Country Market Warms up as Temperatures Rise

There are signs of a seasonal pick-up in activity, but higher mortgage rates are keeping demand in check.

3 minutes to read

Last autumn, stubborn inflation was the biggest enemy of the property market.

If you insert the word ‘services’ before ‘inflation’, the same thing is true this spring.

There is certainly a strong sense of déjà vu as the prospect of a rate cut becomes more remote with each release of economic data and mortgage costs edge higher.

It was therefore not a surprise that the Bank of England held rates last Thursday, although two members of the nine-strong rate-setting committee voted to cut, compared to one last time.

Added to the growing belief the Bank will act before the Federal Reserve, a June cut feels more plausible, although swap markets seemed to largely shrug their shoulders following the Bank’s decision.

The outlook for the UK housing market will improve when services inflation (driven by factors including wage growth) starts to fall noticeably from its current level of 6%.

The overall inflation figure is likely to move closer to the Bank’s 2% target when it is next released on 22 May, but the headline number will be helped by a lower energy price cap from April.

Services inflation will prove far stickier, for reasons explored here.

The result of this economic uncertainty for the property market is a greater proportion of buyers moving because they need to, for reasons such as schooling and employment, compared to discretionary purchasers. It means activity is stronger in areas like south-west London than prime central London, as we analysed last week.

It also means the outlook is brightening for property markets outside of the capital, which are typically more needs-driven and linked to seasonal patterns of higher activity in spring and autumn.

Higher mortgage rates remain the key problem, but activity outside of London has not been helped so far this spring by the fact UK rainfall was 155% above the five-year average in April and there was a corresponding 35% fall in the number of hours of sunshine.

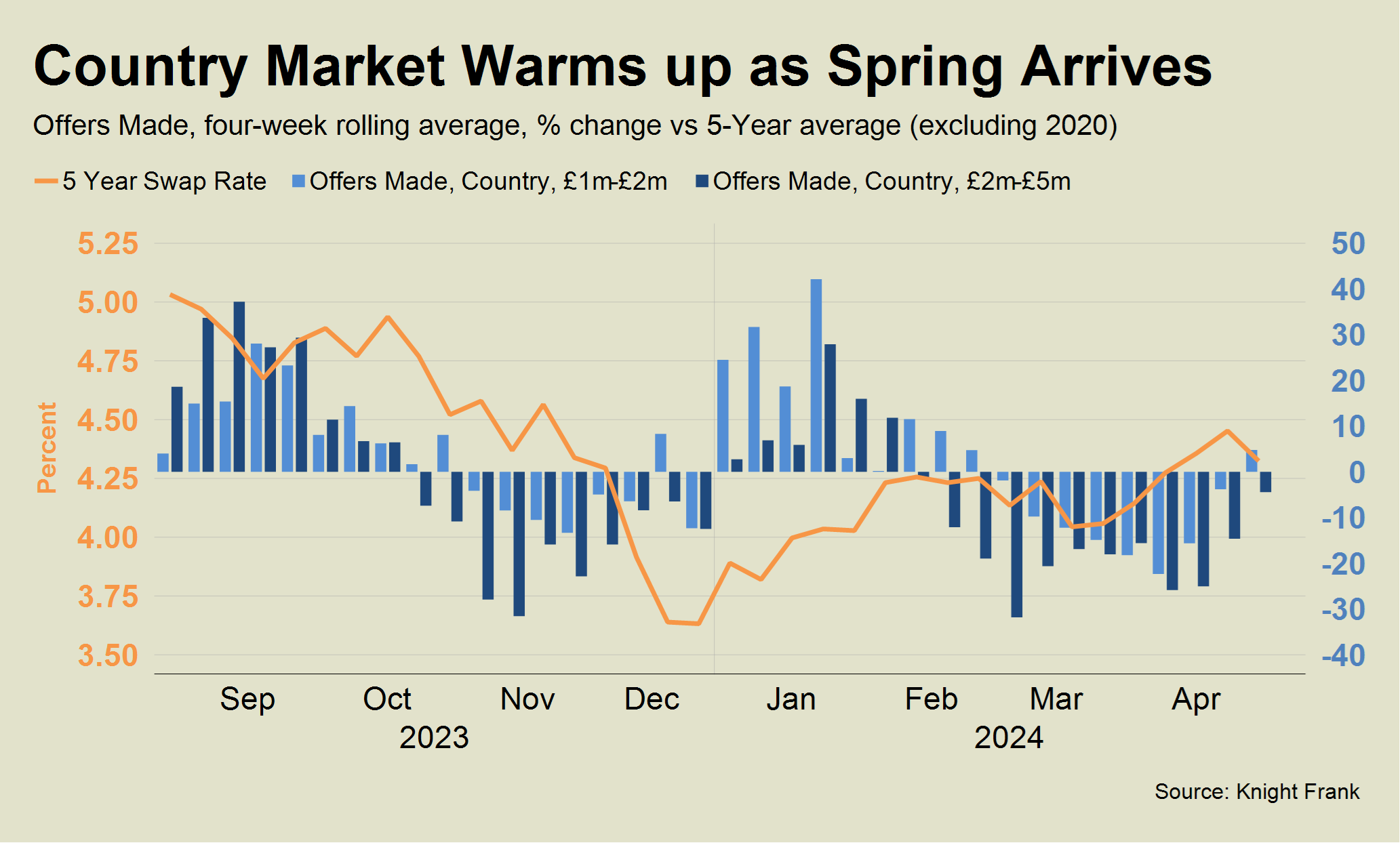

Despite the poor weather, the number of offers made between £1 million and £2 million in the Country was 5% higher than the five-year average (excluding 2020) in the four weeks to last Friday. When you consider how strong the market was in spring 2021 and 2022 during the ‘escape to the country’ boom, that’s a high bar.

There was an equivalent decline of 4% between £2 million and £5 million, which also paints an improving picture but reflects the larger proportion of discretionary buyers in higher price brackets.

Knight Frank Country data relates to a range of rural and urban £750,000-plus property markets across England and Scotland outside of London.

“There is a buzz in the air, but it hasn’t reached everywhere yet,” said James Cleland, head of the Country business at Knight Frank. “Demand is generally stronger in lower-value markets, but there is also the customary ripple out from the capital, which is supporting activity in locations closer to London. These are early signs, but they are positive signs.”

As well the seasonal increase in trading, some buyers and sellers are acting now ahead of the uncertainty of a general election in the autumn.

All of which points to a healthy if not spectacular market this spring.

There were 7.1 new prospective buyers for every new sales instruction in the Country in April, which compares to 6.4 in the same month last year and is slightly higher than the pre-Covid five-year average of 6. For context, the figure was 15.6 in April 2021, during the ‘escape to the country’ surge.

So, sellers shouldn’t get too carried away as the temperatures climb. The Knight Frank Country House index shows average prices are 11.8% higher than they were before Covid in Q1 2020. However, they are also 6.5% down on their last peak in Q2 2022.

After several years of ultra-low mortgage rates and a spike in demand for greenery and space during successive lockdowns, the best but rather unexciting description for the Country market this spring looks like it will be ‘normal’.