Insight 4: Events, expansion, elevation

The fourth insight paper in our London Series, investigating the current occupier mindset and its implications for the London office market.

10 minutes to read

Events, expansion, elevation: The key drivers of London’s occupational market

Occupier requirements are changing, not evaporating. There are three key aspects of the occupier mindset that, when combined with three dominant deal drivers, shape occupier transactions and requirements in London.

Where we have been

There has been no shortage of views about how occupiers will act following the Covid pandemic. The prevailing narrative – often underpinned by evidence from a few high-profile occupiers – has been that the world of work is transitioning to a more remote footing and that, consequently, the quantum of office space they require will be radically reduced.

Aside from the limitations of making generalisations from specifics, this narrative is dangerous. It fails to recognise that many occupiers are still trying to make sense of the great global workplace experiment of the last four years.

They are still trying to separate true signals from the noise; however, less volatile (relatively) economic and operating conditions are leading occupiers to execute on their real estate strategies in London and beyond. As they do, a more nuanced, progressive and expansionist narrative is emerging.

The occupier mindset

There is no doubt that the occupational market is gaining significant momentum. London office take-up for the full year 2023 was up 1.4m sq ft on average annual volumes since the pandemic, while Q4 2023 saw the strongest quarterly take-up volume for five years.

Furthermore, current active demand is at a 10-year high.

Our daily exposure to occupiers active in the market, together with our proprietary occupier research – most notably (Y)OUR SPACE and our quarterly Corporate Real Estate (CRE) Sentiment Index – provides clear access to current occupier thinking and action. Through this insight, we have identified three aspects of the occupier mindset that, we believe, will bring increased market activity over the next 12-24 months.

1. A flexible but office-centric workstyle will be the post- pandemic reality for most businesses.

Our latest CRE Sentiment Index shows that after glacial progress on office occupancy rates around the world, more than one quarter of responding occupiers expect to be back to pre-pandemic levels of occupancy by mid-2024. Furthermore, 8 out of every 10 occupiers surveyed for (Y)OUR SPACE anticipate a future workstyle that is office-centric – be that badged hybrid, office first or office only. Whilst the genie of flexible working will not be returned fully to the bottle, there is little doubt that businesses are seeking to achieve better balance between in-person and remote presence.

2. The blinkers of the Covid pandemic have been removed, with companies thinking progressively as they transform and expand.

The pandemic experience brought a defensive, survival-based narrative into the market. This was understandable but is no longer relevant. Transformation and expansion strategies are both being actively considered by business leaders, and this will have real market implications. More than two-thirds of (Y)OUR SPACE respondents identified a transformation strategy running through their business over the next three years, while 55% expect expansion of their global footprint over the same timeframe. As we will demonstrate shortly, that expansionary intent is already in evidence in the London market.

3. The Covid pandemic experience has brought a re-evaluation of the office but the outcome is typically a different office, rather than no office.

In keeping with the great global workplace experiment, occupiers are emerging from the evaluation phase with stronger signals about what their workplaces need to do, how people will interact with those workplaces and, therefore, the quality and quantity of space that they require at an individual office or portfolio level.

This is not a case for no offices. It is a case for different offices. Offices that elevate both the business and its brand. Offices that drive collaboration, connection, community and culture.

In this context and when you factor in the growing physical obsolescence in the London office market, it is not surprising that 47% of all occupiers surveyed for (Y)OUR SPACE anticipate relocating their headquarters over the next 3 years. Occupier mobility is, and will continue to be, on the rise.

Analysing activity

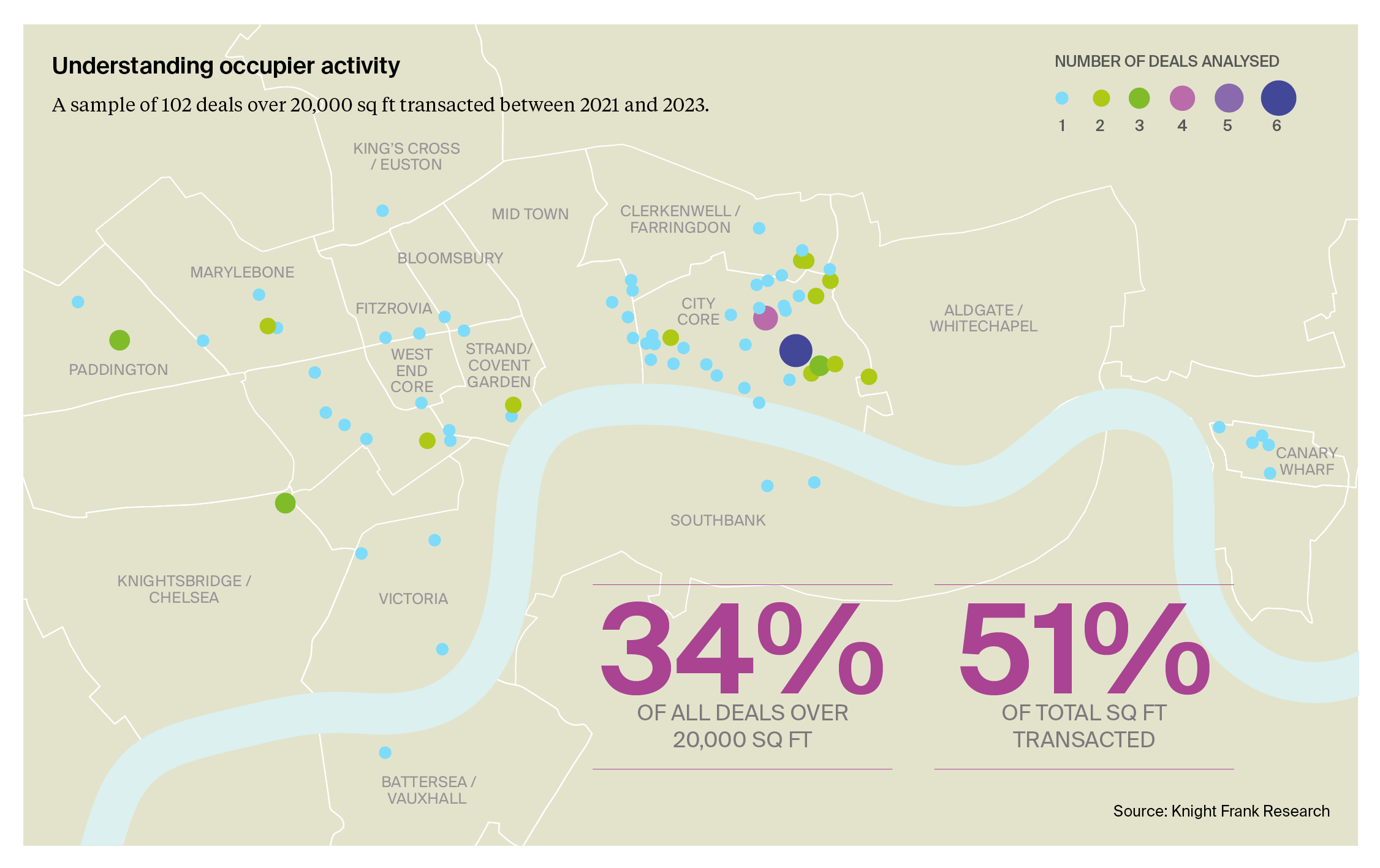

To establish the realities of occupier decision making in the London market, we undertook a detailed analysis of post-Covid transactions. We adopted a sampling approach to create a balanced, representative sample of 102 of the 298 deals of 20,000 sq ft or more seen in the London office market over the period 2021-2023. The deals within the sample accounted for 7 million sq ft of take-up – around half of the space transacted over this three-year period. We specifically analysed occupancy and building details pre and post transaction to establish how both the qualities and quantum of office space leased by each occupier changed. The details were verified by our market facing teams.

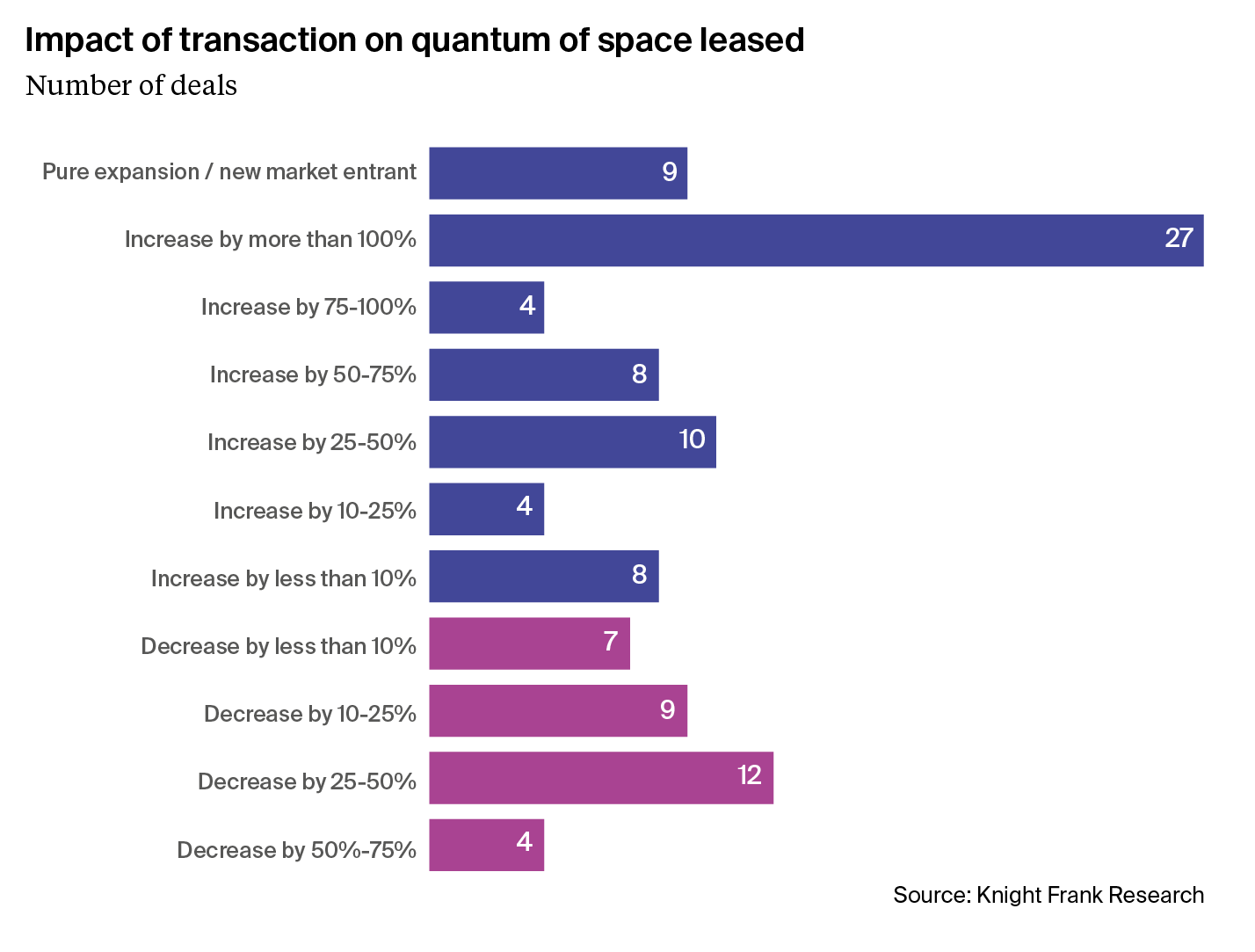

Collectively, and as highlighted in the second paper of The London Series, these 102 deals led to a positive net absorption of 1.1 million sq ft. Tellingly, only 32 of the assessed deals led to the occupier reducing their footprint. Almost as many – 27 deals – saw the occupier more than double their space. The momentum around expansion appears to be sustained. Eighty per cent of those occupiers actively seeking 50,000 sq ft or more in London today, are planning to occupy more space than they currently do.

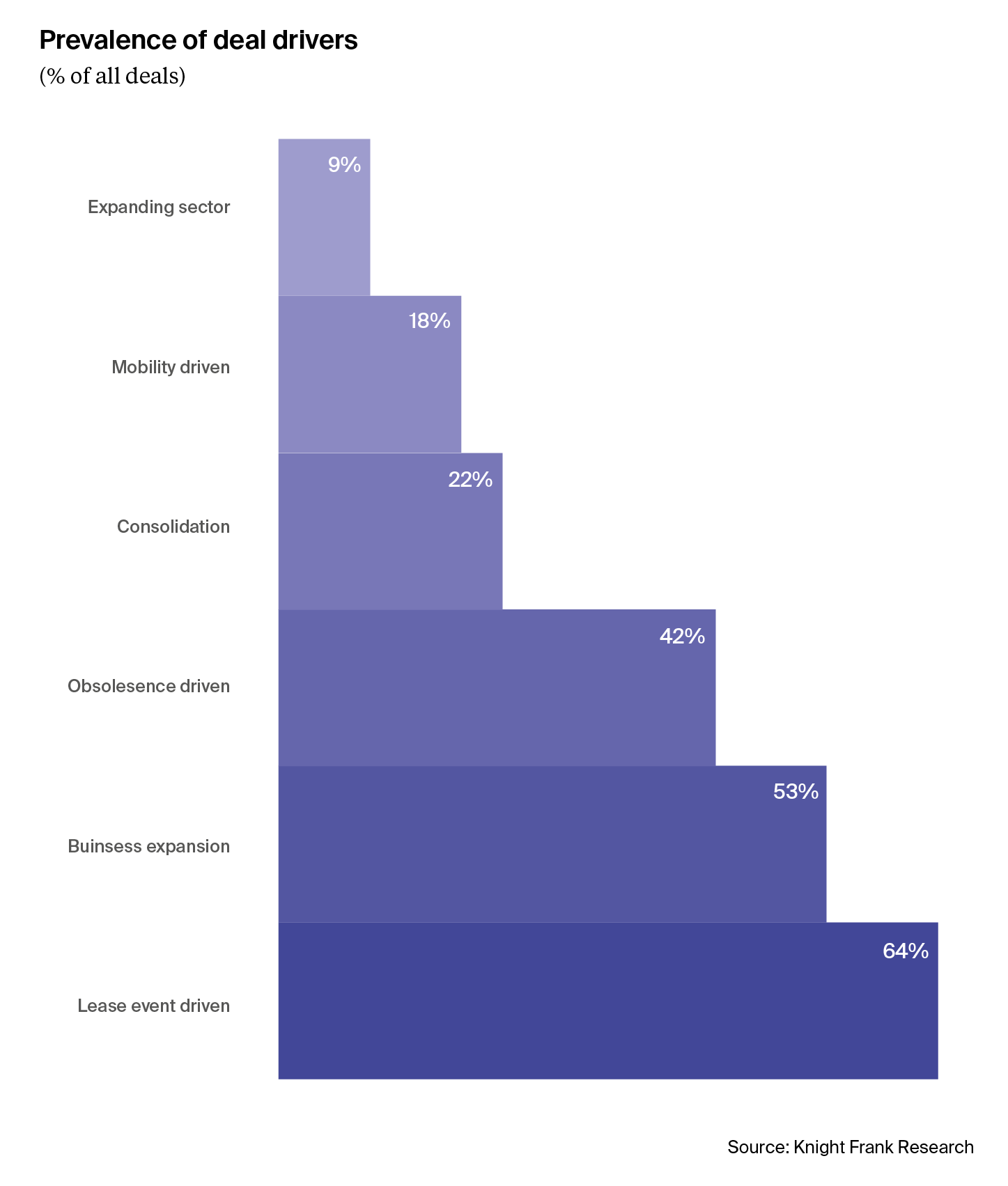

As well as analysing the quantum of space transacted in each deal, we also analysed the drivers underpinning each transaction. This detailed analysis found that there were 6 types of deal driver at work in the London market, namely:

1. Expanding sectors – businesses found within high-growth sectors such as life sciences, elements of the tech- sector or education.

2. Expanding businesses – businesses that had their own growth opportunities which were fuelling the need for additional floorspace to accommodate future headcount growth.

3. Lease events – occupiers facing upcoming breaks or expiries that were being used proactively to drive a change in real estate quantum or quality.

4. Reaction to obsolescence – occupiers responding to the growing obsolescence of London’s built stock and recognising that their existing accommodation is either physically or functionally obsolete.

5. Mobility drivers – occupiers making a proactive move into London or to a different London sub-market, to either secure best in class product, make a step change in their business or take advantage of London’s recent transport infrastructure upgrades.

6. Consolidators – businesses seeking to bring multiple offices into fewer holdings, and in numerous cases a single building, or scaling back real estate to reflect new operational realities.

These deal drivers very rarely occur in isolation. Instead, a number tend to work simultaneously to drive real estate decisions. In illustrating this point, we identified 211 separate incidences of these drivers across the 102 transactions we assessed. What is also clear from this analysis is that three of the six drivers were most prevalent – lease driven events, business expansion and a reaction to building obsolescence.

Our view is that these drivers will remain foremost in driving occupier activity over the next cycle, not least as a response to the 28.3m sq ft of lease expiries occurring in London between 2024 and 2026, or the fact that more than half of London’s current office stock has an EPC rating of C or below and is, in effect, unlettable from 2030 without refurbishment works.

Drivers in action

Exploring these drivers further through real market examples is illustrative.

Although there is a rich narrative across all sectors, a narrower focus on the legal sector is representative.

Dentons' impending move from One Fleet Place to One Liverpool Street, is a clear example of a reaction to both physical and functional obsolescence. The original occupied space was built in the early 1990s when private offices were the norm. The upcoming relocation will enable new workstyles to be delivered, will deliver greater amenity and connectivity and will prevent Dentons from having to endure the upheaval of temporary offices and a double move whilst remediation works at One Fleet Place took place.

Another law firm, HFW, used an upcoming lease event to also deliver activity-based working to the business, whilst consolidating from nine floors into three and drawing on the superb amenity provision of 8 Bishopsgate. Not only has their relocation delivered a positive workplace experience for staff but it also generated efficiency gains by leveraging shared building amenities – a space saving of some 8,000 sq ft. The flight to quality is very often positioned as a meansto simply deliver better spaces but it can also deliv er significant operational efficiencies.

Those efficiencies were also seen in Goodwin Procter’s move to Sancroft where the provision of new working floors of 36,000 and 40,000 sq ft will drive vital team adjacencies and greater collaboration. They also serve to better accommodate the growth that the firm has been experiencing. Indeed, the quantum and qualities of the new space is far removed from the 11,000 sq ft shallow floorplates taken less than a decade ago to accommodate private offices.

So three law firms, different drivers and three different solutions. That is the essence of the current occupational market. Post-pandemic work trends are not one size fits all, nor the ‘be all and end all’ when it comes to making what is not simply a real estate decision but rather something that can enhance (or conversely impede) business operations and strategy.

Conclusion

Our forensic analysis of real market activity, together with our daily engagement with a wide spectrum of occupiers, illustrates that London’s occupational market is in stronger health than the headlines would have you believe. While there are indeed occupiers who have been actively rightsizing their London footprint, many more have been moving in the opposite direction and increasing their London presence either through portfolio consolidation and a ‘flight to quality’, pure expansion or a movement into London from further afield.

The downsizing of the tech titans – which has driven so much of the recent narrative about the occupier – is not representative of the wider market. Indeed, as our research finds, most occupiers – drawn from a variety of industry sectors – have been increasing their London footprint via recent market transactions.

Deal drivers are clearly more progressive than the market narrative. The market which is showing a greater volume of activity than many predicted, is also a market that is generating significant value. The flight to better quality space – so apparent in our sample of transactions – drives higher rental profiles across the market. Contrary to popular belief, occupiers are accepting of the need to pay to secure the very best space. It must be remembered that, from the occupier’s perspective, people represent 60-70% of their cost base. By contrast, real estate is between 7-10%.

Increasingly, occupiers are recognising that having real estate which supports a wider strategic agenda – be that talent or ESG – will lead to an increase in total occupancy costs. Set against this broader strategic backdrop, the cost of compromising on real estate costs is very much a false economy. This is why even throughout the Covid period, many parts of London were still achieving record headline rents and why Knight Frank has redefined prime rental levels.

The London Series insight papers show that, as occupiers adopt a more office-centric and expansionist posture, they will hit head-on a fierce and emerging shortfall of quality supply. This may serve as a brake on transactional volumes and force occupiers into regears over the short- term; however, there can be no doubt that the occupier mindset, when mixed with growing functional and physical obsolesence and the greater use of real estate as a strategic device, will create a rich seam of market demand going forward. No one can afford a bad office anymore. As a result, the post-Covid era of occupier mobility, driven by events, expansion and elevation, is upon us.