What is the outlook for UK BTR rents?

By analysing data on asking rents and matching these to our bespoke market-leading database of BTR developments, we have been able to isolate the change in rental values for BTR-specific assets.

3 minutes to read

BTR investors can point to a strong track record of rental growth in the UK, with rents having risen by 21% over the last decade.

Future rental growth prospects are key to ensuring competitive returns, particularly given recent increases in the risk-free rate.

Yet current measures of rental growth track performance within the private rented sector (PRS) as a whole. While this is a useful guide, our analysis of more than 50,000 unique BTR listings from more than 180 operational schemes, offers an insight into how BTR-specific assets are performing.

How have BTR rents performed?

Rental growth for new leases on BTR schemes over the last 12 months has averaged 12.1%, in line with the strong performance of other indices which track change in market rents for new tenancies. Growth has been driven by high rental demand and limited supply.

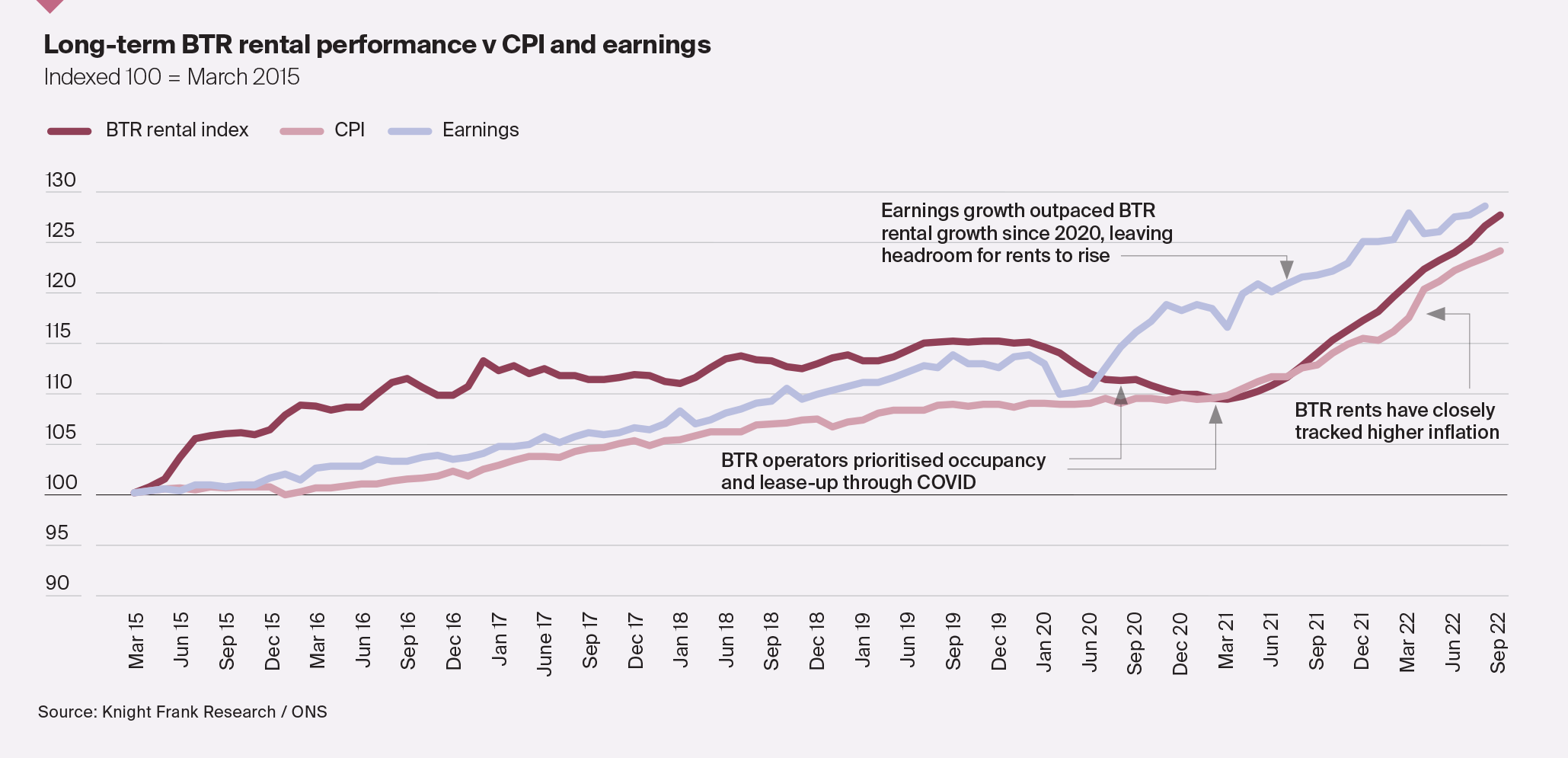

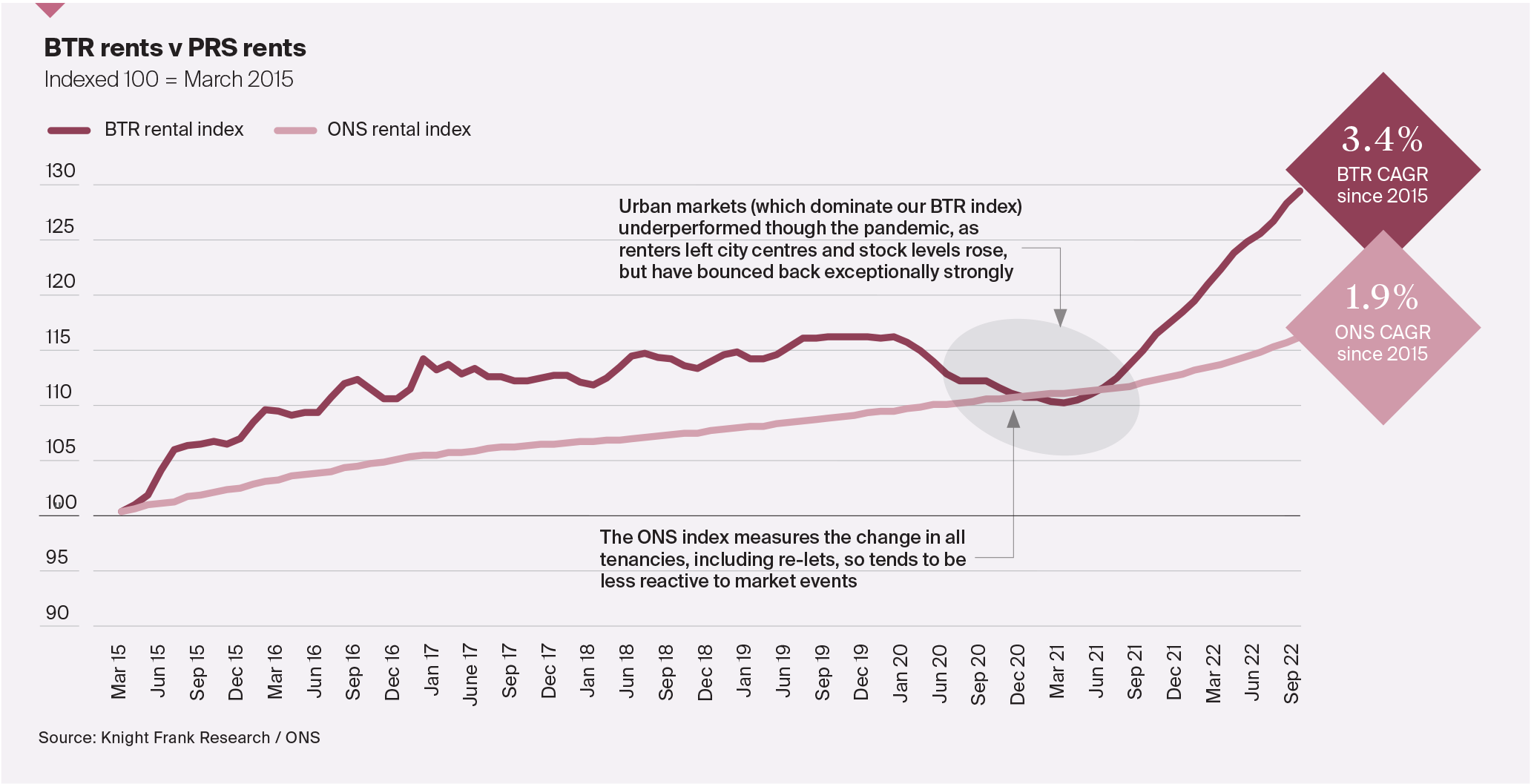

Longer term, the data suggests that rental growth for BTR assets has been more measured, with an annualised rate of growth of 3.4% per annum for new BTR leases since 2015. Cumulative BTR rental growth over that time stands at 28%, outperforming inflation and slightly behind the increase in average earnings.

A dip in rents in 2020 reflects the emphasis by operators through the pandemic on maintaining occupancy and lease up, as well as a focus on

supporting tenants through the pandemic. This was in addition to the comparatively weaker performance of more urban markets through lockdown as cities shut down.

How does that compare to the PRS?

On both a short and longer-term basis, BTR rental growth has outperformed the official UK rental index from the Office for National Statistics (ONS), which tracks rental growth across all rented homes. The ONS index has averaged 1.9% annual growth since 2015, below the 3.4% recorded for BTR. Over time, and as assets stabilise, there will come a point where any premium over local market performance will end and BTR rental performance will run in parallel with the local market. Future analysis of this data will allow us to analyse rental performance by scheme age, market, and price point.

What’s the outlook for rents?

There is little possibility of rental supply increasing significantly in the short term, even as BTR supply increases. There have been more than 260,000 buy-to-let mortgage redemptions over the last five years alone as private landlords look to exit the sector. Meanwhile, unemployment is near record lows, the population continues to rise, wage growth remains strong and access to mortgage finance is restricting owner occupation – which will support rents.

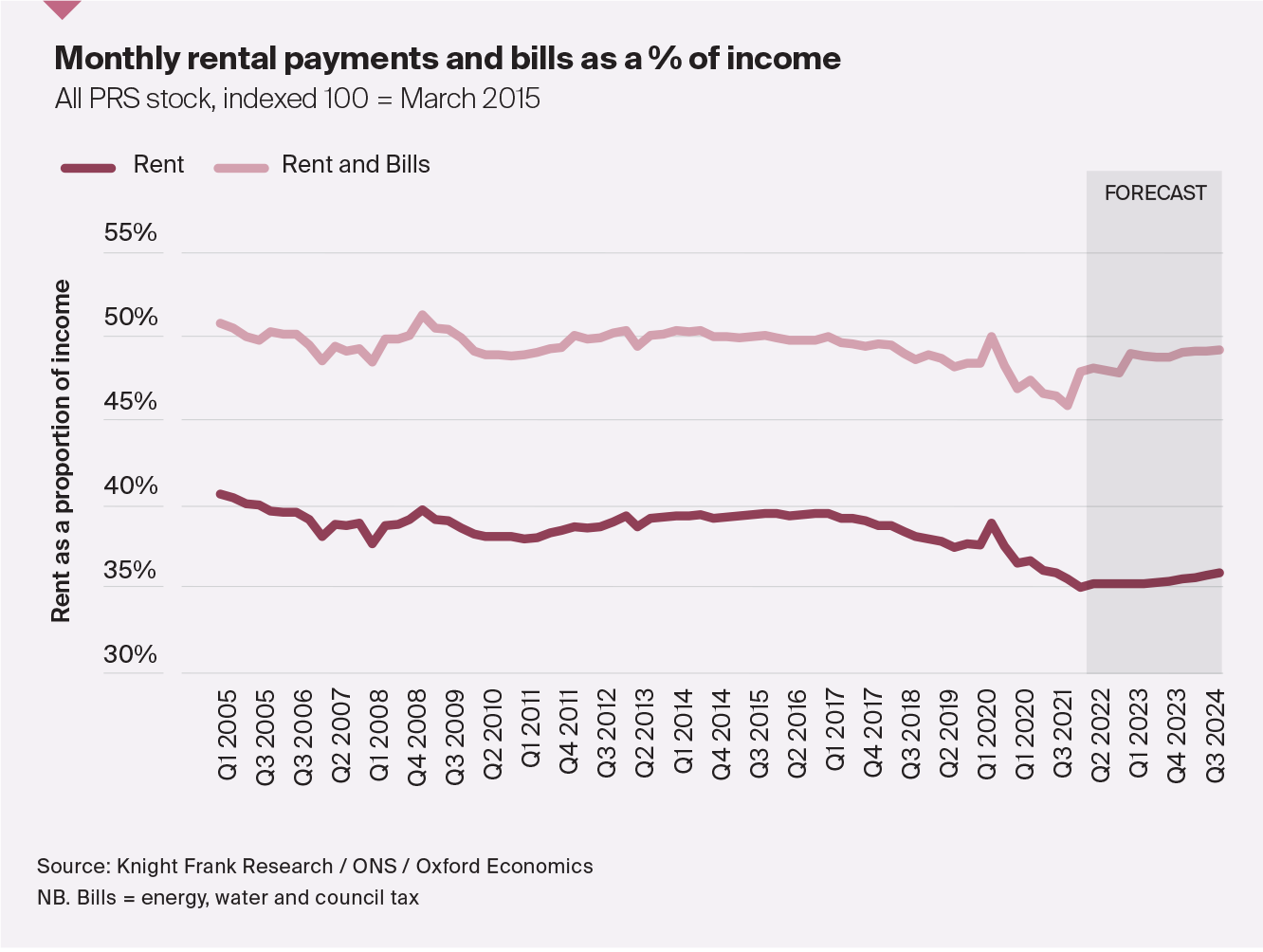

Current forecasts from Oxford Economics suggest that average earnings will grow by 20% between 2022 and 2026, but with energy costs set to spike in the near term, there will be a ceiling to what renters can afford. Tenants in newer, more energy efficient BTR developments, will be less exposed to spiralling energy costs.

Prospects for rental growth will also be supported by the fact that the proportion of earnings spent on rent has been steadily declining in recent years and sits below the long-term average. The average renter spent 35% of their pre-tax income on rent in 2022, down from closer to 40% five years previously. For couples and sharers, this figure will be even lower.

Whilst we expect our BTR rental index will slow from its current highs into 2023 as a result of wider cost of living pressures, the analysis suggests that there is headroom for above average rental growth to continue.