Prime London rental value growth slows as higher-value supply rises

September 2023 PCL lettings index: 218.8

September 2023 POL lettings index: 219.4

2 minutes to read

The downwards trajectory for annual rental value growth in prime London markets continued in September as supply increased and demand held steady.

The number of new prospective tenants in prime London postcodes was flat compared to the five-year average in the third quarter of this year, our data shows. Meanwhile, listings in PCL were only 12% down, according to Rightmove, a figure that compares to decline of 37% in the same quarter last year.

Annual rental value growth in prime central London (PCL) was 11.2% in September, which was the lowest figure in two years. In prime outer London (POL), an increase of 10% means that next month we are likely to be back in single digits. It was also the smallest rise in two years.

Supply has decreased in recent years as more owners have been put off buy-to-let ownership by a proliferation of taxes and red tape.

Meanwhile, demand has dipped over the summer for reasons that include the lower number of Chinese students choosing to attend university in the UK, as we explored last month.

In our updated forecast for the rental market, we think the downwards trajectory for growth will continue until the end of the year, reaching 8% in both markets.

As the imbalance between supply and demand continues to reduce, we think rental value growth will return to more normal levels from 2024.

We expect 5% growth in PCL next year and 4.5% in prime outer London, which are both still high by historical standards. The last time before the pandemic that rental growth ended the year higher than 5% in PCL or POL was in 2011.

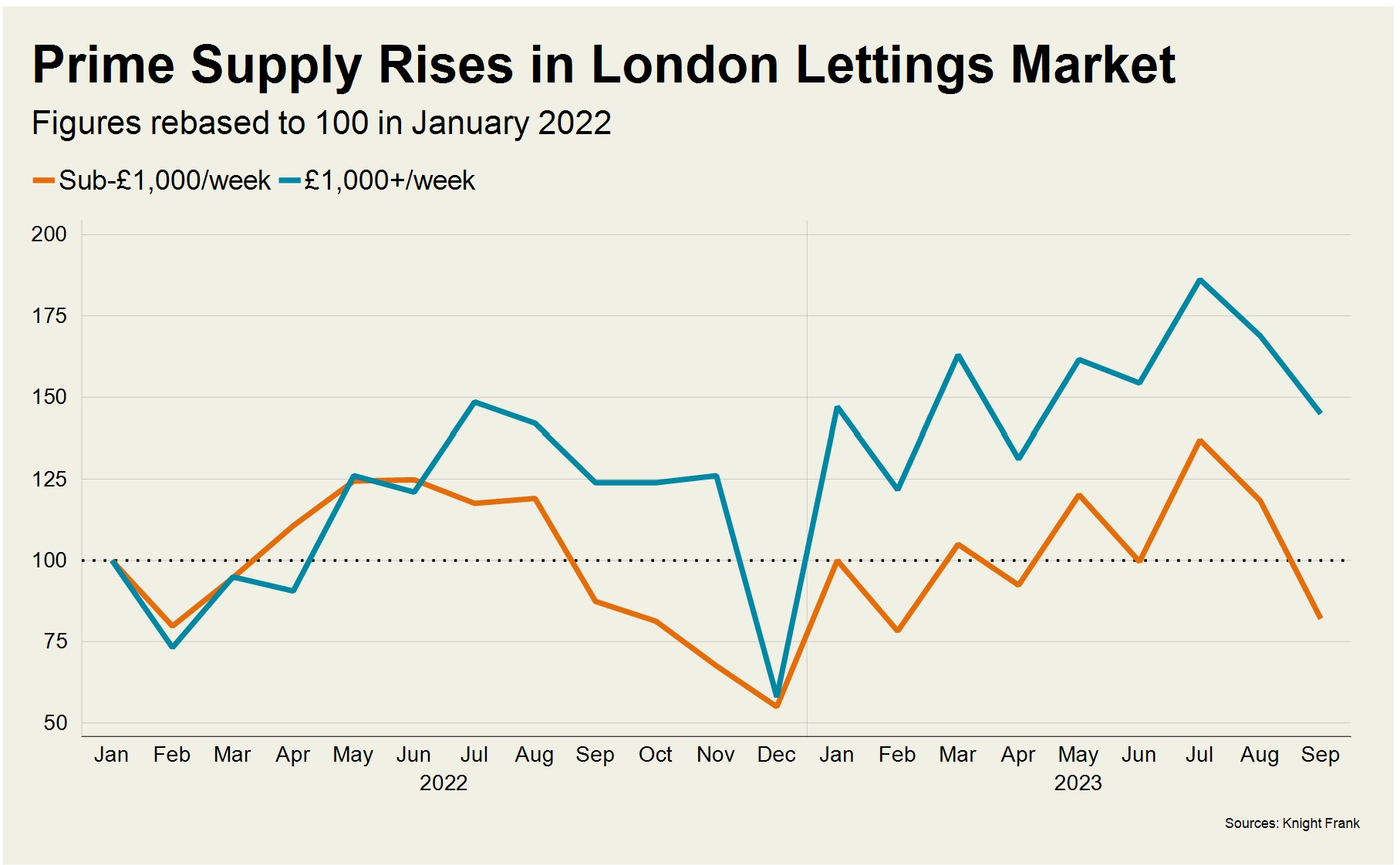

Supply is picking up more quickly in higher-value markets, as the graph shows.

The number of instructions for lettings properties valued above £1,000 per week in London was 45% higher in September than January 2022. Meanwhile, below that figure, there was an 18% decline.

Owners of higher-value properties are often more discretionary, and some have chosen to let them out until the trajectory of prices in the sales market becomes clearer.

As a result, annual rental value growth in PCL above £1,500 per week was 9.6% in September compared to 12.4% below that figure.

“I think the market is at a pivotal point,” said David Mumby, head of prime central London lettings at Knight Frank. “Below £1,000 per week, demand is still ferociously strong but in higher-value markets the time taking to rent is elongating as stock increases. I think we’ll see the rate of growth for prime stock come down further.”

Subscribe for more

Get exclusive market analysis, news and data from our research team, straight to your inbox.

Subscribe here