Covid-19 Daily Dashboard - 19 October 2020

An overview of key economic and financial metrics.

2 minutes to read

Download an overview of key economic and financial metrics relating to Covid-19 on 19 October 2020.

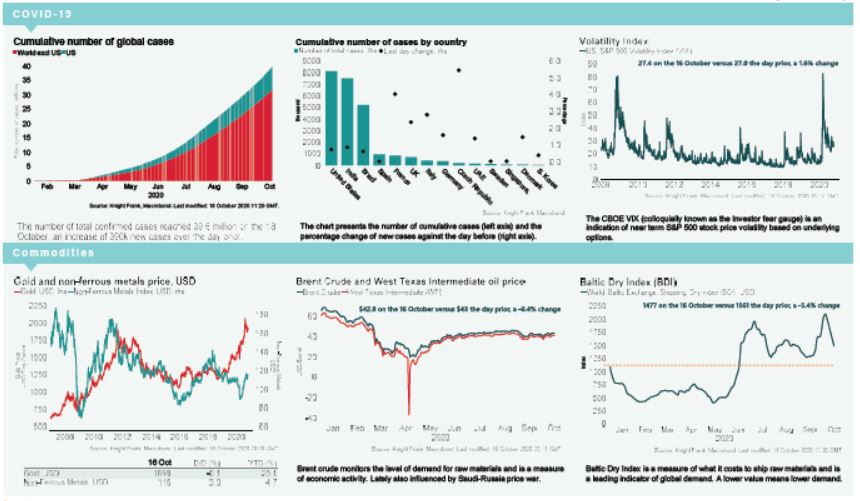

COVID-19: The total number of cases recorded globally has surpassed 40 million, with circa 1.1 million reported deaths according to Johns Hopkins University & Medicine.

Equities: Globally, stocks are mostly higher. In Europe, gains have been recorded this morning by the CAC 40 (+0.8%), STOXX 600 (+0.5%), DAX (+0.3%) and the FTSE 250 (+0.2%). In Asia, the Topix (+1.3%), S&P / ASX 200 (+0.9%), Hang Seng (+0.6%) and the Kospi (+0.2%) all closed higher. The CSI 300 (-0.8%) was the only index to be lower on close. In the US, futures for the S&P 500 are up +0.9%.

VIX: The CBOE market volatility index and the Euro Stoxx 50 volatility index are up +0.4% and +2.2% this morning to 27.5 and 25.9. Both indices are elevated compared to their long term averages of 19.9 and 23.9.

Bonds: The US 10-year treasury yield has softened +3bps to 0.77%, while both the UK 10-year gilt yield and the German 10-year bund yield are up +1bp to 0.20% and -0.62%, respectively.

Currency: Sterling has appreciated to $1.30, while the euro is currently $1.17. Hedging benefits for US dollar denominated investors into the UK and the eurozone are at 0.41% and 1.24% per annum on a five-year basis.

Oil: Brent Crude is down -0.5% to $42.72, while the West Texas Intermediate (WTI) is up +0.2% to $40.94.

Baltic Dry: The Baltic Dry decreased for the eighth consecutive session on Friday, down -5.4% to 1,477. The index is now -24% lower than the peak seen in July, due to a -30% cumulative decline over the last nine sessions. However, the index remains +36% higher than it was at the start of January.

Gold: The price of gold decreased -0.5% on Friday to $1,898 per troy ounce. Gold remains -8% lower than its record high in August, but is +24% higher than it was at the start of the year.

UK Credit Rating: On Friday, Moody’s lowered the UK credit rating by one notch for the first time since September 2017, reducing it from Aa2 to Aa3. However, the outlook remains stable and ratings by other credit rating agencies remain unchanged.