Insight 1: London’s Global Differentiators

With global tensions rising and economic uncertainty yet to abate, London has reprised its role as a leading safe haven. Yet there is also a more progressive case for London, driven by rising employment and expansion in new growth sectors.

8 minutes to read

Resilience, renewal and reinvention

It was meant to be a return to the roaring 20s. A time for global output and prosperity to recover the lost years of the pandemic. A revival of the familiar.

Instead, major economies around the world are expanding sluggishly, at best. The pernicious inflation that has helped reverse a generational decline in interest rates and caused widespread social disruption is only just beginning to normalise.

At home, governments fret about ballooning fiscal obligations at a time when borrowing costs are suddenly no longer trivial. And that's before they consider the vast investments in infrastructure required to address climate change and growing, or ageing, populations.

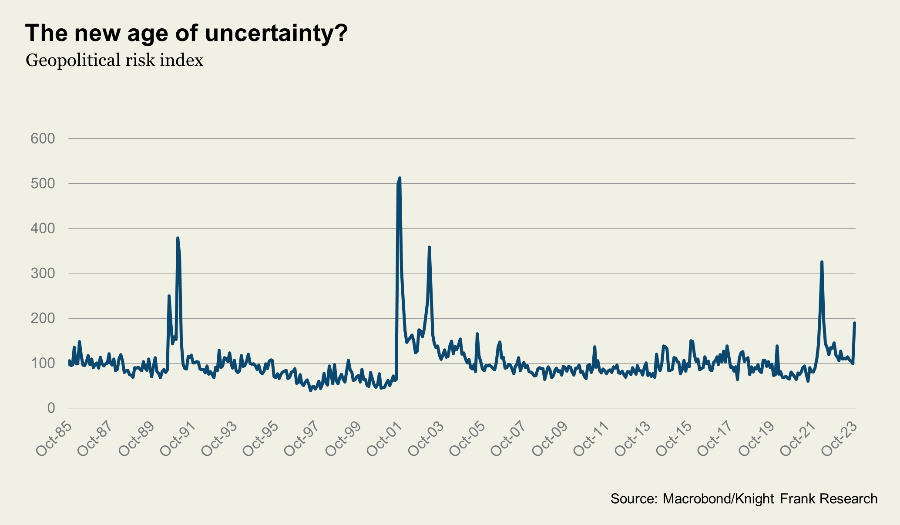

On the global stage, geopolitical tensions are escalating, with social media amplifying the immediacy and reach of crises at a rate unseen before.

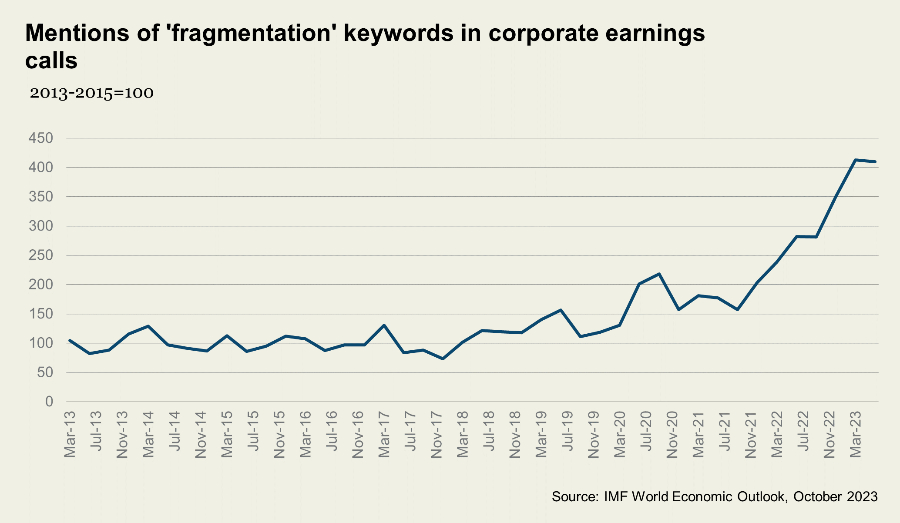

'Fragmentation' or 'fracturing' have become popular narratives amongst thought leaders, as governments and corporates alike openly question whether the forward march of political and economic globalisation is going into reverse.

For what is still, just about, a period of economic expansion, the mood is remarkably jittery.

Reprising the safe haven role

Against this confusing backdrop, the idea of a global city as a safe haven takes on a new significance. At other times, those making the investment case for London might invoke attributes such as the English language, transparency, connectivity, favourable tax structures, or a helpful position on the time zone map. Today, even more fundamental factors, long taken for granted, are once again important. The promise of the rule of law, political stability and pragmatism, and even personal safety are not inconsiderable attractions in the prevailing context.

A window of investment opportunity

None of this has been lost on real estate investors. While commercial real estate investment has slowed globally, London remains the top destination for overseas capital, with almost £5bn deployed in 2023. In addition to the reasons outlined above, a few factors have made London a particular lure in recent quarters.

Unlike many other global cities, London offices did not see the sharp decline in yields from 2016 onwards and have been quicker to reprice post-covid. With favourable currency effects, this has equated to a material advantage for overseas buyers. Meanwhile, our forecasts show that we expect prime rents will continue to grow, as occupiers compete for a finite amount of high-quality space. Many will view the combination of factors as supportive of total returns over the coming years.

Private purchasers have been a notable driver of recent activity and accounted for almost 50% of office investment by volume in the third quarter of 2023. Their rationale draws on many of the ideas outlined above. In addition, with rising interest rates acting to price out many debt-backed investors, private purchasers have enjoyed the benefit of less competition than usual.

Understanding the private perspective

"Given the current backdrop, whether our clients are looking at residential or commercial property, one thing they have in common is a focus on wealth preservation. These are astute, sophisticated investors, often working closely with seasoned industry experts, and not averse to timing foreign exchange markets in order to maximise value. Ultimately, however, they are typically seeking to buy into London for the long term, and recognise the current time as an attractive window of opportunity.

Despite its many attractions, it would be wrong to assume that London doesn't compete for attention with other locations - leading European cities clearly vie for private capital too. Often, however, we see buyers return to London for a mix of reasons, including affinity and familiarity, world-class education for those with younger families to consider, as well as the simple economics of a market that has traditionally provided unrivalled liquidity and a reasonable and consistent return."

Alasdair Pritchard, Partner, Private Office

"A client recently outlined three key attractions of the UK; the rule of law, which they believe has greater clarity and fairness than anywhere else in the world; the quality of education at all levels; and the security that the UK offers its residents, which, in an unstable and uncertain world is very, very important.

Clients are definitely diversifying, be that in terms of currency, real estate, or global markets. Wealth preservation remains key; placing their money safely for long-term and in many ways for the next generations is of the utmost importance.

The diversification story means a continued interest in London residential property, but also increased exposure to commercial assets. The opportunity for private capital and the appetite to take advantage of the challenging debt markets has been clear this year. There may be more to come, as I feel many are still biding their time, waiting for the market to correct further in the short term. Longer term, property still holds appeal as a good hedge against inflation, which is going to be with us in some shape or form for the foreseeable future."

Paddy Dring, Partner, Global Head of Prime Sales and Joint Head of Private Office

The new case for London

London's role as a safe haven is compelling, but there is also a more progressive case to be made. As the end of the first decade since the UK's EU referendum looms on the horizon, most of the worst fears for London have not come to pass. There has, of course, been change. But on the big questions of employment, global financial significance, and the ability to successfully fund and incubate new ventures, London's dominant position is intact, alive, and well.

Employment and talent

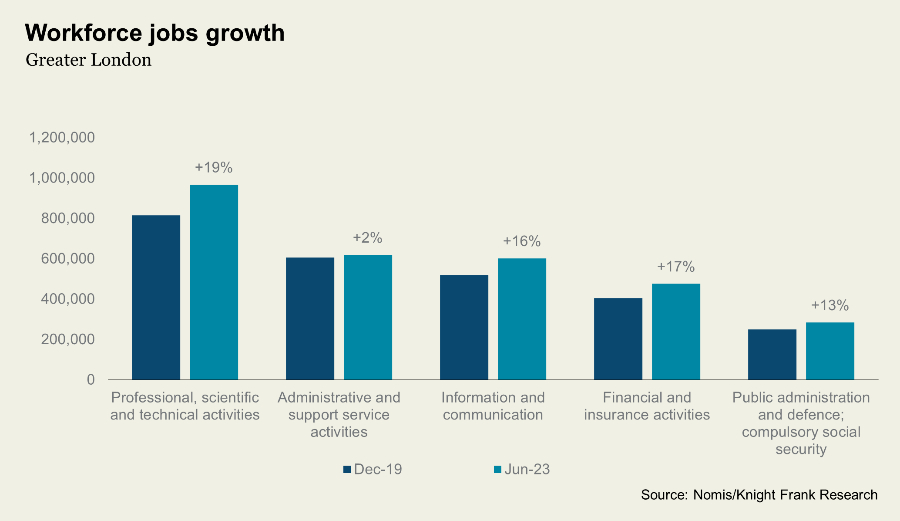

Greater London added a net 400,000 jobs from December 2019 to mid-2023, a 7% increase over one of the most disruptive economic periods of modern times. Notably, the five business sectors with the most direct link to office occupation saw a 13.5% increase in jobs over this period. London tube journeys, a proxy for workplace attendance, have recovered to within a few percentage points of pre-pandemic levels.

London's future talent pool will be bolstered by rising student numbers. We forecast a 16% increase in full-time undergraduates between now and 2030. Driven by rising overseas demand and growth in the UK 18-year-old cohort, this could equate to an increase of 263,000 students and, eventually, a similar impact on London's talent pool.

London remains unquestionably the financial capital of Europe, ranking second only to New York in Z-Yen's long-running Global Financial Centres index and retaining its position as the leading green finance hub. In a symbol of the ongoing desire to attract leading global institutions, October 2023 saw the UK end the cap on bankers' bonuses that had been carried over from the EU.

Our own data shows that the ongoing appeal of London as a home for professional services, financial and technology businesses is translating into demand for London office space. Businesses in these sectors accounted for 6.5m sq ft of office leasing over the past year.

Innovation sectors

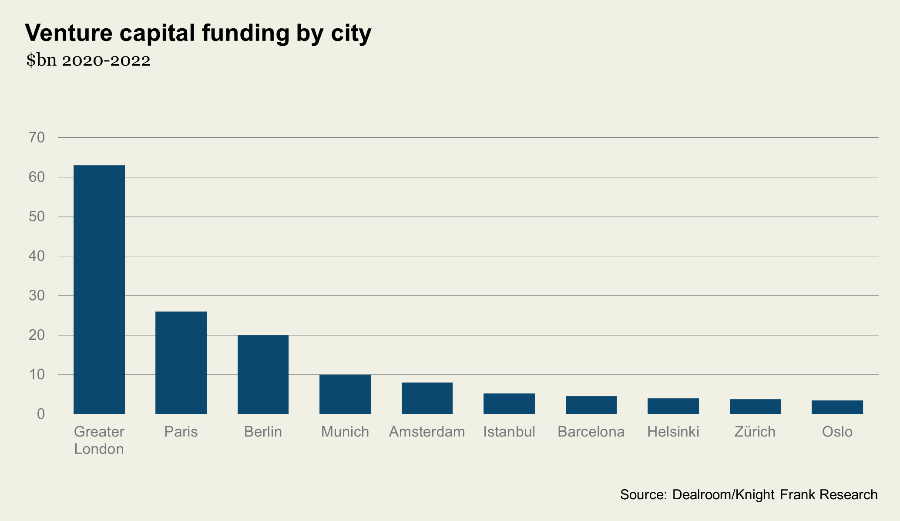

In previous research covering 288 global cities , we found that London had scored highest on both innovation credentials and real estate investment liquidity, in a cohort that included the likes of New York and Tokyo. There is clear evidence that it continues to build on this leading position.

London continues to draw the largest share of venture capital in Europe, according to recent data from Deal room.

This funding is being deployed into several new growth sectors, ranging from the relatively well-established areas such as life sciences, to cleantech and climatetech, and creative sectors including film and gaming.

The rapidly growing AI industry is a case in point. London is home to over 2,000 AI companies and leading research institutions, such as the Alan Turing Institute. More than 70% of UK AI firms are based in London, attracted by the symbiotic relationship with the 50,000 professionals listing AI as a core skill. At a time when some have questioned the UK's commitment, November's AI Safety Summit demonstrated that the UK still has a leading role to play at the forefront of technology.

Challenges

While building a compelling case for London's future is straightforward, it is not entirely without challenges. The anticipation of political change risks slowing decision-making in 2024, even if our analysis shows that national politics tend to have little direct correlation with either economic or real estate performance. In the longer term, London is grappling with the same questions that many large cities face: how to tackle the arising scarcity and cost of housing, how to upgrade buildings to more sustainable standards, and the need to adapt infrastructure to changing societal requirements. None of this is easy to address and is likely to require partnership approaches.

Timing is everything

Although always a nuanced and evolving picture, previous reservations over London’s ongoing significance as a global city have been shown to be misplaced. Now, with clear reasons to forecast an ongoing expansion and some macroeconomic headwinds just beginning to ease, the question for any decision-maker becomes one of timing.

The long history of London’s built environment is a rich lineage of those with vision, conviction, and the willingness to act when others remain cautious. In recent years, those who were first to return after the GFC were rewarded with the strongest investment performance, and those who continued to develop, the luxury of weak competition. It may only become apparent with hindsight, but the next chapter of this story is starting now.

The London Series - Insight 1: London's Global Differentiators from Knight Frank on Vimeo.

View the London Series homepage View the London Series report