Covid-19 sparks expat re-evaluation

A survey of our global network confirms an increasing number of expats are seeking a foothold back home

4 minutes to read

Knight Frank’s global network has seen an uptick in enquiries from expats since the start of the Covid-19 pandemic.

We undertook a survey to understand more about the attitudes of expats globally and found 64% of expats said the lockdown had influenced their decision to buy a property in their home country.

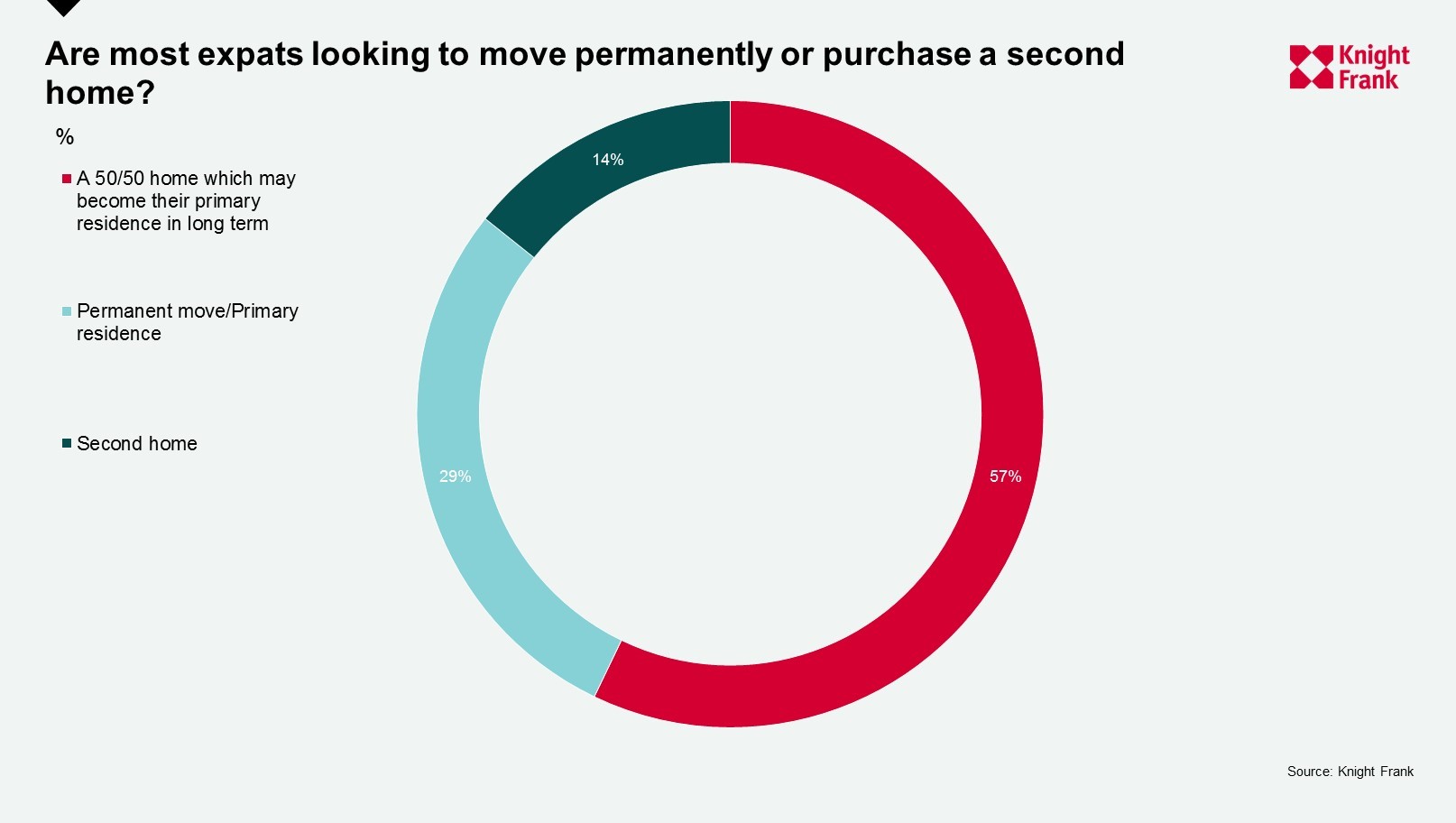

However, data from our survey of prime agents shows only 29% of expats are considering a permanent move, 14% are buying a property purely as a second home but the majority (57%) are seeking a 50/50 home, one which will provide them with a base back home and one that they might consider returning to permanently in the long-term.

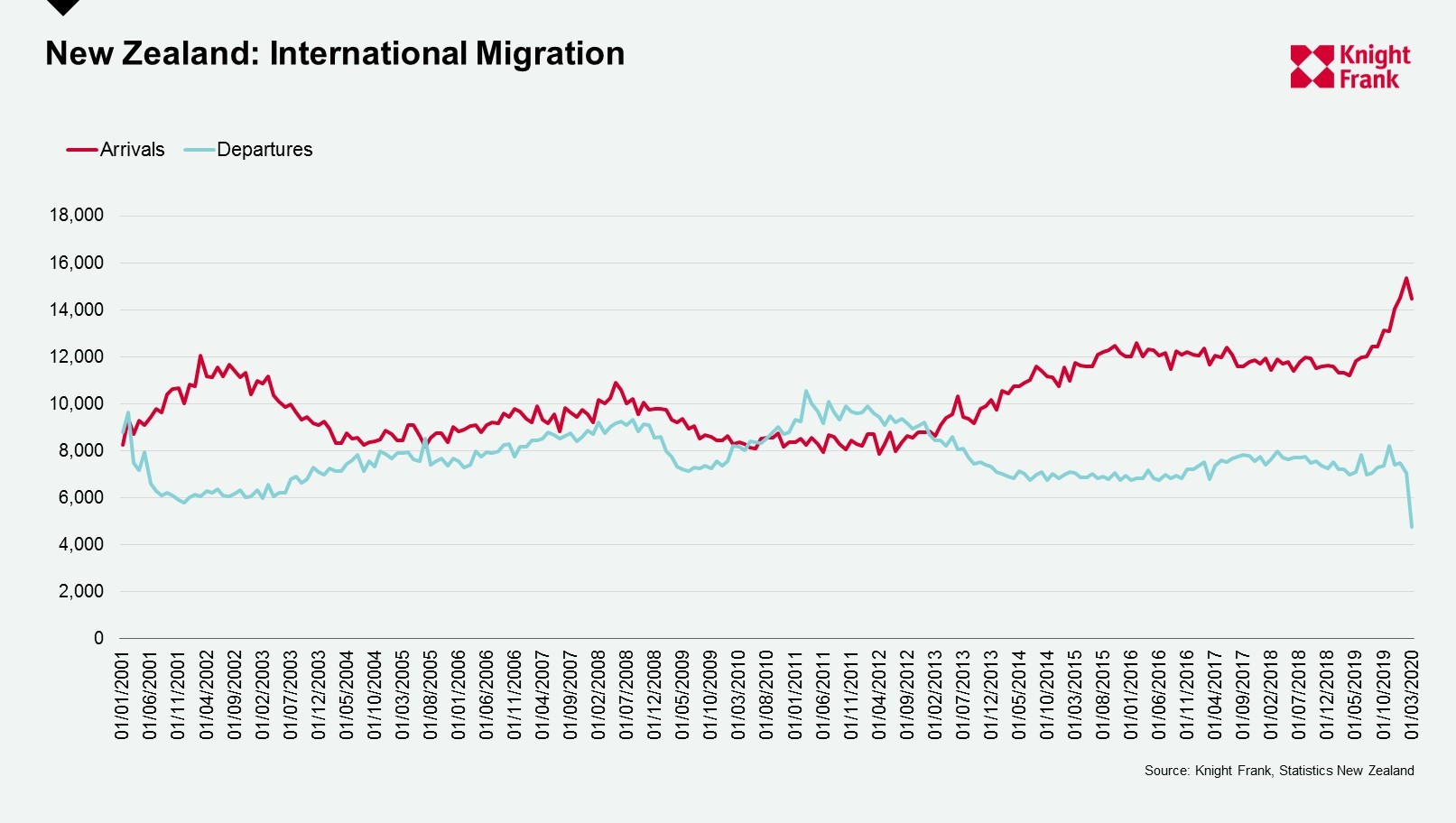

Data from Statistics New Zealand, confirms that this trend was gaining traction pre-Covid-19 but the results of our recent survey shows the level of demand from expats globally is now accelerating.

In the year to March 2020, arrivals to New Zealand increased by 13% and departures declined 5% over the same period. New Zealand citizens were the largest group of incomers, totalling 42,800 over the 12-month period.

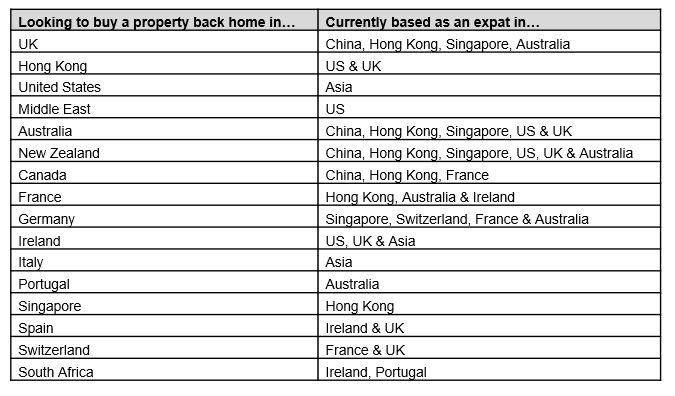

Where are the key flows of expats occurring?

A snapshot of some of the key trends being observed by our global prime team are highlighted below. Not surprisingly, demand is strongest amongst those expats located an 8-hour+ flight from home, intra-European expats movements for example are not as evident.

Interestingly, expats aren’t targeting high-yielding investments with many opting not to rent their second home out. French expats for example aren’t seeking investment assets in central Paris but looking to the Alps instead.

Roddy Aris, Knight Frank’s specialist in the French Alps, has helped a number of French buyers based in locations such as Australia and Hong Kong acquire ski chalets in resorts such as Megeve and Meribel. According to Mr Aris, “Easily accessible via Geneva Airport, a ski home in the French Alps is increasingly where families dispersed across continents are looking to meet up and enjoy time on the slopes together, many with a view to retiring there in five- or ten-years’ time.”

Paddy Dring, Knight Frank’s Global Head of Prime Sales adds: “Expats are taking the long view, balancing current career plans with family and lifestyle needs and at the same time keeping one eye on tax and currency shifts.”

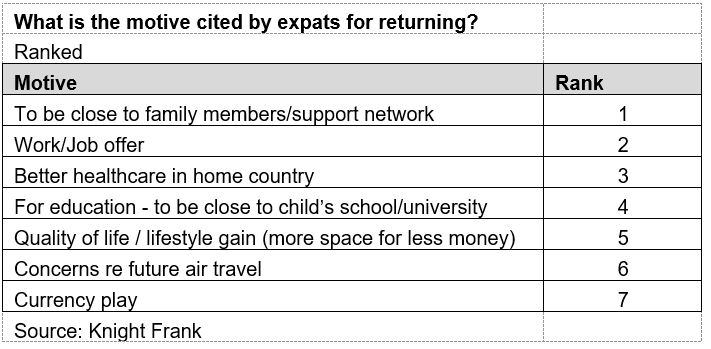

What’s motivating expats to buy a property back home?

“Time in lockdown has underlined the importance of family for many and focused their minds on the type of lifestyle they want to lead,” according to Victoria Garrett, Knight Frank’s Head of Residential in Asia Pacific.

Ms Garrett adds: “For expats with older parents back home or young children heading to boarding school abroad - and the prospect of a potential 8 or 12-hour flight to reach them – the Covid-19 pandemic has meant many are rethinking their long-term plans.”

Our survey found that being close to family members was cited by expats as the main reason for their property search, followed by a new job offer, whilst a better healthcare system back home ranked third and their children’s educational needs in fourth place.

With expats reconsidering their options, this will have implications for the corporate relocation industry, international schools and multinational corporations globally.

Some industries are also seeing a surge in repatriations, the oil and gas sector is seeing senior executives relocating from states such as Texas in the US back to the Middle East, in part due to the recent decline in oil prices and a reorganisation of senior management.

Although currency ranks low as the key motive for expats purchasing back home, 57% of our prime agents noted that the expats they were dealing with had cited it as an influencing factor. For expats taking a USD-denominated salary and purchasing in the UK, Australia or New Zealand there is a significant currency play compared with just two years ago.

Where are expats targeting and what type of property is most popular?

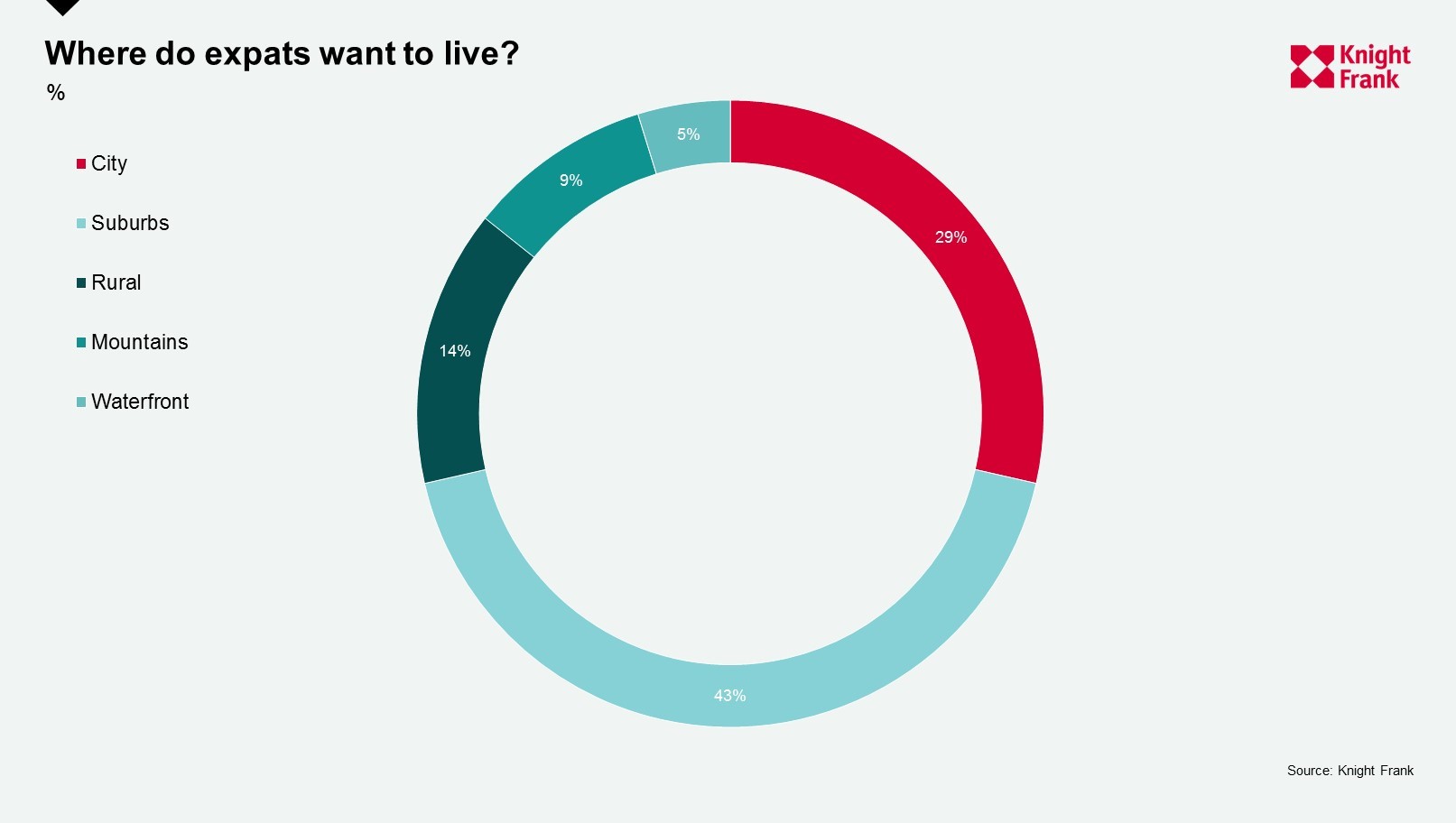

Perhaps contrary to expectations, a rural retreat (14%) is not the top priority for expats. According to our global prime team suburbia (43%) is the preferred location. With many expats city-based whilst abroad, a move to the countryside for some may be considered a step too far, most settling instead for the middle-ground, enabling them to still sample urban life, its restaurants, bars and cultural amenities from time-to-time.

Most expats are seeking a resale property with 29% prioritising new-build, the majority of these being Asia-based.

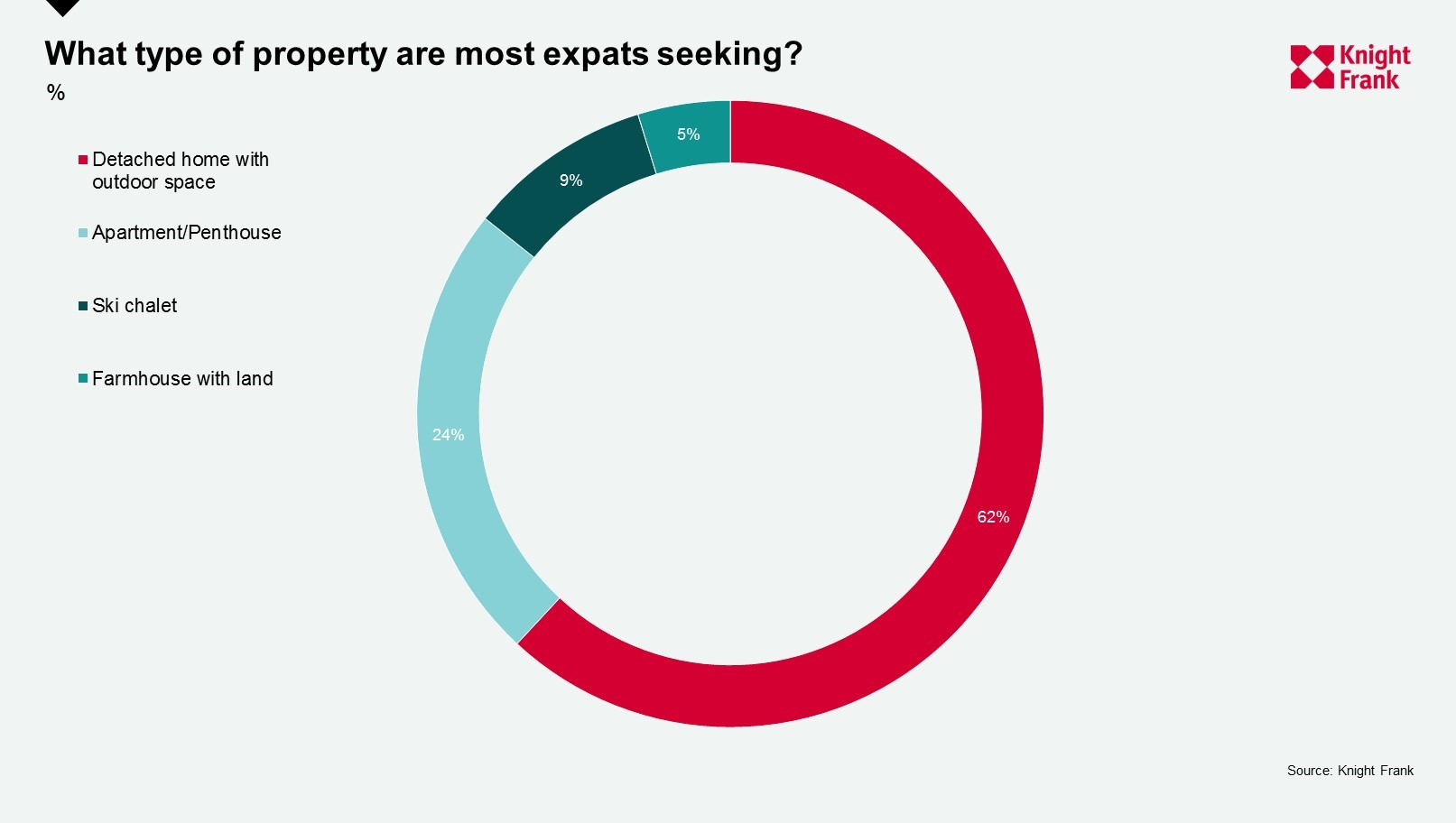

In terms of property type, 62% are seeking a detached home with outdoor space mirroring post-lockdown trends we are seeing across the wider market although it is difficult to gauge whether this will be a lasting development.

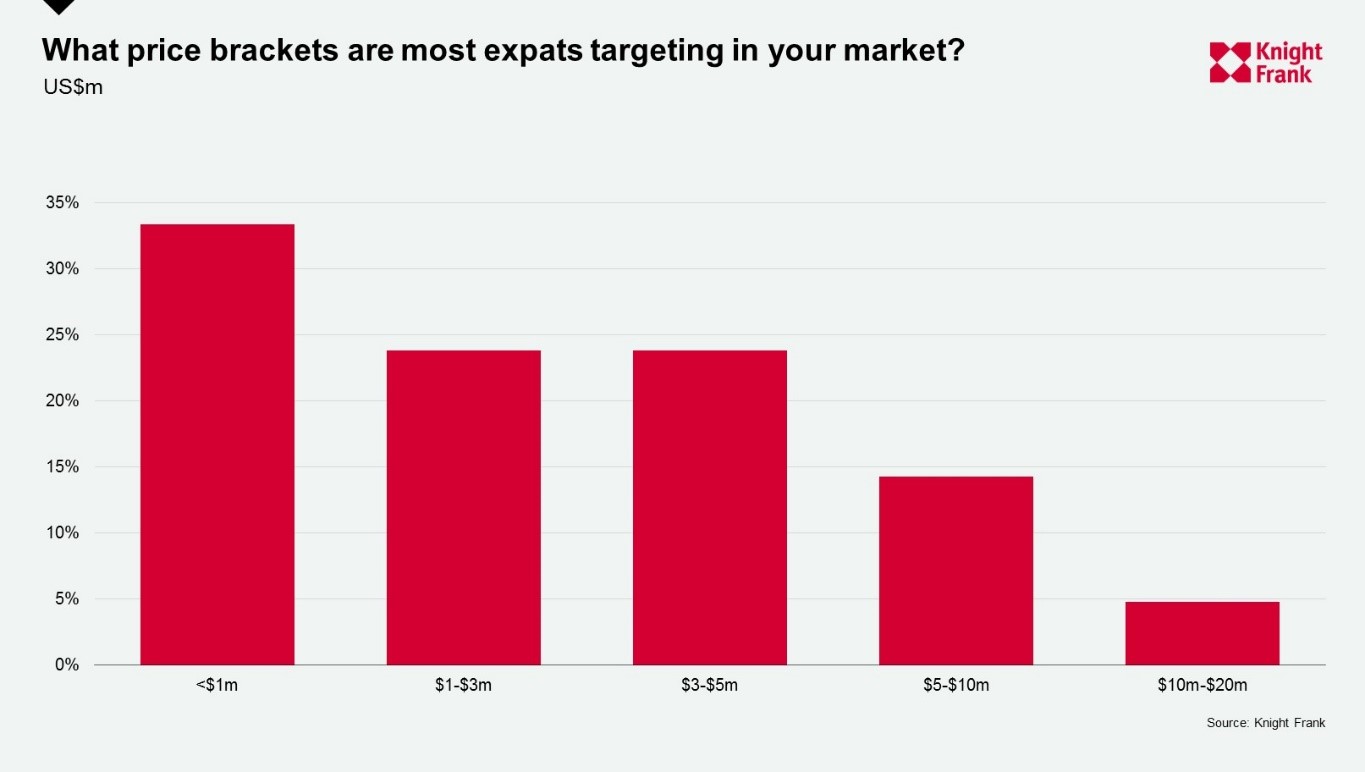

Within the prime segment, what price bracket are most expats targeting? (US$)

Most expat budgets sit below US$3m but higher budgets are evident in markets such as Australia, Switzerland and France. Families want a home where their children can stay longer or can come back to if they need to bunker down together and in some cases they are willing to stretch that bit further to have the luxury of space and a waterfront location.

For more information on our expat research contact Kate Everett-Allen or to discuss any property requirements you might have do get in touch with Victoria Garrett or Paddy Dring.