NY’s surge in cash buyers, all eyes focus on New Zealand and China is set for more stimulus measures

Plus, why households in Spain and Portugal are some of the biggest mortgage overpayers.

4 minutes to read

US: Soft landing?

The narrative around a soft landing in the US is gathering momentum as US inflation cooled sharply last month to 3%, down from its peak of 8.9%.

Recent reports from three major US banks, JP Morgan, Citigroup, and Wells Fargo, suggest investors are increasingly betting on a “Goldilocks scenario,” in which the US avoids a recession as inflation eases swiftly.

But challenges remain; household balance sheets are weaker, US credit-card balances have climbed, and two more rate rises are still expected this year.

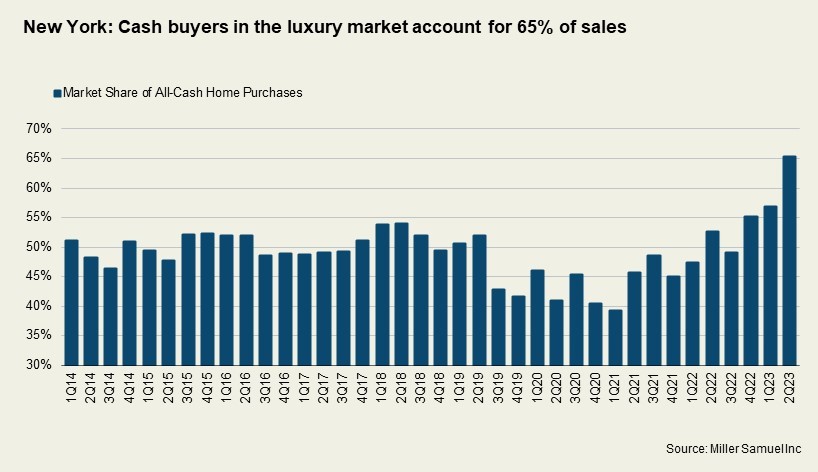

Against this backdrop, New York’s luxury market saw cash buyers account for almost two-thirds of luxury sales in Q2 2023, a nine-year high, according to Jonathan Miller.

Jonathan, who authors Douglas Elliman’s series of market reports, Knight Frank’s residential partners in the US, comments, “the climb reflects continued relative strength at the upper end of the market that favours cash.”

With US mortgage rates at almost double their early 2022 levels, buyers that can afford to are turning away from finance. Plus, sellers are more likely to accept offers from cash buyers eager to expedite deals in a market that has cooled from the pandemic boom.

Diverging Europe

With 19 countries now part of the Eurozone and the European Central Bank (ECB) setting rates for all of them, it’s tempting to view their mortgage markets as a homogenous bloc moving in parallel.

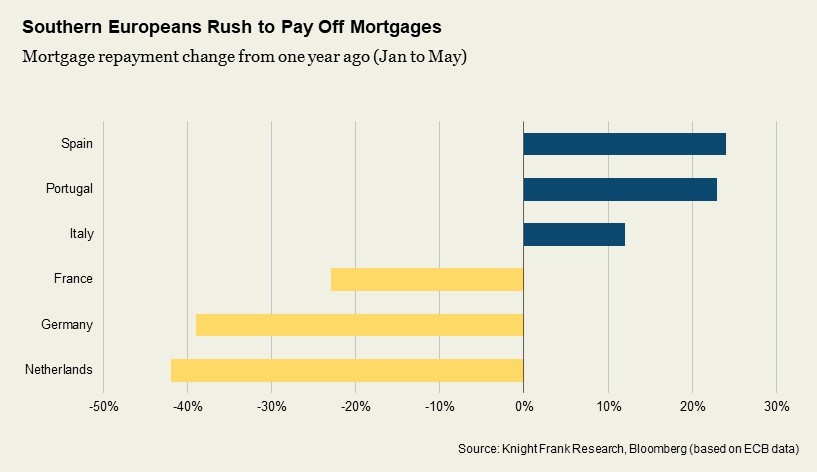

However, research by Bloomberg reveals that surging interest rates have triggered vastly divergent reactions from European homeowners.

In the first five months of 2023, early repayments jumped 24% in Spain and 23% in Portugal. Meanwhile, Germany and the Netherlands saw drops of 39% and 42%, respectively. Variations in mortgage types, fixed versus variable rates, explains the trend.

In southern Europe, variable rates predominate, meaning households have seen an immediate impact to the ECB’s hikes and opted to pay off what they can of their outstanding loans.

In northern Europe, where fixed rates are more common, most mortgage holders have locked into fixed rates for ten years or longer, meaning the hikes have yet to have an impact.

Lessons from New Zealand

All eyes are on New Zealand, with economists tipping it to be the first advanced economy to pivot. After 12 rate hikes, the last two months have seen the Reserve Bank of New Zealand keep rates at 5.50%, and Capital Economics now expects the first rate cut to come in November 2023.

As a result of such rapid tightening, New Zealand fell into recession in June, but in sharp contrast, the housing market is gaining traction.

Sales volumes increased 14.6% in the year to June, and although prices continue to fall, the rate of decline is slowing, down 8.2% in June, compared to -13.4% in February, according to the Real Estate Institute of New Zealand (REINZ).

What does this mean for other global housing markets? It’s a highly nuanced picture; each market’s fundamentals, from supply and demand to cross-border flows, regulations, and taxes, vary significantly.

It’s clear most are not out of the woods yet; the impact of higher interest rate rises has yet to be felt fully. In the UK alone, the Resolution Foundation estimates that only half of the 7.5 million mortgaged households that will be affected by the rate-rising cycle have yet to see a change in their mortgage rate.

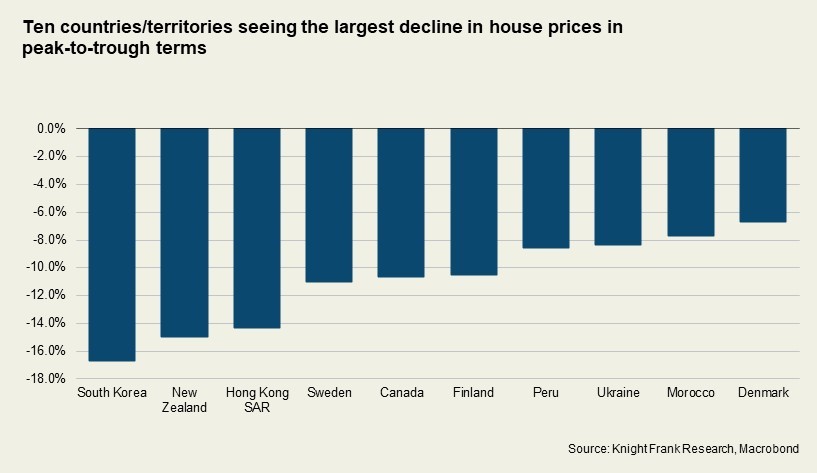

But, where supply remains tight, it’s likely housing markets that have registered the biggest price falls may see sales rebound, and price declines moderate, as buyers take advantage of a window of opportunity and the lower market entry point.

The chart below, using data from Knight Frank’s latest Global House Price Index, shows the ten countries/territories that have recorded the largest decline in house prices in peak-to-trough terms since their pandemic highs.

China

Economic activity is slowing. Exports are down, youth unemployment is at a record high (21%), the much-anticipated consumer binge following the country’s reopening has been a damp squib, and the property market is proving anaemic at best. All this in a week when Evergrande announced its losses hit US$81 billion.

Expectations are mounting that more stimulus measures are on their way, but a speech by Zou Lan, head of the central bank’s monetary policy department, suggests these will be tailored to cities, not nationwide.

One measure that has been announced is a one-year extension for developer loans that were previously due by the end of 2024.

Local analysts have hinted that China is considering a suite of measures, including further relaxing restrictions for residential purchases, reducing downpayments in some non-core neighbourhoods of major cities, and lowering agent commissions.

The measures will need to be ambitious to avert what Goldman Sachs expects to be an “L-shaped recovery”. According to Bloomberg analysts, “As long as physical property has lost its investment appeal as an asset class; it will be difficult for homebuyer confidence to reverse and sales to pick up.”

In other news…

Sydney leads our rankings for global waterfront premiums, Mallorca’s reputation as a haven for cyclists is boosting its property market, meanwhile and the yen, rand and Norwegian krone have turned from being 2023’s worst-performing major currencies to the best (Bloomberg) and finally Portugal keeps its golden visa but ditches the real estate option (International Investment).