London new homes update: Spring 2024

Snapshot of key Knight Frank market data and trends impacting residential development in the capital

5 minutes to read

Demand for new build homes in London is on the rise, with key demand metrics showing an improvement on last year. Reservations should pick up as rate cuts come into view in the second half of the year, but housing supply is stretched in the capital as soaring costs are limiting new development, making housing a key battleground in the UK’s imminent general election.

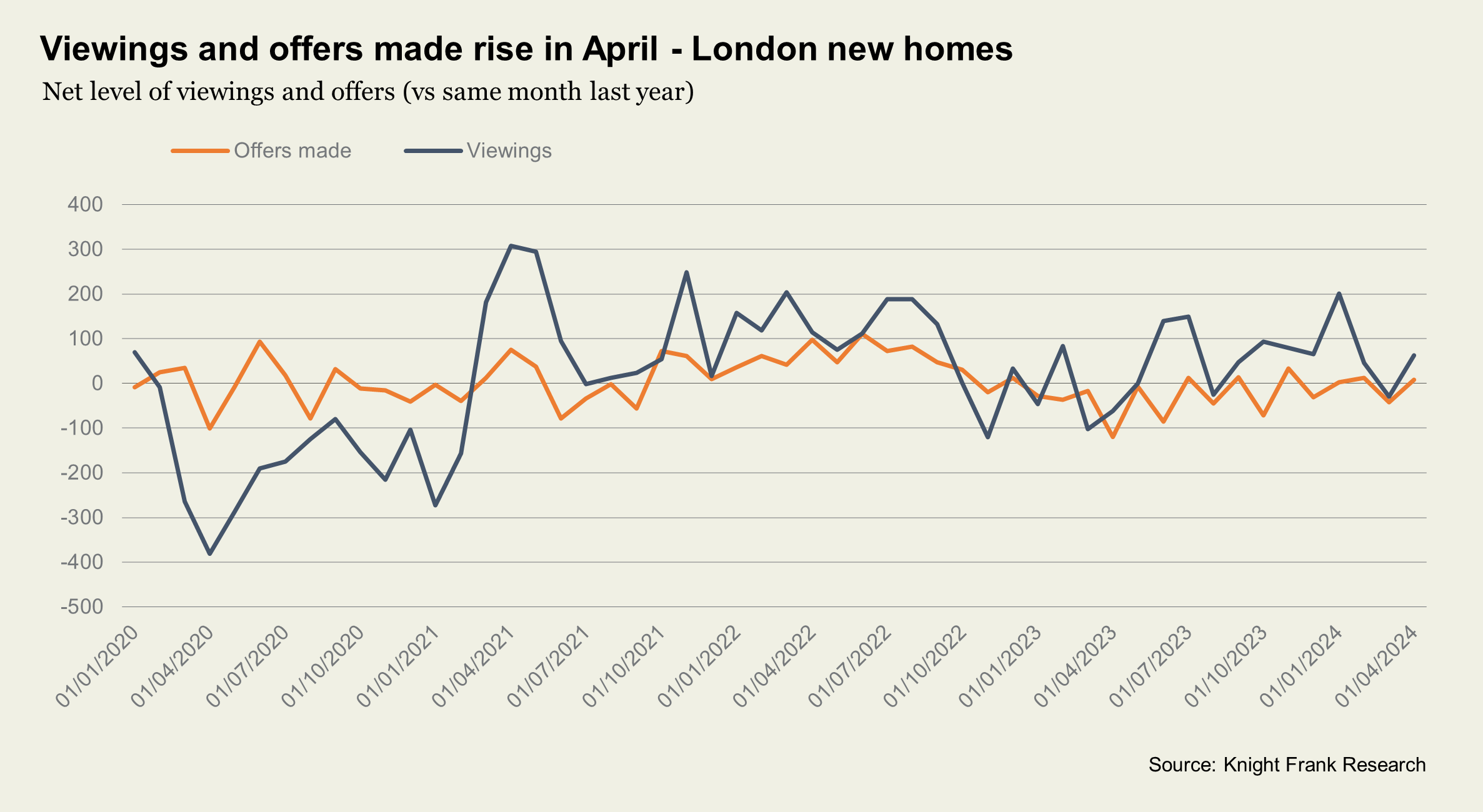

In April, the total number of offers made on new homes in the capital rose 9% compared with a year earlier, while viewings were up 17%, Knight Frank data shows. In early 2024, the net volume of viewings and offers made has largely been positive against 2023, other than a dip in March when inflation rose at a stronger rate than expected (see chart).

The number of prospective buyers registering their interest in purchasing a new home last month in London increased by around 15-20% compared to April 2023 for the mid-to-upper markets. The most popular price points are either £750,000 up to £1 million or £2m plus.

The increase in demand, combined with a cut in interest rates now expected in August, should feed into higher reservation volumes later this year.

The lack of available stock in Prime Central London, means that buyers at the top end of the market are seeking out opportunities in new areas. Southbank is a key example of this, with demand for prime London property now spilling south of the river. This is creating new opportunities to build homes such as US developer Hines’ 433-home project 18 Blackfriars Road, which was granted planning consent in April, and Native Land's Bankside Yards, a 1.4 million square foot mixed-use development set to include a total of around 600 homes.

While the pandemic saw buyers gravitate towards outer-London schemes with access to green space, there has been a revival of interest in residential schemes in financial districts. Notably, these are also attracting a wider demographic, with larger units now selling faster than one-bed apartments or studios. This has been the case for Canary Wharf’s One Park Drive and 10 Park Drive, where all three-bed apartments are sold out, with the sale of a combined 830 apartments across both schemes now nearing completion.

The City of London has also completed its first branded residence tower, Bishopsgate Plaza, a concept which is experiencing considerable growth. It appeals to residents due to its wider breadth of amenity and higher levels of security. Bishopsgate Plaza is split into 160 private flats and 237 hotel rooms. Sales are underway and a large proportion of the private flats have already been sold.

Constrained supply

But as demand builds, stock levels and pipelines are depleting across the market, with elevated build and finance costs having deterred some developers from making new applications to build new homes.

Housing delivery levels in London remain well below target. Completions are trending downwards, while new starts have fallen 20% in a 12-month period and new permissions for major residential developments have collapsed to a record-low.

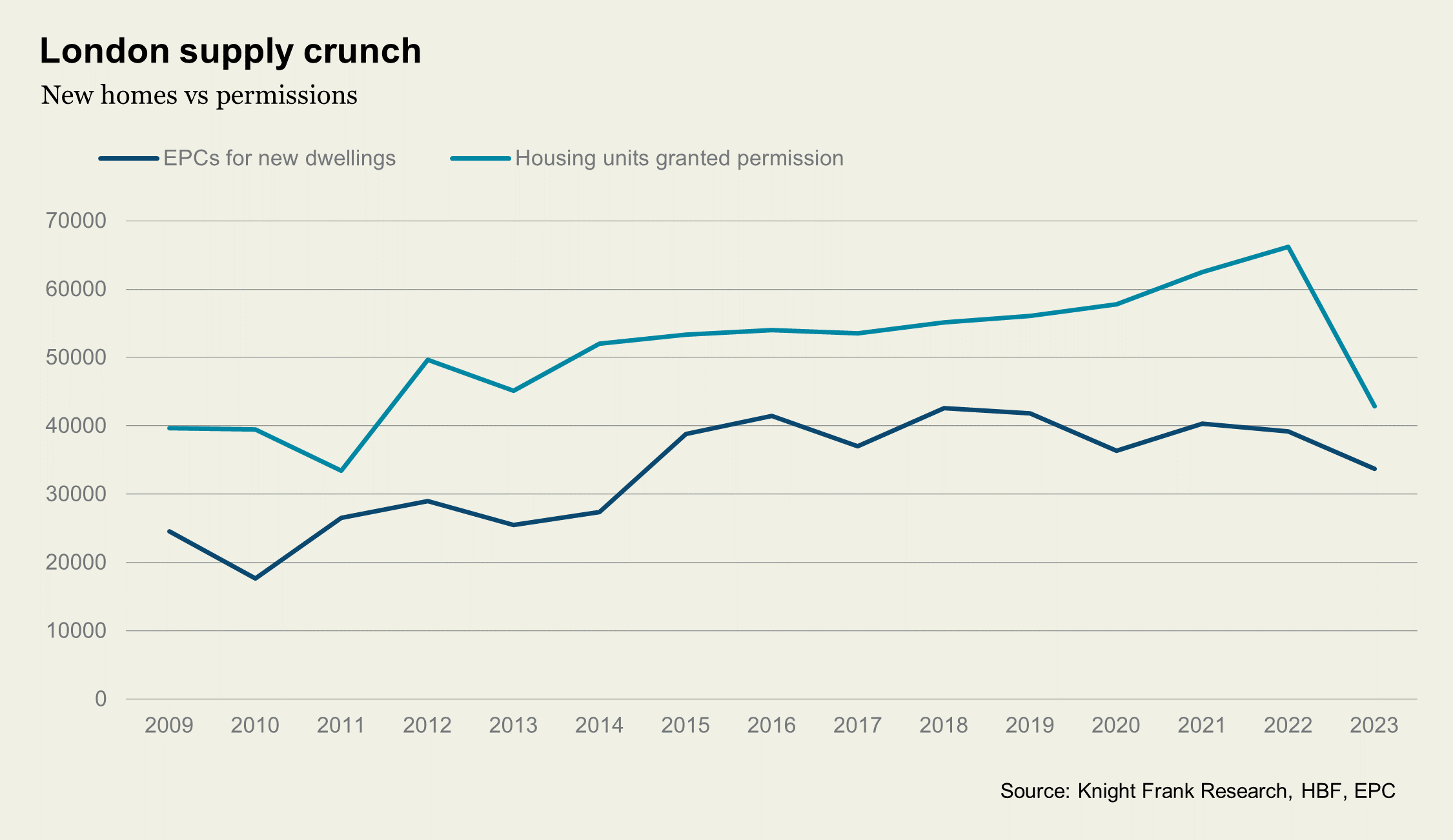

Delivery has eased to around 35,000 homes per year, according to the latest net additions figures to March 2023, down 10% from the year before. This is over 30% below the Mayor of London’s target for 52,500 new homes a year.

The planning pipeline is also squeezed: the number of housing units granted permission last year dropped 35% in London to 42,908, a 12-year low, Home Builders Federation data shows, as full year delivery eased 14% to 33,712 homes, using EPCs as a proxy for completions (see chart).

For major developments of 10-plus homes, just 265 projects were granted consent in 2023, the lowest level since Office for National Statistics records began in 2000.

This is down to a decline in applications coming forward rather than rejections, with the percentage granted planning permission remaining stable at 80%.

Broader vision

Private-public partnerships are set to play a larger role in the capital’s housebuilding landscape over the next decade.

Combining publicly owned land with private housebuilder expertise is one way to leverage scale to ease London's housing crisis.

For example, many NHS-owned sites have further potential for increased occupation from both health services and other uses such as housing.

These include Springfield Hospital in Tooting, South London, which launched for sale in 2021, and includes over 800 new homes, and Ravenscourt Park Hospital in West London, set to provide 140 homes, due to be launched to market next year. Another example is the St Pancras Hospital redevelopment in King’s Cross which is currently at the pre-planning stage to build a mixed-use scheme including 120 residential units and around 6,000 sqm of healthcare floorspace, alongside new commercial space.

Additionally, council estates are being regenerated across London, with some key examples demonstrating an uplift in housing numbers.

In Islington, the council has approved plans from Newlon and Mount Anvil to redevelop the Barnsbury Estate. Existing social rented and market homes will be replaced, and the project will lead to a significant uplift in affordable and market housing.

The project will deliver 914 homes, up 40% from the existing 646, two new parks, new streets, and a new community centre.

Another large-scale example includes Westminster’s Church Street regeneration programme, which will deliver up to 1,120 new homes and ensure the re-provision of all existing council homes, with affordable homes making up 50% of the homes delivered.

The regeneration will triple the number of homes on the site, currently 400.