Prime London Rentals Index June 2019

The latest snapshot of performance in the prime London rentals market.

2 minutes to read

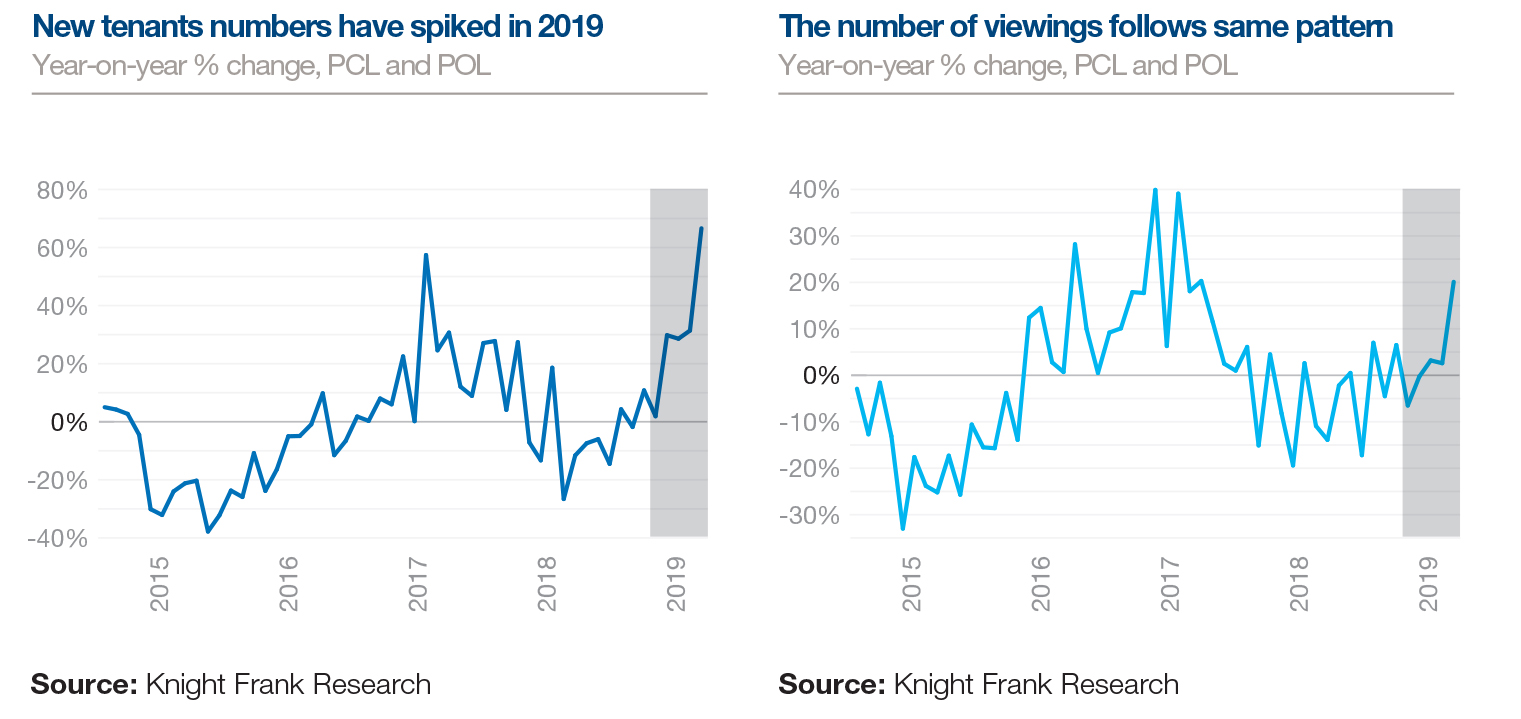

The number of new prospective tenants registering in PCL and POL rose by two-thirds in May compared to the same month last year. This was due to political uncertainty as some exercised caution by renting. In lower price brackets it has also been in response to the tenant fee ban, which came into effect in June.

The number of viewings also increased in May, rising 20% compared to the same month a year ago in PCL and POL. Despite the series of tax changes faced by landlords in recent years, the spike in viewings and new tenant registrations indicates the current strength of demand.

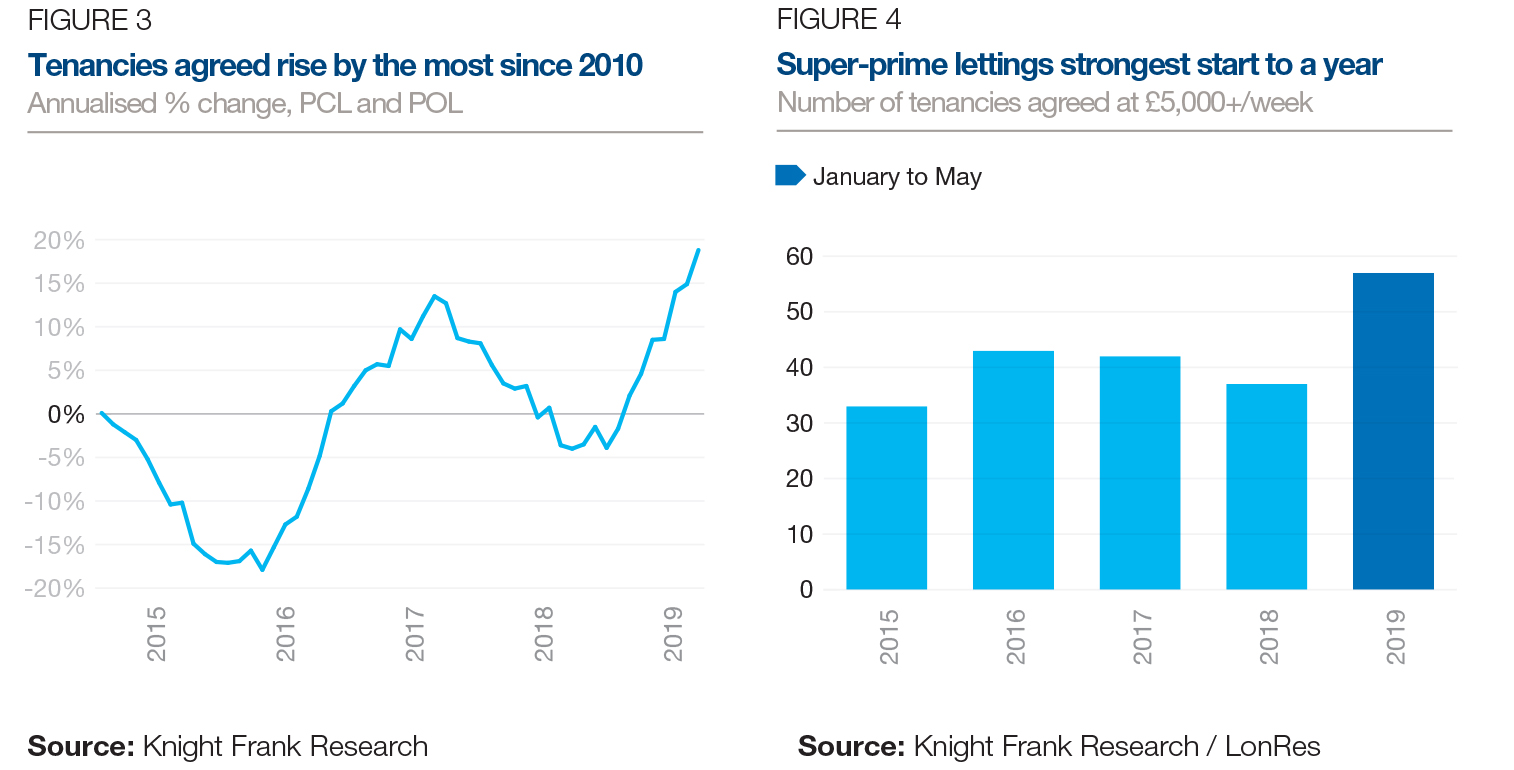

The number of tenancies agreed is also on an upwards trend. In the year to May 2019, Knight Frank agreed 19% more tenancies in PCL and POL compared to the previous 12-month period. It was the highest such rise recorded since 2010.

The super-prime (£5,000+/week) lettings market has had its strongest ever start to the year. There were 57 tenancies agreed in this price bracket across London between January and May, compared to 37 last year. The trend is unrelated to the tenant fee ban and highlights how political uncertainty has boosted tenant demand.

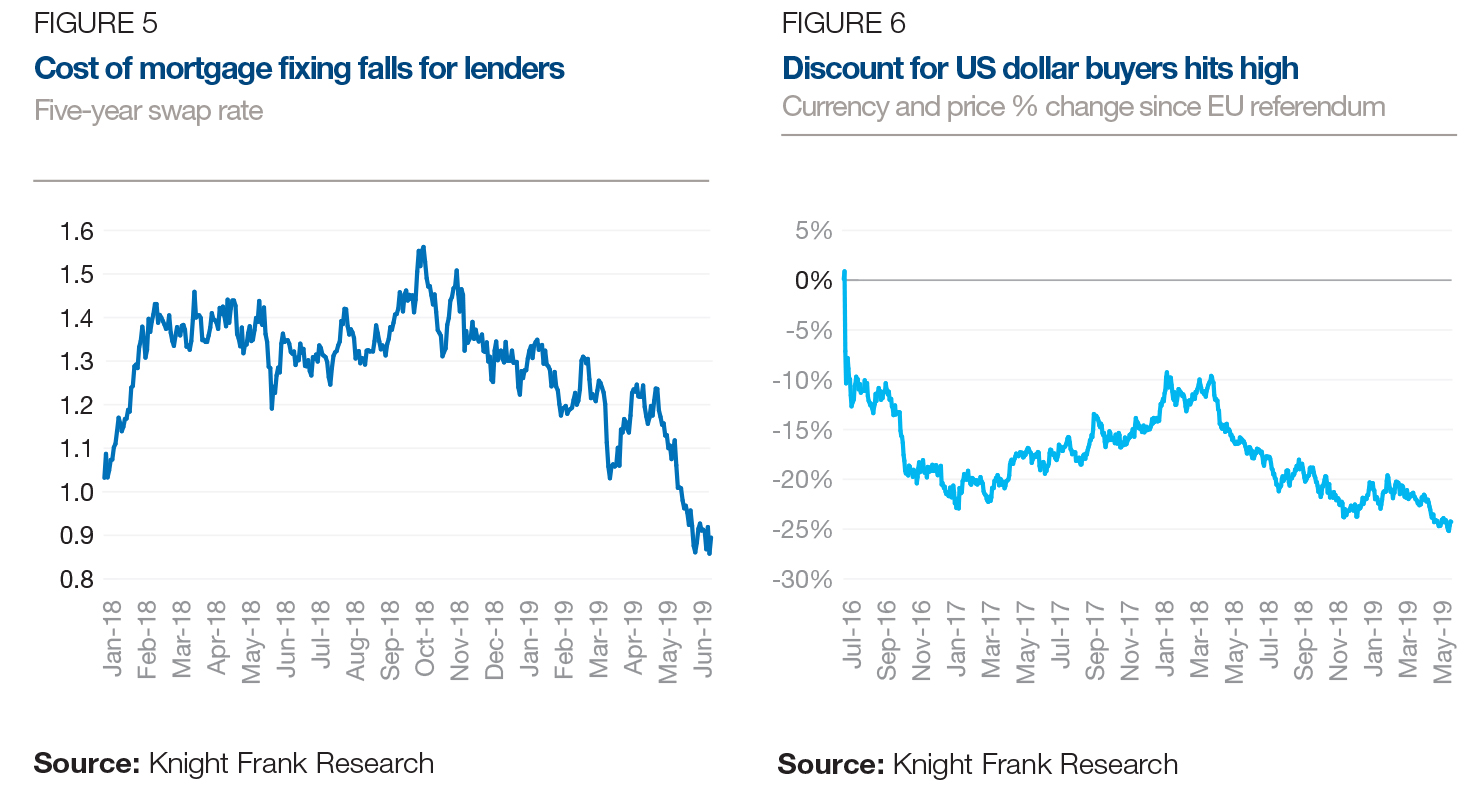

Five-year swap rates, which are used by lenders to acquire fixed-price mortgage funding, have fallen in recent months. This is a response to a more benign global interest rate backdrop, with the US Federal Reserve signalling it may cut rates this year. Lower rates will underpin mortgage market liquidity and housing demand.

The effective discount for US buyers in PCL, which combines currency and property price changes, reached 24.7% at the end of May, the highest figure since the EU referendum. Sterling has weakened in recent weeks in response to uncertainty generated by the Conservative Party leadership election.

For further information please contact Tom Bill