A pulse on the global economy – 12 June

To help cut through the noise we bring you a roundup of the latest news, emerging trends and forecasts across the global economy and asset classes and how this is impacting residential markets.

4 minutes to read

Nothing seems to really shock me anymore, surprises are become unsurprising. Since the beginning of 2020 we have seen so much, from oil trading at negative prices to the global pandemic with, at times, half the world’s population under some form of lockdown or restriction on movements, 2020 certainly is one for the history books.

But this past week has proven to have one – US employment. The government survey of establishments indicated that, after declining by 20.7 million in April, the number of people employed increased by 2.5 million in May - both numbers are records. This could mean greater confidence in a swift recovery and be a positive sign for the housing market.

The World Bank and OECD put out their renewed economic outlooks this week. The World Bank now expects global gross domestic product (GDP) to shrink by 5.2% in 2020, whilst the OECD are predicting a fall of 6% if a second wave is avoided and 7.6% if not. The IMF are expected to revise their April forecast, a fall of 3%, downward later this month.

However, in Australia the news is a bit more upbeat with the Treasury Secretary Steven Kennedy saying that the economic impact from COVID-19 will not be as bad as anticipated at the onset of the pandemic. They now expect the unemployment rate to be around 8% in September after initially expecting it to peak at 10% by June. This reinforces the view that Sydney’s prime market will bounce back strongly in 2021.

There are positive signs that a recovery is underway. The global services Purchasing Managers Index (PMI) increased from a record low of 23.7 in April to 35.2 in May, whilst still a contraction it is a great improvement. The measures we track for global cities shows an uptick in activity across the world in terms of population mobility and traffic.

New York became one of the latest cities to be ‘back in business’ with as many as 400,000 workers returning to construction jobs, manufacturing sites and retail stores on Monday in the first of the state’s four-phase reopening plan. The city will be one to watch over the coming weeks, as the prime residential market there has historically had a close relationship to stock market performance, we look below at these.

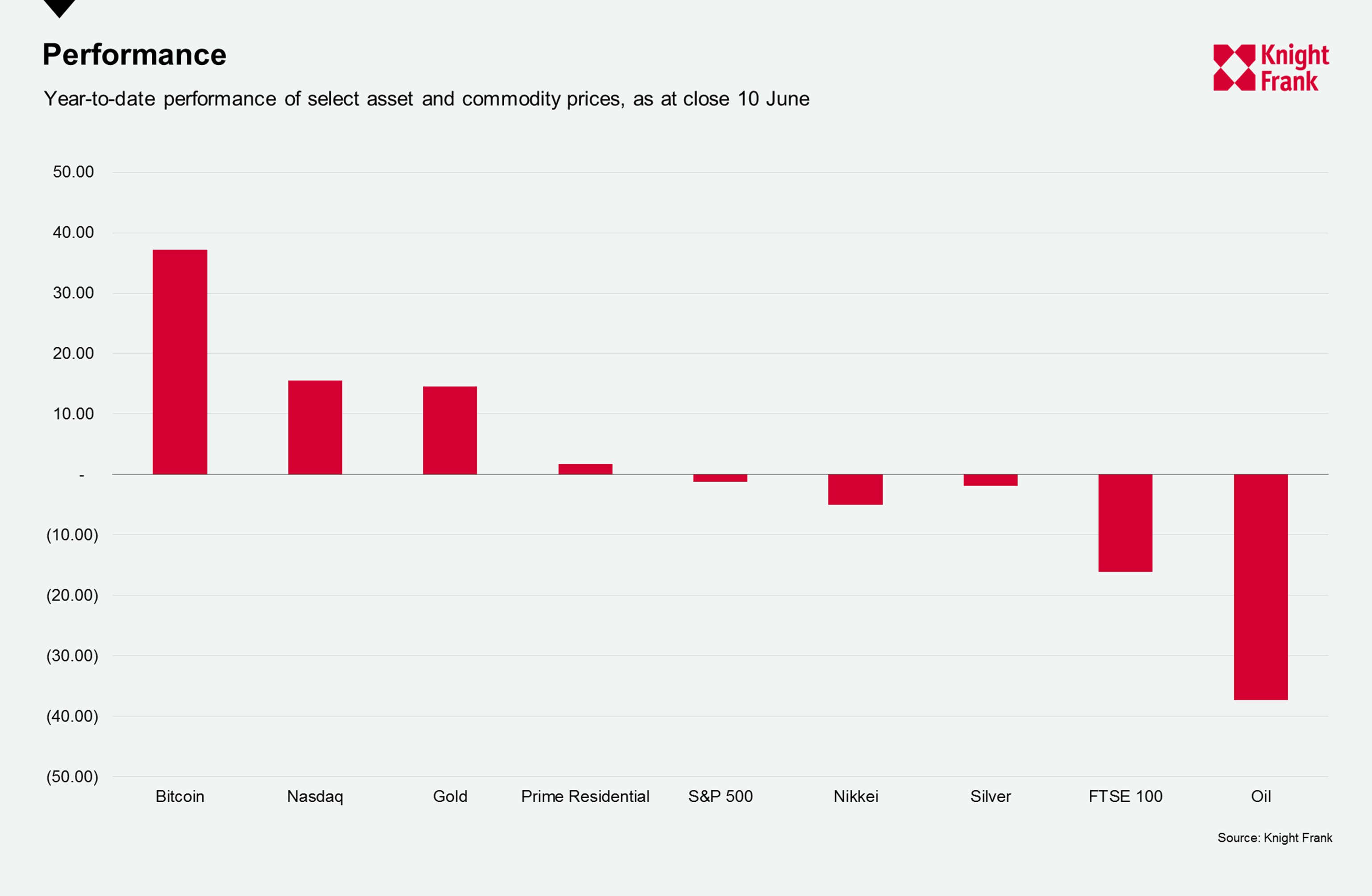

The chart shows the performance of select asset and commodity prices since the onset of 2020. Bitcoin, the NASDAQ and Gold have been the outright winners – gold, a traditional safe haven in turbulent times, has seen its price increase 13% since January and is almost 30% higher than this time last year, Bitcoin sits just below the $10,000 mark, up 37% in 2020. The NASDAQ hit an all-time high on 10 June, 4% above its previous high in February 2020, led by the growth in technology and internet-related companies who have performed well during the pandemic.

In terms of equities, the NASDAQ stands out, however, the S&P has climbed 43% since its trough on 23 March, after dropping 34% from the peak in February - it is still 6% off this peak. The FTSE 100 has climbed 27% in the same time, still 18% below the peak after dropping 35% between January and March.

For prime residential property it is worth noting that this relates to the first quarter of 2020 as measured by the Knight Frank Prime Global Cities Index, where prices rose on average 1.7%. The momentum we saw at the beginning of 2020 will be impacted by the fallout from Covid-19 as we talk about in our Global Market Outlook.

In the past few weeks, oil prices have recovered a lot of ground from their recent slump, but still remain 37% below their 2020 opening at around $40 a barrel, a doubling from their low of just below $20. OPEC+ has extended its 9.7m bpd of production cuts for another month (until end-July). Many expect that global demand will not return to its pre-virus levels until at least 2022 acting as a ceiling on prices. However, if demand does bounce back and prolonged cuts lead to a shortage of supply we could see an upward pressure on price over the next few years.

Check back in next week as we round-up the latest global economic news, including the release of some GDP figures for April and we will also be looking more in-depth at oil and its relation to global residential markets.