Supply struggling to close the demand gap in the country market

For now, property for sale remains low after sustained period of high activity.

2 minutes to read

UK house prices are proving resilient due to high demand and low supply, and outside of London this same imbalance persists as we head into the traditionally busy spring period.

However, with supply depleted after a record 2021 that saw a stamp duty holiday and the escape to the country trend in full force, some sellers remain reticent to list their properties due to a perceived lack of purchase options, despite the arrival of spring.

“We’re getting called out to appraise plenty of property but there’s an element of people sitting on their hands waiting for more property to come onto the market before they commit themselves,” said Harry Bethell at Knight Frank Cheltenham.

It means this year’s spring market is unlikely to mark the return to more balanced pre-pandemic conditions, with demand set to continue outstripping supply as the impact of Covid on the property market lingers.

While market valuation appraisals were up 6% in February versus the five-year average outside of London, new sales instructions were 9% down in the same period.

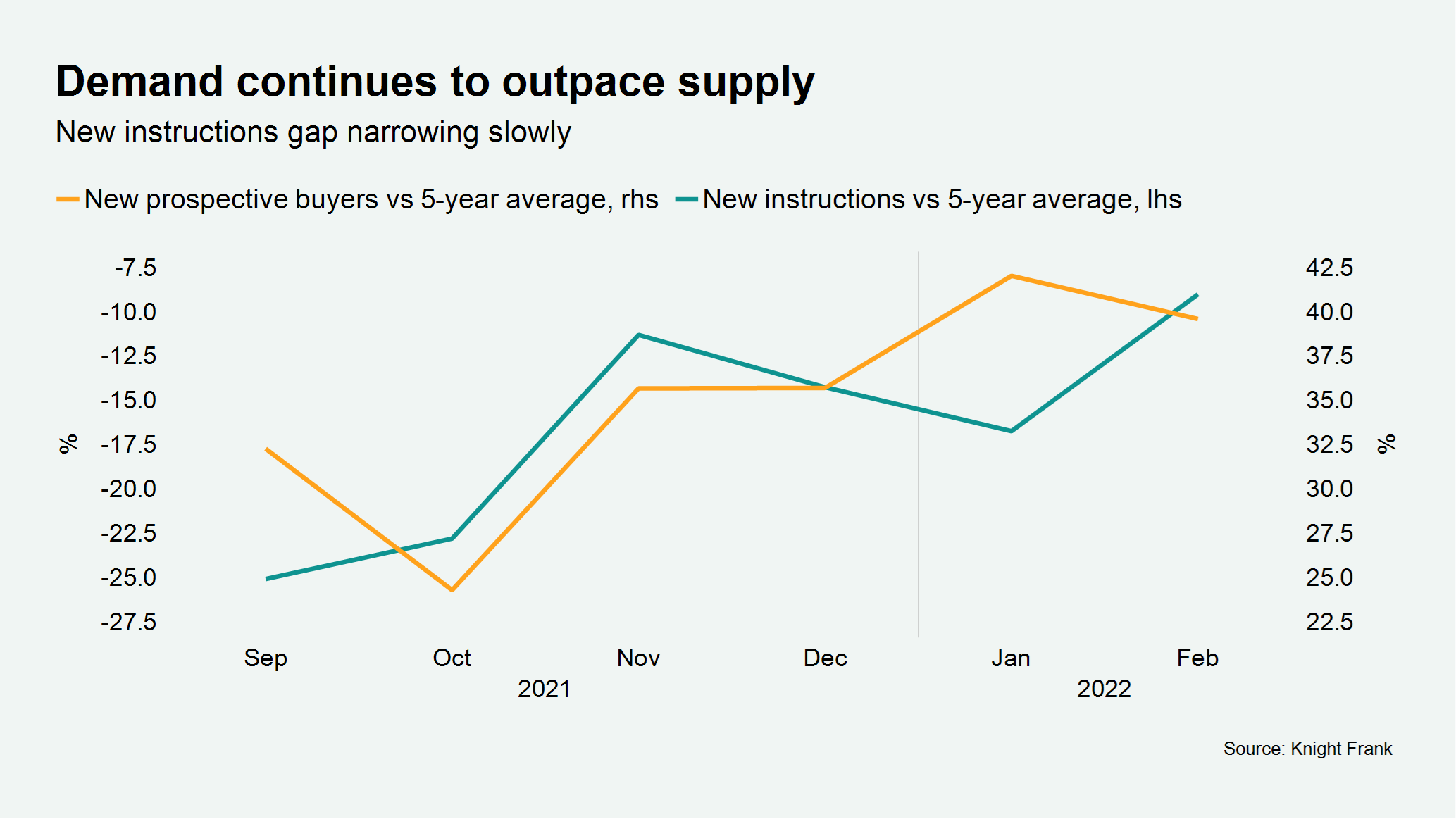

Although this is the best reading for new instructions since June of last year, demand remains high (see chart).

New prospective buyers were up 39.5% versus the five-year average in February outside of London and offers accepted were up 42.9% on the same basis, which was the strongest reading since April.

This continuing imbalance means that as of February 2022, the amount of property for sale outside of London was 42% lower than it was in February 2020 before the UK’s first national lockdown.

The data for the first two weeks of March suggests a continuation of this trend, which will retain strong upwards pressure on prices.

“Supply remains tight and there’s still a long way to go, but there’s a percentage of vendors that acknowledge the strong market and will sell,” said James Toogood, office head at Knight Frank Bristol.

It means buyers looking to secure their next home in the coming months will face plenty of competition.

“For sellers it remains a great time to do exactly that, as buyer interest is strong and there is less competition in the marketplace at present,” said James Cleland, head of the Country Business at Knight Frank.