Residential Market Outlook 5th October

The majority of deals done since the market re-opened originated in the pre-lockdown period. It suggests momentum will continue to build.

2 minutes to read

In June, we outlined the mismatch between real-time property market data and what was happening in the wider economy.

Resurgent demand for housing seemed to jar with some daunting GDP numbers.

After a summer when the economic news and national mood improved to some extent, this mismatch appears likely to get starker in the final quarter of the year.

While the economy is showing signs of tailing off and concerns over a second wave of Covid-19 grow, the number of transactions is rising.

Buying a property can take several months and the momentum generated after the market re-opened in May is still building.

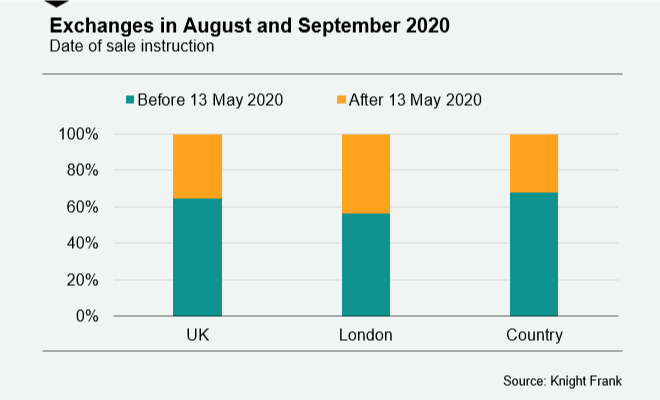

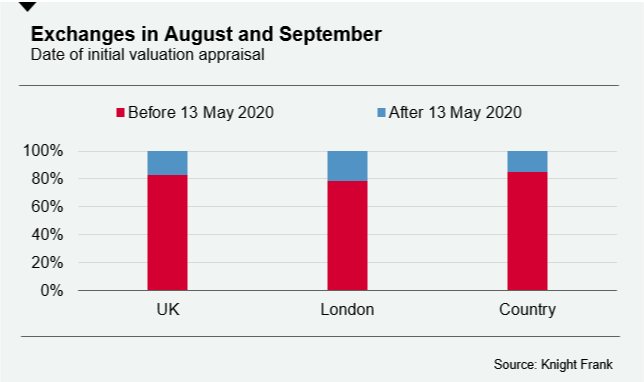

An analysis of transactions in August and September underlines the point.

Almost two-thirds (65%) of UK transactions that took place over the two-month period were instructed for sale before the market re-opened on 13 May. Furthermore, 83% of exchanges originated from market valuations that were carried out before mid-May. In other words, the majority of sales that exchanged over the last two months were unconnected to the post-lockdown burst of activity, as the below charts show.

The average time between a sale instruction and exchange is six months and staff shortages can mean conveyancing and local authority searches now take longer.

The number of instructions to sell only reached normal levels a fortnight after the market re-opened. Unless deals start to fall through at an unusually high rate, which is something we will track, it suggests strong levels of transactional activity for the rest of 2020.

When you factor in the closing window of a stamp duty holiday (March 2021) and the fact the highest weekly number of instructions to sell this year was in September, this momentum appears likely to carry through into next year.

What happens with Covid-19 will, of course, be the deciding factor.

Should a national lockdown take place that includes the housing market, activity could be suspended and the record number of offers accepted over the summer would be put on ice.

The key question for the UK property market over the next several months therefore boils down to this: will there be positive news on a treatment or a vaccine before the momentum runs out?