Farmland update, New Zealand calls, Oil bounces

The Knight Frank Rural Property and Business Update – Our weekly dose of news, views and insight from the world of farming, food and landownership

4 minutes to read

Politicians do make me laugh. Railing against the use of unskilled foreign labour while addressing a meeting at the recent Tory party conference the new Home Secretary Suella Braverman opined: “There are studies which show that young people just don’t know enough about farming.” I don’t think I’m being too controversial when I say that the same could be applied to politicians. To them the countryside is generally somewhere to plant trees or “do” nature until, that is, somebody invades another country sending food prices rocketing. Then, of course, we need to ban solar farms, pour scorn on environmental schemes already too long in the making and talk lots about “productivity”. The government is apparently planning to explain how it hopes to boost agricultural productivity later this month. We all await with baited breath.

Do get in touch if we can help you navigate through these interesting times

Andrew Shirley, Head of Rural Research

In this week’s update:

• Commodity markets – Diesel up as cartel cuts output

• Farmland market – Values return to peak

• Debt – Lending market starts to calm

• Tory conference – Employ more Brits, says Home Secretary

• International news – New Zealand beckons

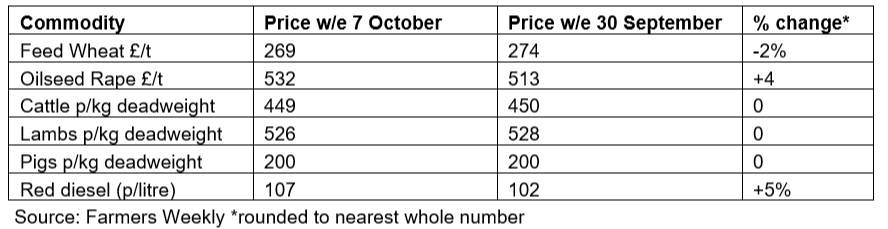

Commodity markets – Diesel up as cartel cuts output

Red diesel prices, having been on their way to back below 100p/litre, hit the wrong gear last week and are now closer to 110p/litre. The U-turn follows a decision by the Opec+ oil-producing cartel, which includes Russia, to cut its output by around two million barrels a day. Given, however, that some members were already failing to pump their quotas, commentators reckon the daily drop will, in reality, equate to one million barrels, although that’s still roughly equivalent to 1% of global output. Meanwhile, those needing to buy in kerosene for grain drying or heating their houses should consider getting their orders in now as there are reports of supply issues, says Andrew Martin of our Agri-consultancy team.

Farmland market – Values return to peak

The average value of farmland is now back almost exactly to the peak seen in the autumn of 2015, according to new results from the Knight Frank Farmland Index. Prices for bare agricultural land rose by a further 1% to just over £8,300/acre in the third quarter of this year, taking annual growth to 13%.

Against a backdrop of mounting global economic uncertainty, exacerbated in the UK by Kwazi Kwarteng and Liz Truss’s badly received “mini-budget” at the end of September, farmland outperformed all the other asset classes that we track during the past three months, such as equities, gold and house prices.

It seems that once again farmland is continuing to perform its traditional safe-haven role, acting as a potential hedge against inflation supported by ongoing demand from tax and environmentally driven buyers. Ms Truss’s growth agenda and mooted planning reforms could also see more farmland required for new developments and infrastructure.

However, price growth is starting to slow with the latest quarterly uptick the weakest since the beginning of 2021. The big question now is whether values will continue to rise over the rest of the year.

For more insight and data please download the full report.

Debt – Lending market starts to calm

While we are on the subject of Chancellor Kwazi Kwarteng’s now infamous “mini-budget”, I thought it would be worth catching up with colleague Bradley Smith, the rural specialist at Knight Frank Finance, to get his thoughts. Here’s what he had to say:

“It has been a turbulent few weeks since the mini budget rocked the market with lots of domestic lenders pulling rates and in some cases their offers. Swap rates reaching dizzying hights not seen for over a decade. But from an agricultural lender perspective, I am yet to hear of a deal being rescinded, which is good news.

“Things are starting to settle down a bit now and the hope is that with a few more weeks of stability lenders will begin to reduce their fixed rates again as swap rates drop. But with rates set to continue to rise over the short term, it is certainly worth looking at your finances and stress-testing your own business against its borrowing to see how a possible 2% increase will affect you.”

Tory conference – Employ more Brits, says Home Secretary

Prime Minister Liz Truss’s economic playbook is baffling to many, but at least she has gone on the record to acknowledge that UK agriculture needs an expanded Seasonal Worker Scheme to boost growth following the loss of free movement from the EU post Brexit. Interesting to read then that the new Home Secretary Suella Braverman sees no need for an increase in the cap on unskilled labour. She believes that farmers must end “reliance” on foreign workers and replace them with domestic workers and automation. “There are studies which show that young people just don’t know enough about farming.”

International news – New Zealand beckons

For anybody pondering a move to New Zealand the latest edition of Country produced by Bayleys, our NZ associate business, is well worth a look. It’s packed full of a mouth-watering selection of rural properties for sale, from productive vineyards to breath-takingly scenic stock units.

Photo by Roselyn Cugliari on Unsplash