A Global Education Hub

London’s educational sector has an unwavering draw for domestic and international students alike. As the sector evolves to meet rising demand for educational services so to have space requirements with technology and ESG principles at the core.

4 minutes to read

London’s educational sector has an unwavering draw for domestic and international students alike. As the sector evolves to meet rising demand for educational services so to have space requirements with technology and ESG principles at the core.

Flora Harley - Partner, Residential Research

Presence of leading institutions

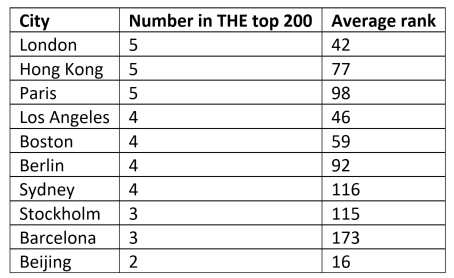

London is the leading global city for universities with the most, and highest-ranking, top universities according to the Times Higher Education World University Rankings 2022. Among the top 200, London is home to five – four of which are in the top 100, this is matched only by Hong Kong. However, of those five the average ranking is 42 ahead of 77 for Hong Kong – meaning London has more that rank highly.

These universities include Imperial College London (12), University College London (18), the London School of Economics and Political Science (27) King’s College London (35) and Queen Mary University of London (117)

Sources: Knight Frank Research, Times Higher Education

London has 36 universities based here, with a further 25 having a footprint in the capital. Together they occupy almost 400 hectares within the Greater London area, according to geospatial analysis from Knight Frank’s Analytics team. The largest by area are Brunel University, Kingston University and Imperial College – comprising a third of the total.

The footprint of higher education in the UK capital is unsurprising given the unwavering demand. The number of students at London locations rose 8% in the 2022 cycle according to UCAS. The increase in number for non-EU domiciled students was the most notable, at 17%, the fourth year of double-digit growth, and for UK domiciled students the rise was 11%. The number of EU students fell by almost a third as Brexit came into reality.

Accelerating thus use of technology

The pandemic has been coupled with better technology, acceptance of that technology and the increasing costs of education which has meant that universities globally are facing key decisions about their approach to ‘EdTech’. These considerations, sit within the wider context of mass digital content production and it will be crucial for universities worldwide to respond to this quickly.

On the flip side, the pandemic has also helped to provide clarity for universities about the aspects of higher education that were working well before Covid-19 – such as face to face learning and campus development. For universities in the UK, ‘blended learning’ has started the process of discussion on the dividing line between what can be successfully digitised and what cannot.

Despite these challenges ‘on campus’ will win out, but universities and investors must be alive to two things. Firstly, they must continue to work with stakeholders locally to deliver the highest quality student experience and to win the value for money argument. There is a need to respond to the needs of generation Z students, embrace the post-lockdown momentum they have for freedom, travel and new experiences and use this to support changes in our approach.

The pandemic has undoubtedly accelerated many of the challenges we face. However, longer term, student numbers are still forecast to rise and the campus will continue to be at the centre of a university’s offering to students. Universities themselves acknowledge that they must play a larger role in the evolution of cities and in the repurposing of place, with their own real estate a key agent in driving this agenda.

Increasing levels of take-up

Since the pandemic there has been a significant increase in the take-up of floorspace in London from Education occupiers. In 2022, there were 12 transactions recording almost 372,000 sq ft, a rise of 485% compared with 2021. This was the highest level of education take-up since we’ve been breaking down our data by occupier group.

The distribution of take-up across London shows the sector to be a significant occupier in many of London’s submarkets but is especially important with a high concentration of education establishments in Aldgate/Whitechapel, Docklands and Stratford and Strand/Covent Garden.

In Aldgate/Whitechapel take-up in 2022 by education occupiers was 165,000 sq ft – just over 35% of transactions. The occupier group accounted for 20% of transactions in Docklands and Stratford and just over 15% in Strand/Covent Garden.

Traditional Universities have maintained a high number of lettings transactions despite fears that London would lose its attraction as an education centre post Brexit. Moreover, the largest transactions last year were from non-traditional universities such as BPP and the Fashion Retail Academy. The latter is a good example of how the sector is evolving to collaborate with the private sector. The second largest transaction last year was by New York University, 73,000 sq ft art 265 Strand. This was the first transaction by an overseas university to establish a London campus in a similar vein to other universities located outside of the capital.

Space requirements have changed considerably in recent years from cellular design to larger, flexible and more open floorspace. The increased role of technology in the sector requires space that is adaptable to accommodate a variety of learning methods. In addition, recent transactions show a clear drive to best-in-class buildings that meet the highest ESG standards.