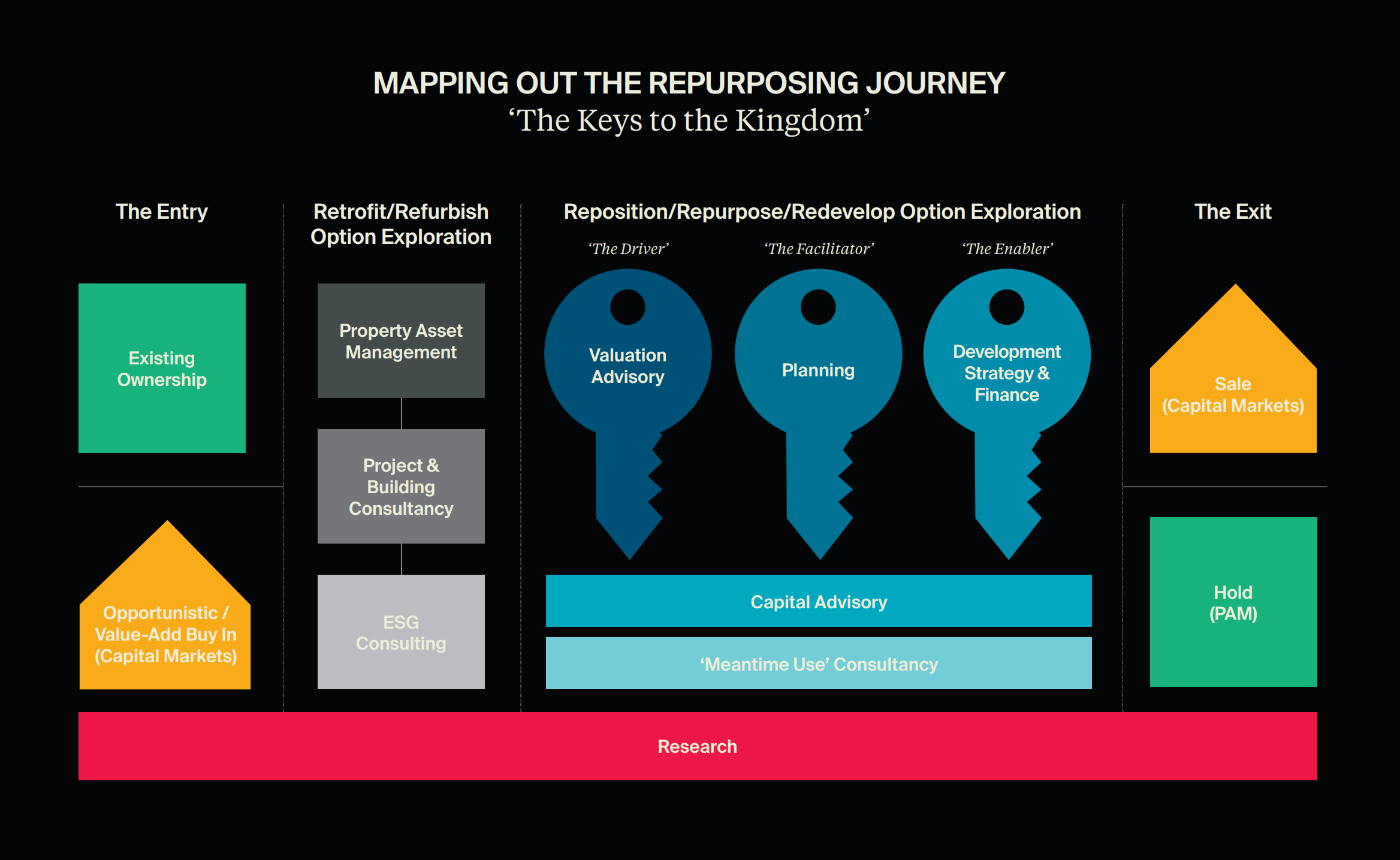

Mapping out the Repurposing Journey: the Keys to the Kingdom

Mapping out the Repurposing Journey is our analysis into the three keys which will unlock what, and how to, assess the repurposing potential of an asset.

5 minutes to read

- Repurposing projects are highly complex, with very few quick wins. Many will not stack up financially and most will involve a difficult-to-navigate journey.

- Valuations hold many of the keys, but the process is shrouded by the lack of “middle ground” transparency – a segment where many assets sit.

- Planning may be less a blocker than previously on account of reform to the system, with permitted development rights presenting more of an opportunity than a barrier.

- Development strategy is likewise a complicated and painstaking process to unlock the repurposing opportunity. Capital markets hold the key to any potential exit.

Complex. Drawn-out. No cookie-cutter solutions. Bespoke and intricate responses required. A journey. A marathon, not a sprint. But navigable with the right know-how and guidance. The Keys to Repurposing Kingdom in a nutshell.

Key 1 – Valuations – “The Driver”

Value is simple. Valuation is complex.

In the world of commercial real estate, offices are more than just buildings - they are complex workplace ecosystems. The same thought process applies to other real estate uses.

Value underpins everything. Period. Value will underpin every strategic decision and it will unlock every initiative. But it is nevertheless a challenge that the valuation profession has to successfully navigate.

The property market at large tends to always think (or at least talk) in terms of a two-tiered system, but the reality is vastly different. The terms “two-tiered” or “polarised” market are a common currency, whatever the property use. Both poles have the benefit of price transparency.

But this polarity/dichotomy massively over-simplifies what the market is facing. The market is generally silent on those assets which fall between these poles or between these two tiers. And this ‘forgotten segment’ is not a small part of the market – it is actually the mainstay of the whole market.

But the fundamental question is this - does the end value support the investment needed? Does it make financial sense? Will the long term, sustained (non-cyclical) occupational market, support significant investment? If it doesn’t, where is your exit and what form does that exit take?

Ecosystems are complex, solutions to threatened ecosystems are complex. And ultimately value underpins everything.

Key 2 – Planning – “The Facilitator”

Not always the villain of the piece

The ‘Planning System' is often perceived to be the single most obstructive source of uncertainty and risk, a barrier or door that is well and truly locked. But this perception may be something of a legacy of the past that does not fully reflect the level of reform that has been implemented in recent years.

Planning, or rather the correct planning strategy, may actually be an opportunity to unlock latent value and repurposing potential. And this may well accelerate if the Labour Government remains intent on speeding up Planning and, in particular, boosting the supply of housing. The stated number one priority is 1.5 million new homes within its first term.

Repurposing is generally supported by Planning Authorities and stakeholders. With no demolition required, repurposing projects minimise carbon usage and help achieve net zero objectives. Delivery is often more rapid compared to new build schemes. New flexibility within Use Class E captures many alternative and hybrid uses that previously would have required a formal change of use.

The attraction of Permitted Development (PD) is that:

• it has fewer planning policies to satisfy and thus there is less scope for objection or debate

• it has a 56 day determination period

• it currently has no affordable housing obligations.

However, there is seldom a “one size fits all solution” and the correct strategic advice is paramount to maximise return and unlock value:

And it is important to act soon, before Planning Authorities introduce blocks on PD (article 4) or Government adds an affordable housing requirement.

Planning – not necessarily the hurdle it is perceived to be, perhaps even an opportunity creator.

Key 3 - Development Strategy – “The Enabler”

Making the opportunity happen

What to do when the CAPEX required means that it is simply not viable to refurbish the property to meet the regulatory and functional requirements of its current use? What next?

We’ve already established that value underpins everything and it will underpin every strategic decision. Where valuation professionals identify that a property simply won’t stack up, we need to think outside the box to find the new value and breath new life into the ecosystem of the asset.

This may entail a complete change of mindset, a complete challenge of what we think an asset could and should be.

But is this necessarily the key to the proverbial kingdom? Again, if only it were that straightforward, it’s a complicated multi-faceted process which will provide a solution, but with no small journey to get there. Over and above the planning considerations, there’s also the fabric and layout of the building itself and location and City DNA to factor in.

A pathway rather than a “one size fits all solution”.

Capital Markets – the entry and/or exit point

Capital markets can book-end the entire journey. Many landlords may embark on the repurposing journey by default and out of necessity. Assets that they own may have become highly challenged or obsolete as a result of identified factors. Some landlords may not wish to go down the repurposing route themselves, either through lack of motivation or, more likely, through financial constraint.

Other investors may be looking to opportunistically acquire problem assets with the aim of unlocking full repurposing potential. Some are proactively looking to ‘buy into the problem’ and embark fully on the repurposing journey themselves, either alone or in partnership with other parties from either the public or private sector.

At the other end of the journey, capital markets are obviously also integral to any exit strategy. The finished product attracting broad investor interest from a wide base, with keen pricing to match.

Conclusion

A journey fraught with complexity. But a navigable one with the right vision and strategic advice. And built on the firm understanding that value underpins everything.

Maybe not the keys to the kingdom of heaven in the true biblical sense. But the keys to the kingdom of relevance, sustainability, environmental compliance, social inclusion, strong property performance and decent return. An alternative heaven in the context of a problem asset that is currently, or at risk of becoming, obsolete.