low interest rates continue to support the relative value of commercial property assets – the average spread between prime CBD office property yields and 10-year government bonds rose to 441 basis points in the March quarter, its highest level since the September quarter 2012.”