Covid-19 Daily Dashboard - 20 October 2020

An overview of key economic and financial metrics.

2 minutes to read

Download an overview of key economic and financial metrics relating to Covid-19 on 20 October 2020.

Lockdown: Wales will enter into a two week ‘firebreak’ national lockdown from Friday, with schools, shops, pubs and hotels to close. A district in Bavaria, Berchtesgadener Land, is the first area in Germany to impose a lockdown since the spring, with citizen’s travel limited to shopping and going to work. In Spain’s Navarre region, movement in and out of the area will be restricted for two weeks on Thursday, with bars and restaurants also closing. Ireland’s level 5 restrictions come into force from midnight tomorrow, with citizens asked to stay at home.

Equities: In Europe, stocks are mostly higher this morning, with gains recorded by the CAC 40 (+0.6%), FTSE 250 (+0.4%) and the STOXX 600 (+0.1%), however the DAX is -0.2% lower. In Asia stocks were mixed, with the CSI 300 (+0.8%) and the Kospi (+0.5%) both higher on close, the Hang Seng closed flat and both the Topix and the S&P / ASX 200 were -0.7% lower on close. In the US, futures for the S&P 500 are up +0.5%.

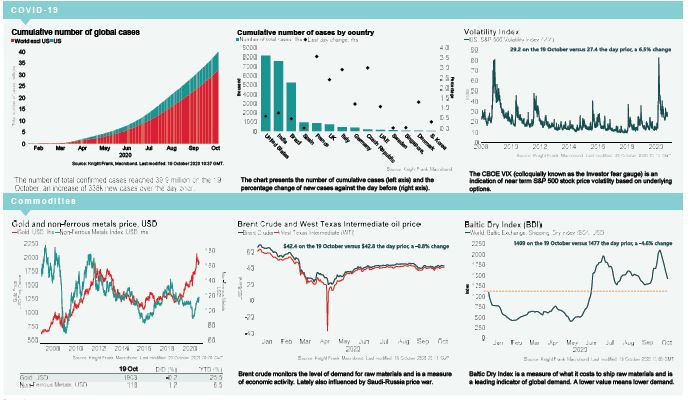

VIX: After increasing +6.5% yesterday, the CBOE market volatility index has declined -2.6% over the morning to 28.4. Meanwhile, the Euro Stoxx 50 volatility index is flat at 26.6. Both indices are elevated compared to their long term averages of 19.9 and 23.9.

Bonds: The UK 10-year gilt yield and the German 10-year bund yield have both softened +1bp to 0.18% and -0.62%, while the US 10-year treasury yield remains flat at 0.77%.

Currency: The euro has appreciated to $1.18, while sterling is currently $1.30. Hedging benefits for US dollar denominated investors into the UK and the eurozone are at 0.42% and 1.24% per annum on a five-year basis.

Oil: Brent Crude and the West Texas Intermediate (WTI) are down -0.9% and -0.2% over the morning to $42.24 and $40.77.

Baltic Dry: The Baltic Dry decreased for the ninth consecutive session yesterday, declining -4.6% to 1,409. The index is now -28% lower than the peak seen in July, due to a -33% cumulative decline over the last ten sessions. The decline has been predominantly driven by the capsize index which has also contracted over the last nine sessions, down -7.8% yesterday.