Investors flock to Europe's student housing

Making sense of the latest trends in property and economics from around the globe.

4 minutes to read

Conflicting signals

Last week, we looked at data from the UK, Europe and the US that suggested western economies were faring far better than economists had been expecting despite the steepest tightening of monetary policy in a generation. If central bankers were looking for evidence that economies can handle more interest rate hikes, then there is now plenty to go around.

More came on Friday. The US personal consumption expenditure report, touted as the Fed's preferred measure of inflation, increased 0.6% in January compared to a month earlier. That pushed the annual rate to 5.4%, up from 5.3% in December.

It remains fairly uncertain as to how much of the prevailing cycle of rate hikes has fed through to consumers and businesses. Consensus suggests it takes between nine and 18 months for a hike to feed through, but a new working paper from the Bank for International Settlements, aka the central bank of central banks, suggested that higher adoption of longer-term loans on fixed terms could be shielding the global economy from rising interest rates relative to previous cycles.

There are plenty of conflicting signals. US companies are reporting dramatic improvements in hiring conditions despite official figures showing unemployment is at its lowest level for decades, the FT reports. In the UK, most businesses are optimistic that economic growth will improve over the next three years, despite an impending downgrade from the OBR, due to be served up alongside the chancellor's budget next month.

It's going to be a crucial few weeks and the minutes of the next Bank of England Monetary Policy Committee, due out a little under a month from now, will make for interesting reading. Catherine Mann, generally the most hawkish of the MPC, has consistently warned that inflation would prove stickier than markets anticipate and told the Resolution Foundation last week that a dovish pivot was "not imminent."

European student housing

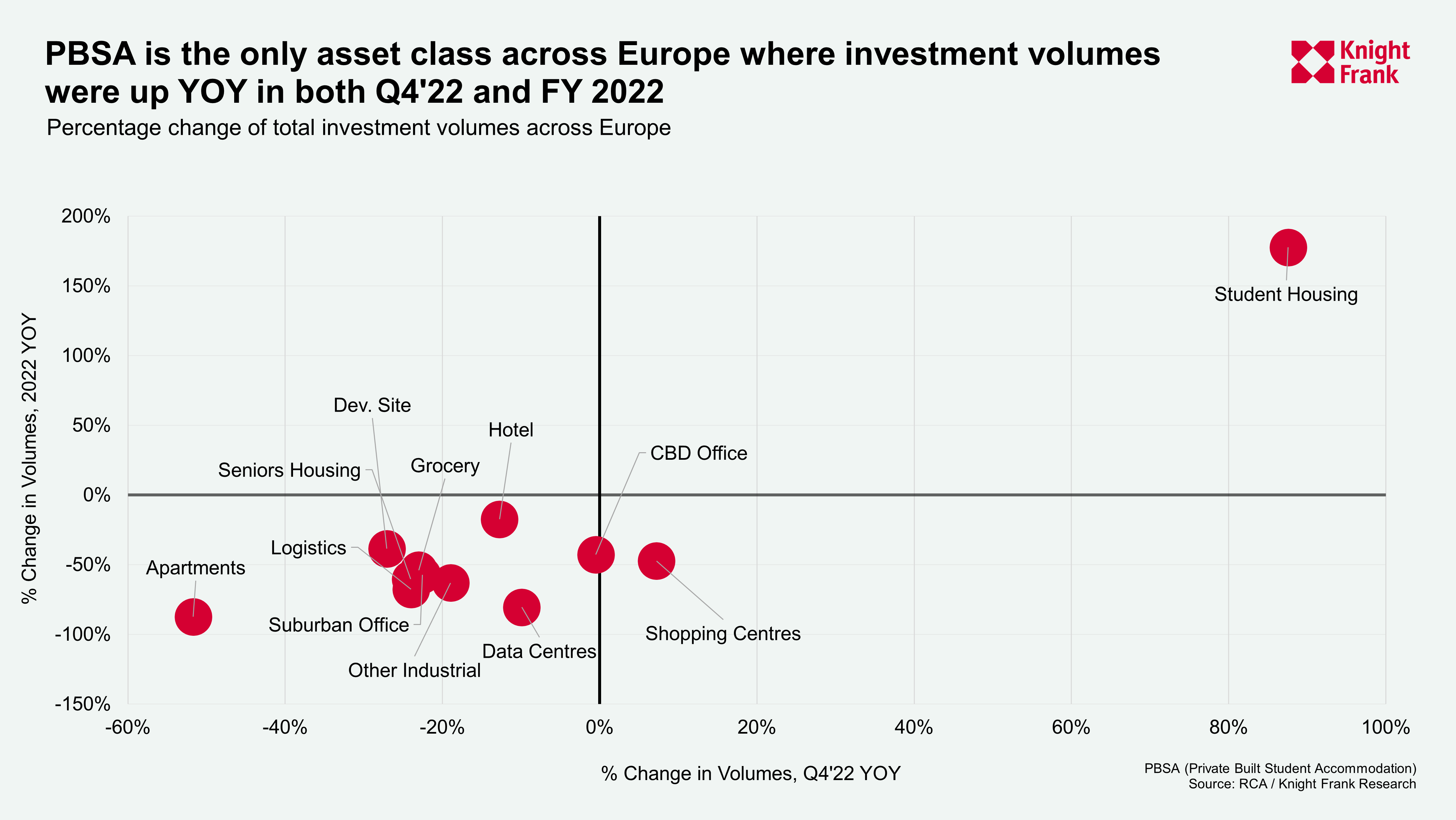

Investors spent a record £13.1 billion on European student housing last year, making it the only asset class on the continent to record an increase in investment volumes both year-on-year and in the final quarter (see chart).

Growing student age populations and an increase in international student numbers have supported strong enrolment figures across the continent, which has fed through to high occupancy levels and rental growth.

GIC and Greystar’s £3.3 billion acquisition of the UK based Student Roost portfolio in the fourth quarter swelled the figures, but even stripping that out, 2022 investment volumes

were still up by 40% compared to a year earlier. Katie O'Neill has more.

Pressure on housebuilding

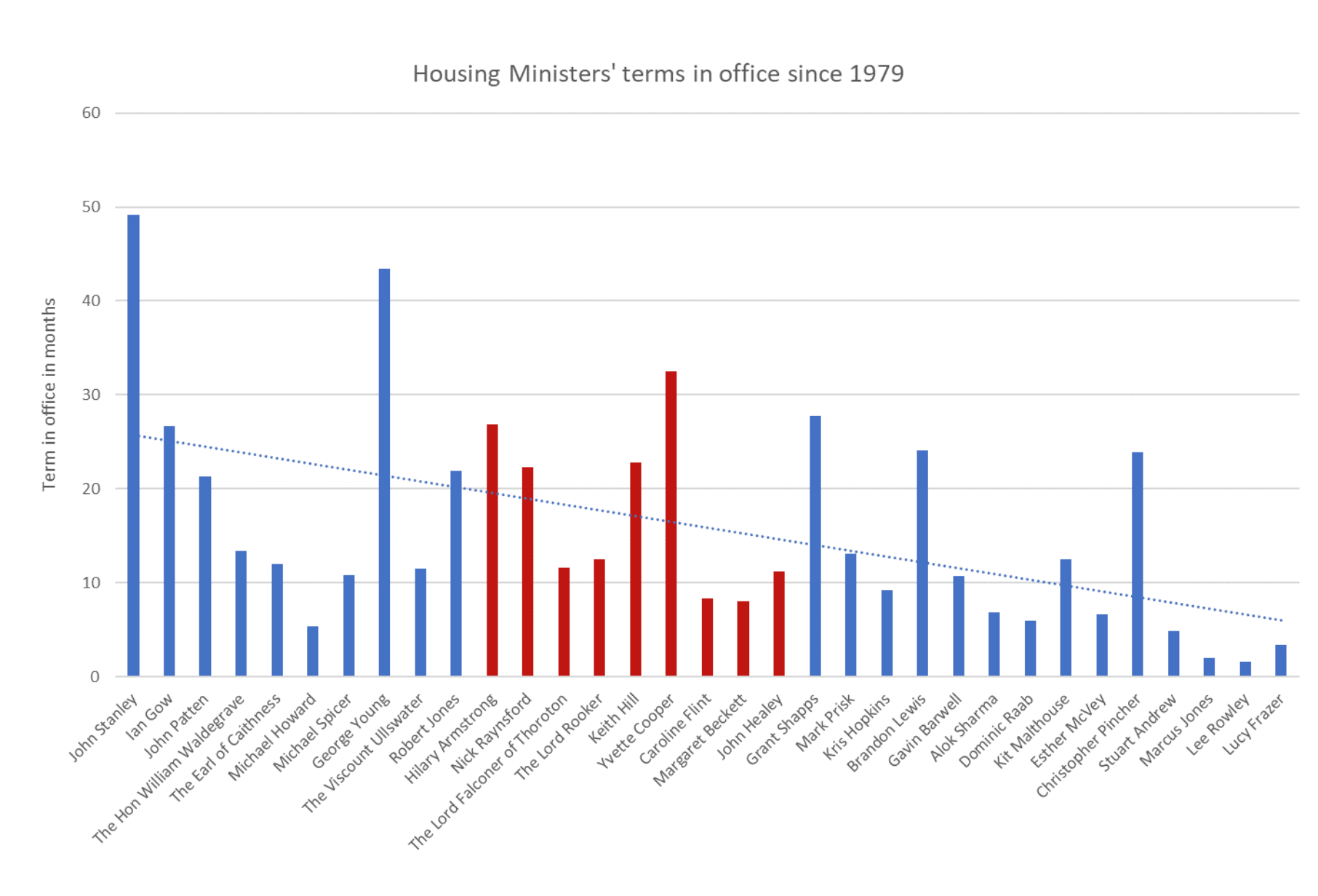

Earlier this month, Rachel Maclean became the sixth housing minister in the past year and the 15th since the Conservatives came to power in 2010.

It's a particularly bad time to have so much change at the top. The Home Builders Federation this morning shared research with the FT warning that rising mortgage rates, the revolving set of housing ministers, plus changes to planning and environmental rules could result in annual housing supply falling from 233,000 additional homes in 2021-22 to just 111,000 later this decade.

The housebuilders had a particularly difficult final quarter, though several reported that trading conditions had improved during the early weeks of 2023.

Embodied carbon

There are now fewer than a thousand working days left until April 2027, at which point office buildings will need to be at least EPC rated C if they are to secure new lettings. About 7 million square feet of leases due to expire before then are in buildings that fall below the new requirements.

The government is in the process of legislating that the minimum EPC standard rises to B by 2030, at which point the numbers become truly eye popping - approximately half of London’s 300 million square feet of offices will require remedial work if that target is going to be met.

Bringing existing buildings up to scratch is complex work. For a new edition of Intelligence Talks I spoke to Janine Cole, sustainability and social impact director for Great Portland Estates and Will Matthews, Knight Frank's head of commercial research, to find out how developers are meeting the challenge. Listen here, or wherever you get your podcasts.

In other news...

The Ukraine war and the impact on UK consumers. Mark Topliff parses the data.

Elsewhere - affordable housing at risk from new levy, say Church of England and charities (FT), UK tax authority launches crackdown on holiday let owners (FT), HSBC to halve space for head office (Times).