The housebuilders back the Labour party

Making sense of the latest trends in property and economics from around the globe

5 minutes to read

Election campaigning is now well underway for a public vote likely to take place during the autumn. It's already clear that homeownership will form a central part of the battleground.

The housebuilding industry is ready for change: we asked 50 developers who they are backing and 70% chose the Labour Party. The respondents build about 70,000 new homes a year and offer the clearest insight so far as to who the industry finds most credible.

You can find the FT write up here and we'll be publishing more on the Knight Frank Intelligence Lab soon. The Conservative Party has long sought to walk a fine line between building enough homes in places that aspiring homeowners would like to live, while avoiding upsetting existing homeowners in rural constituencies that are wary of new development. The result, housebuilders tell us, is a confused policy landscape full of risk and delays.

“There is clearly mounting frustration amongst housebuilders, and growing demand for practical solutions,” Charlie Hart, Knight Frank's head of development land tells the paper.

The grey belt

Three months’ ago, Labour pledged to kickstart housebuilding by better utilising areas of previously developed green belt land dubbed the ‘grey belt’. Sounds sensible, but how much additional housing could it support?

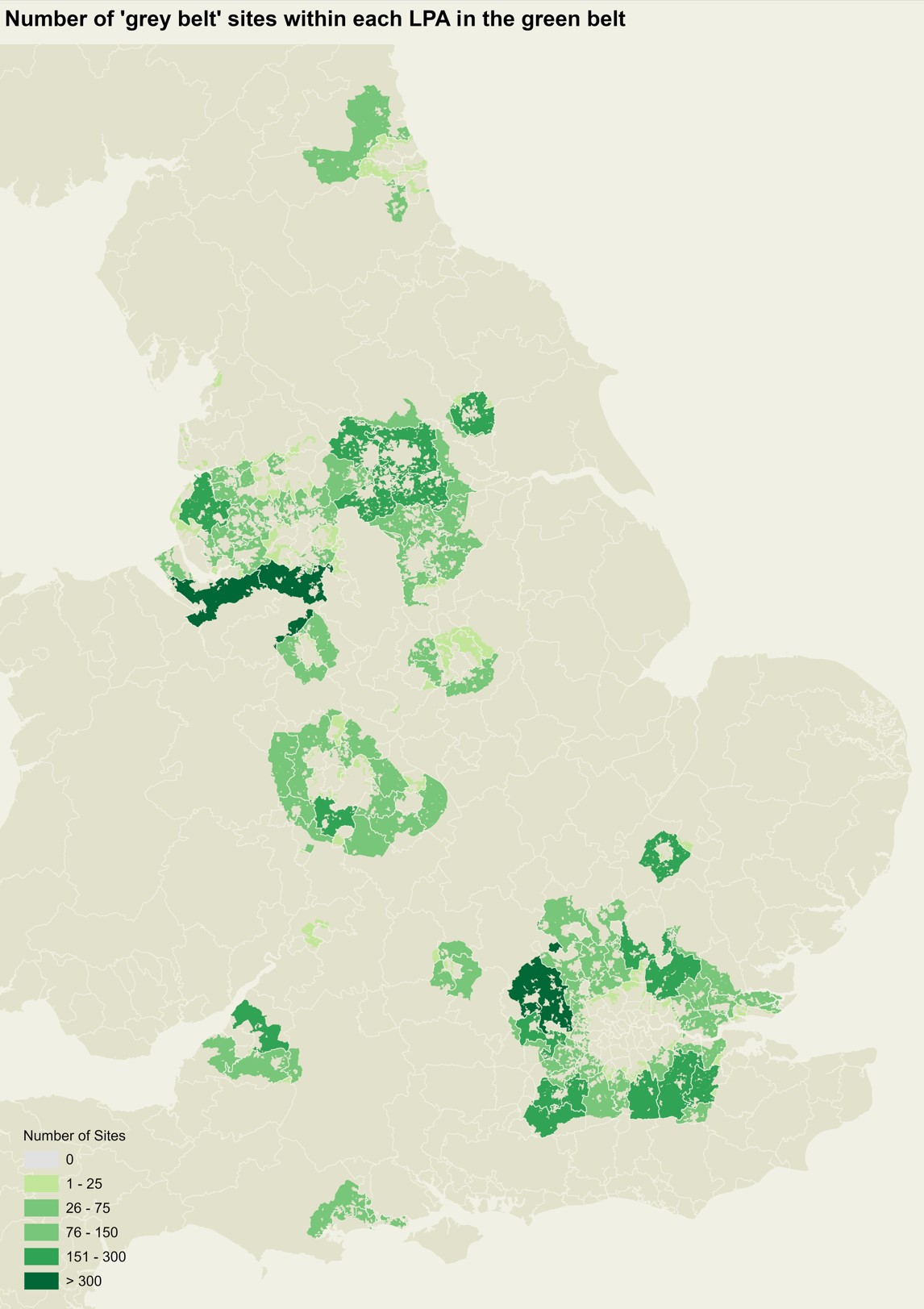

Roughly 12% of England is green belt land. Within that, Knight Frank research has identified more 11,000 previously developed sites that comprise less than 1% of the green belt. Those sites combined could produce 100,000-200,000 new family homes, depending on the density of the developments.

The data suggests that "the ‘grey belt’ will only ever be part of the solution, and it should form part of a range of housing land supply including sites in our towns and cities, as well as at other strategic or sustainable locations," writes Anna Ward.

Of the 11,205 sites identified, just over 40% (4,612 sites) sit within the London green belt area (see map). Merseyside and the Greater Manchester green belt area offered the second highest number of available sites (1,068), followed by green belt areas in Birmingham (1,351 sites), South and West Yorkshire (1,129 sites) and Bristol and Bath (606 sites).

Net absorption

There are a few competing narratives underway in the London office market. On the one hand, occupiers are competing for the greenest, most amenity-rich space and pre-leasing new offices up to an average of 13 months ahead of practical completion. On the other hand, businesses are rationalising and offloading space as they adjust to new workstyles.

Shabab Qadar and the team has done some interesting research on how each is impacting the rate of net-absorption, which is the amount of space leased by occupiers, minus the space vacated. Positive net absorption is a key ingredient for rental growth. The study covers absorption in the London office market since 2021, and looks at a sample of transactions greater than 20,000 sq ft. It amounts to a little more than 100 deals and 50% of the floorspace transacted.

The study shows 8.1m sq ft of positive absorption of office space whilst just over 7m sq ft has been vacated, resulting in 1.1m sq ft of net absorption. More than two-thirds of occupiers have relocated to more space than they vacated. The team also identified upcoming expansionary requirements of 4.1m sq ft and contractionary requirements of 1.5m sq ft, resulting in a potential net absorption of 2.6m sq ft over the next 12-18 months.

All of this is taking place amid a contracting pipeline. The under-construction pipeline completing by 2026 is 5.3m sq ft below average levels of take-up of new and refurbished space.

There is much more in the report. Read it here.

Super prime lettings

Many owners of super prime homes opted to rent out their property rather than sell amid a sluggish sales market, which fuelled leasing activity.

The number of so-called super-prime tenancies carried out by Knight Frank - classified as tenancies above £5,000 per week in central and north London and higher than £15,000 per month in south-west London - rose 10% to 108 in 2023, from 98 in 2022. That's also up from 81 in 2021.

Uncertainty surrounding the general election will support demand this year, according to Tom Smith, head of super-prime lettings at Knight Frank. Should the Labour Party win power, they have pledged to overhaul the non-dom tax regime as well increase the surcharge for overseas buyers of residential property.

“Global ultra-high net worth individuals like the non-permanence of renting and super-prime lettings properties are often in direct competition with London’s luxury hotels for that reason,” Tom says. “If tenants need to subsequently relocate, they won’t be worried about how property prices have performed or the fact they have forked out 17% in stamp duty, which can be the equivalent of four or five years’ rent. These tax changes have pushed up demand in recent years, which means landlords need to specify their property to the same high standard as they would if it was being sold.” You can read the analysis here.

In other news...

Conservative chair hints at tax cuts in March and later in year (Reuters), Conservatives trail Labour by 16 points, poll shows (Reuters), Labour and Tories risk reigniting debt crisis, warns top investor (Telegraph), EY starts monitoring UK staff office attendance with turnstile data (FT), Bank of England set to hold rates despite improving inflation backdrop (FT), big rise in property sales as mortgage rates fall (Times), rates on US 30-year, fixed mortgages are expected to fall to 5.5% (Bloomberg), and finally, Blackstone is building a $25 billion empire of power-hungry data centers (Bloomberg).