Friday property news update - 12th March

New forecasts for house prices, rental supply tightens, and the end of the hot desk?

4 minutes to read

All raise

Not to be outdone by the OECD, which hiked its forecast for global growth earlier this week, we have revised our forecast for house prices.

We now expect UK house prices to increase by 5% in 2021, rising from a forecast of zero at the start of this year. The strength of key market indicators in the first two months of the year, as Tom Bill set out last week, meant that an upwards revision was likely even without the measures announced in the Budget.

Our forecast for Greater London has risen to 4% from 1% in January. We now expect price growth in the UK to outperform the capital as the impact of the tapered stamp duty holiday extension drives demand in lower-value markets through to the end of September.

Our forecasts for Prime Outer London and Prime Regional markets have remained largely unchanged as both areas continue to benefit from a drive for more space. However, continued uncertainty around the relaxation of international travel restrictions means we have revised our 2021 forecast for prime central London (PCL) down to 2% from 3%.

Rental supply tightens

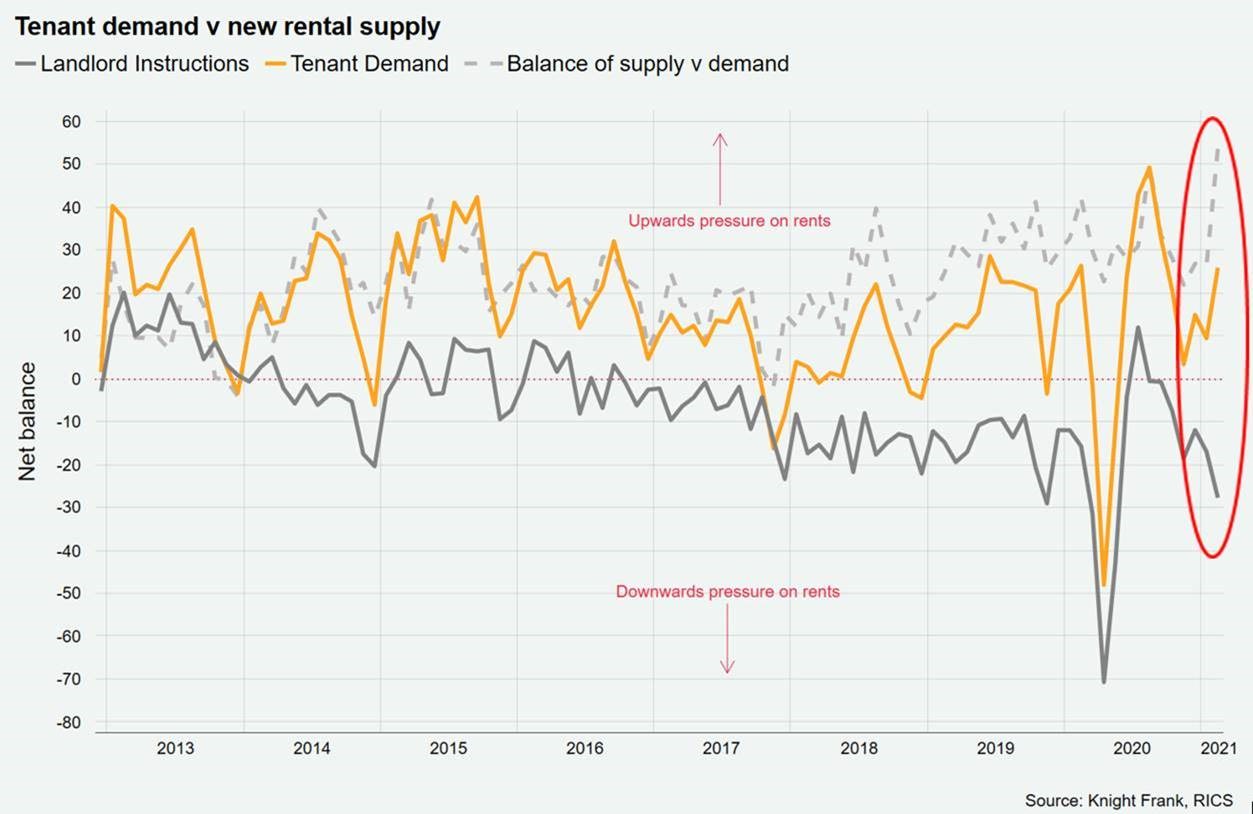

The latest RICS survey of estate agents shows the biggest gap on record between national landlord instructions and tenant demand - see the chart below courtesy of Oliver Knight. That explains why the rental market has been relatively buoyant - rents climbed 1.3% in the year to January, according to the ONS.

A net balance of +37% of RICS respondents envisage rents increasing during the coming three months. On a twelve month view the RICS survey suggests rents will rise by a little over 2% at the national level. The mooted changes to capital gains tax could trigger further upwards pressure on rents as landlords leave the sector, should that come to pass in the Autumn.

America sets a date

Every US adult will be eligible for vaccination by 1st May and the 4th July Independence Day holiday is now the target for a return to normality, Joe Biden said in a televised address last night.

The president was speaking after signing the enormous $1.9tn stimulus bill into law. That pushed the S&P 500 to an all-time high and the dollar is on course for its biggest weekly decline since December - settling around $1.40 to the pound.

The successful vaccine roll-out and the steady drip feed of better than expected economic data is all coalescing around a rosier outlook than was apparent just a few weeks ago. The next big question will be whether such a strong recovery triggers a burst of inflation.

The end of the hot-desk

The pandemic will end hot-desking, with offices in future having fewer desks and more meeting rooms, Derwent chief executive Paul Williams tells the Times. Mr Williams said that while offices have been designed with 8 sq m for every worker, future workplaces would be designed with about 12 sq m per person.

Meanwhile Lee Elliott's Occupier Dashboard monitoring 86 global office hubs suggests asking rents in most markets are being held stable but deals are being underpinned by more generous tenant incentives such as rent free periods.

Some 67% of the markets covered in the report are expected to show tenant favourable market conditions for 2021, an increase from the 44% of markets in our Q3 report. Only 7% of the global markets we cover are expected to show landlord favourable conditions in 2021 – those markets being Amsterdam, Brussels, Bengaluru, Cairo, Seoul and Taipei.

Paying for the crisis

What is the fate of cities across the globe as they seek to reopen? And what does the prospect of inflation mean for governments with growing deficits?

These questions are at the core of the latest Intelligence Talks podcast, in which Patrick Gower speaks to Wealth Report editor Andrew Shirley and deputy editor Flora Harley about the findings of the 15th annual edition.

The team also explores whether governments will turn to wealth taxes in order to pay for the Covid crisis, considers how philanthropists are shaping matters once considered the sole domain of governments and investigates whether Pokemon cards are to young investors what classic cars were for the previous generation. Listen wherever you get your podcasts.

Meanwhile, here's more from Flora on why optimism among the wealthy is at a four year high.

In other news...

While take up of previous mortgage guarantee schemes has been poor and pricing doesn't always match the government's ambition, this time things look different. At least half a dozen lenders have signed up for the new 95% guarantee scheme launching in April and it looks like rates for new 95% mortgages may come in under 2% when you fix for two years, according to David Hall of Knight Frank Finance.

Plus, in Australia the government will pay for your flight, global chief executives say UK market is more attractive after Brexit, UK plans sweeping markets review to give London a Brexit edge, Sunak worries about the risk of rising interest rates, town centres show signs of life as the lockdown frays, UK spending climbed in early March, WTO cautious after sharp services trade rebound, EU study finds the virus has already wiped out 6 million jobs, and finally, New Zealand's unsustainable house prices could trigger a pronounced correction, says the IMF.