As expectations run high, will this be another summer of misplaced hope?

Making sense of the latest trends in property and economics from around the globe

4 minutes to read

Sluggish, cautious and lacking in urgency. Whether you're following the UK housing market or the England football team this summer, some things remain consistent, but do brighter times lie tantalisingly close?

Perhaps. On Monday, Barclays said it would make sizable reductions to many of its two and five-year fixed rate products. Its five-year fix at 60% loan-to-value is now 4.23%, which as of yesterday made it market leading. The two-year fix at 4.67% also put Barclays top of the table.

Falling short

Lenders have spent weeks raising and cutting rates, but the size of these cuts from a large bank makes them unusual. Granted, swap rates have come down: the five-year Sonia has eased to 3.86%, from 4.1% a month ago, but the move by Barclays suggests that we might see lenders opt to move ahead of a potential Bank of England rate cut in August. All would like a larger share of purchasing activity that, like certain sporting exports to the eurozone, has fallen well short of expectations.

Granted, this could be reversed at short notice. Earlier this week, Tom Bill considered the various forces being exerted on UK mortgage rates. The average margin charged by a mortgage lender is 0.3 percentage points, when it used to be 1 or 1.5, making them very vulnerable to short term shifts in swap rates. Inflation, both domestic and in the US, remains a real threat to any housing market recovery.

Yet, the nasty surprises that were occurring almost fortnightly are becoming rarer. The US economy now looks less of a cipher - consumer confidence is coming down, shoppers are tightening their belts and traders are pricing in 75 basis points of cuts in the next nine months. In the UK, the slowdown in the latest purchasing managers index was led by a fall in the services sector, a key concern among BoE policymakers.

All of this presents a more stable environment for UK lenders to make bets on the future, slashing the odds that we'll have yet another summer of misplaced hope. Surely?

All-time highs

Resilience or dysfunction. It's hard to know the difference when it comes to the US housing market.

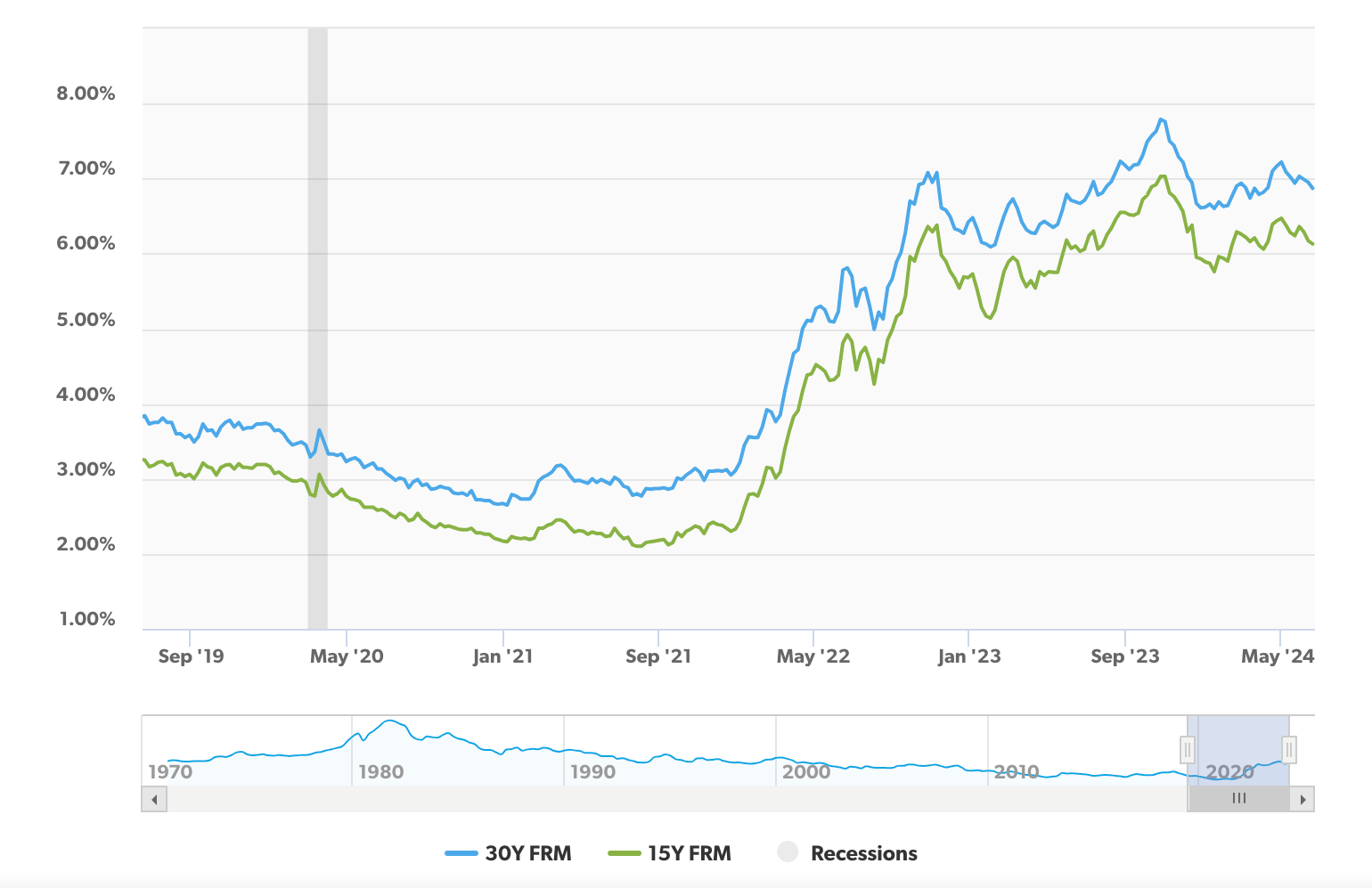

Mortgage rates have now edged down for three weeks due to the brighter outlook for interest rates, yet at 6.87% the 30-year rate remains painfully elevated - see chart below from Freddie Mac. That puts the 30-year rate roughly back where it was in April, when national house prices hit another all-time high, according to the S&P CoreLogic Case-Shiller Index, published yesterday.

The problems are now well documented. High house prices prevent many would-be buyers from exiting the rental sector. Long-term mortgage rates provide a powerful disincentive to move, which strangles supply and pushes up prices, even when demand weakens.

The supply side is improving, but slowly. Plus, the rate of house price growth is slowing. The National Home Price NSA Index, covering all nine U.S. census divisions, reported a 6.3% annual gain, down from 8.3% the previous month. The index of 20 cities posted a 7.2% gain, down from 7.5%. But this is still remarkable growth to be posting on the cusp of a new, albeit likely slow, rate cutting cycle.

The election

We've seen the manifestos, but the UK's main parties continue to flesh out their plans during interviews with journalists - particularly Labour.

See Ed Miliband's Telegraph interview for hints of his plan to tweak the NPPF to make it harder for communities to block wind turbines, plus Labour's pledge to scrap the 2035 ban on new gas boilers. The FT has details of Labour's confusing proposals to prevent bidding wars in the rental sector. In an interview with ITV, Keir Starmer outlines some big plans for growth.

We cover everything relevant to the commercial sectors in a new edition of Intelligence Talks, out this morning. Anna Ward is joined by Will Matthews, Shabab Qadar, and Stephen Springham to discuss the key manifesto proposals on finance, investment, tax, business rates, and planning laws, plus we hear how each expert would invest a hypothetical sum of £50 million. Listen here, or wherever you get your podcasts.

In other news...

Barcelona plans to ban short term rentals for tourists from 2029 (Bloomberg), BTG to spend a billion euros on European real estate (Bloomberg), a new take on London's housing crisis (Bloomberg), minimum tax on billionaires would raise up to $250bn a year, says report (FT), and finally, Landsec buys more of Bluewater shopping centre (Times).