Many happy returns

Against a challenging backdrop, the past 12 months saw an uptick in wealth creation, driven by the robust performance of the US economy, a recovery in equity markets and a shift in outlook for interest rates. Liam Bailey reports

4 minutes to read

Most major economies managed to steer clear of downturns in 2023. In fact, global GDP expanded by a healthy 3.1%.

Emerging economies and Asia led the recovery, with India a notable example. Europe struggled to gain traction, but the US was the standout developed economy with a strong performance supported by government stimulus.

Following a disastrous investment environment in 2022, marked by the breakdown of the 60/40 equity/bond model and a staggering US$10 trillion loss in UHNWI portfolios, 2023 saw a turnaround in returns.

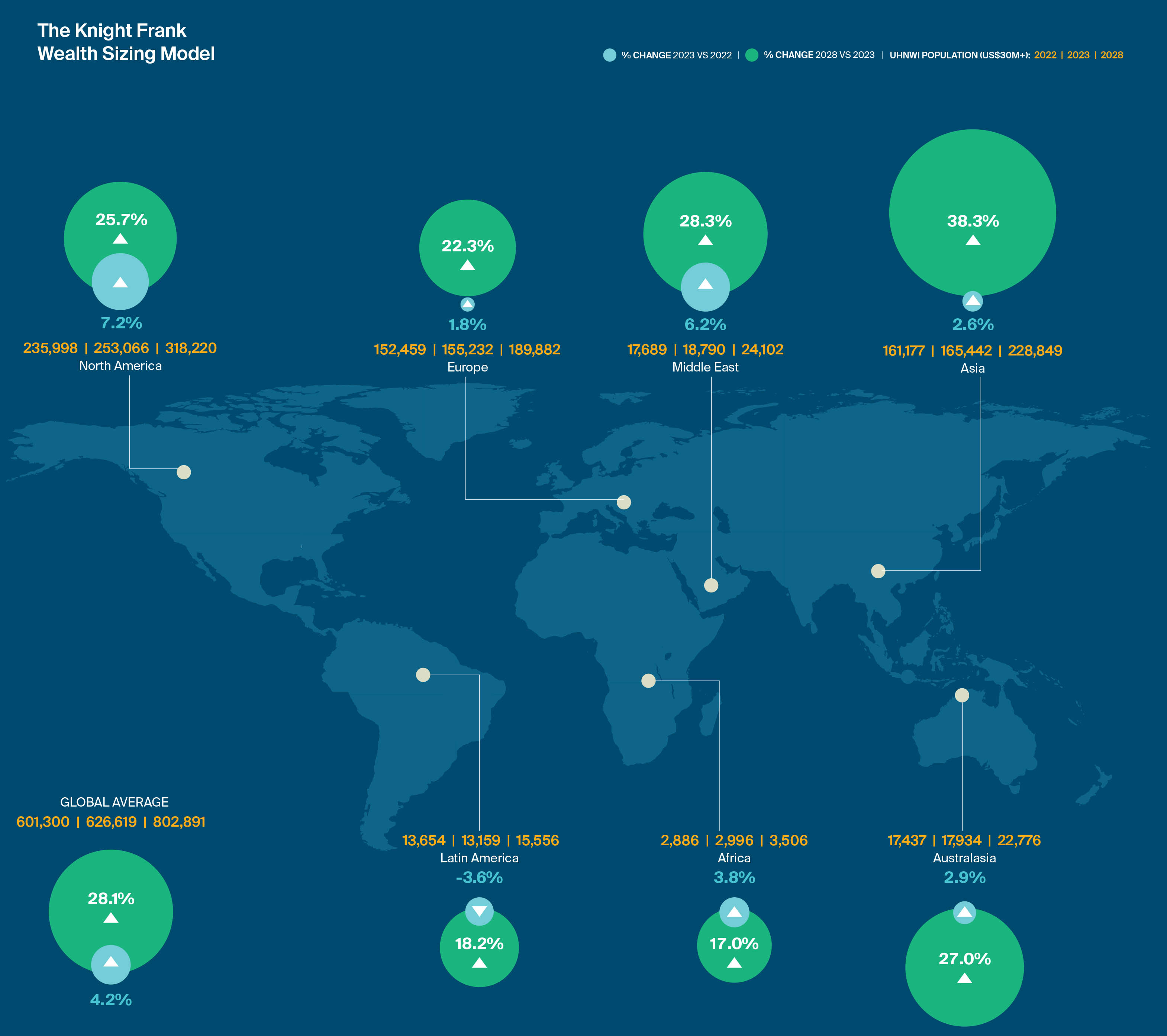

The number of UHNWIs globally rose 4.2% to 626,619, from 601,300 a year earlier. That more than reverses the 2022 decline. At a regional level wealth creation was led by North America (7.2%) and the Middle East (6.2%), with Latin America the only region to see its population of wealthy individuals decline. In terms of key country performance, Turkey leads our rankings with a 10% expansion in UHNWI numbers, followed by the US at 8%.

The rise in wealth creation was supported by global economic growth and the improved fortunes of key investment sectors. In the first half of 2023, despite ongoing rate tightening and rising bond yields, equities surged on the back of enthusiasm surrounding AI.

Even as this trend waned in the second half of the year, declining inflation and the anticipation of earlier and more substantial rate cuts provided renewed momentum to equity markets. The S&P Global 100 delivered a 25.4% annual increase in 2023, albeit this was hugely flattered by the outstanding performance of the “magnificent seven” US tech stocks.

On the upside

Bond markets experienced improved performance in the final quarter of the year, as investors factored in likely rate cuts.

While some sectors grappled with the lingering impact of elevated debt costs, particularly commercial real estate and private equity, residential property values surprised on the upside.

Residential capital values grew by 3.1% across the world’s leading prime markets through 2023. For investors, residential returns were supported by prime global rents rising at an average three times their long-run trend.

Other sectors delivered positive returns during the year, with gold up 15% and Bitcoin up 155%, reversing a large part of the losses sustained by this volatile asset in 2022

“The pandemic disrupted the delivery of new homes, especially in the luxury segment in markets such as London. There is a real window of opportunity for developers over the short to medium term”

Bright prospects

We expect the number of wealthy individuals globally to rise by 28.1% during the five years to 2028. While positive, our forecast points to a rate of expansion noticeably slower than the 44% increase experienced in the five-year period to 2023.

As we note on page 6, the global economy will likely be impacted by higher inflation in the medium term, leading to a lower growth outcome compared with the recent historic trend.

Our model points to strong outperformance from Asia, with high growth in India (50%), the Chinese mainland (47%), Malaysia (35%) and Indonesia (34%). With the mobility of wealth increasing all the time, a key question is whether future growth remains within these and other high-growth markets, or whether there is a leakage of talent to Europe, Australasia or North America. Outside Asia, strong growth is focused on the Middle East, Australasia and North America, with Europe lagging and Africa and Latin America likely to be the weakest regions.

Challenges and opportunities

Despite the slower rate of forecast growth in UHNWI populations over the coming five years, this expansion is still much faster than underlying population growth – likely to be around 5% over the same period.

This expanding cohort of wealthy individuals looks favourably on real estate. Almost a fifth of UHNWIs plan to invest in commercial real estate this year, while more than a fifth are planning to buy residential. Growth over the forecast period provides various opportunities for investors, particularly developers able to deliver property that suits the shifting tastes of the newly minted.

In the residential market, the Covid-19 pandemic disrupted the delivery of new homes, especially in the luxury segment in markets such as London. There is a real window of opportunity for developers over the short to medium term.

While the challenges are different in commercial markets, there are arguably larger opportunities. The market disruption impacting offices in particular, but affecting other sectors as well, considered alongside the requirement for investment to “green” existing property assets, points to a need for very deep pools of equity to come into the sector. We note on page 42 the activity of private capital in real estate investment, which points to a readiness to engage with this challenge. With so much wealth due to be created in the coming years, there will be plenty of opportunities for those with the right skills and insights.

“Almost a fifth of UHNWIs plan to invest in commercial real estate this year, while more than a fifth are planning to buy residential”

Download the full report here