Updated: discounts for overseas buyers widen as pound comes under pressure

Following the mini-Budget on Friday, uncertainty over the UK’s economic plan and the prospect of aggressive rate rises in the US have made prime London property more attractive for overseas buyers.

3 minutes to read

Financial markets have reacted nervously to the economic plan set out by the UK Chancellor in last week’s mini-Budget.

The pound fell to US$1.03 in early trading on Monday morning before recovering to US$1.07.

The government hopes to stimulate investment and growth through tax cuts and other financial incentives.

Such measures include a cut to stamp duty, the ramifications of which we explored in more detail here.

However, there are concerns around the inflationary impact and cost of the measures, which has put downwards pressure on Sterling.

This pressure, which some believe may result in parity between the pound and dollar, has a shock absorber effect in some parts of the economy, supporting the share price of London-based companies paid in dollars for example. The same is true of the residential property market in London’s prime postcodes.

There has been a mixed response from economists to the latest currency movements.

Capital Economics said the Bank of England should now step in to support Sterling - either by signalling it would raise rates aggressively in November or by doing so immediately.

“By bringing forward a lot of the policy tightening that might needed to have happened anyway, the Bank would demonstrate in no uncertain terms that whatever the government does it will ensure that inflation returns to 2%. This would go a long way to easing the crisis,” chief UK economist Paul Dales said on Monday morning.

Savvas Savouri, chief economist at hedge fund Toscafund took a different view. “This is not Sterling slumping but the dollar surging. If the Monetary Policy Committee (MPC) intervene purely to support Sterling, they will prove their incompetence - their job is to manage inflation not the currency and the currency going down does not mean inflation is certain to worsen. The MPC of 2008 allowed the currency to fall and were wise to do so.”

While the pound has been one of the worse-performing major currencies this year, it’s also true that the dollar has grown in strength versus a series of other currencies, hitting parity with the euro in recent weeks. In addition to the US economy proving resilient and paving the way for more aggressive rate hikes, safe-haven investors have also been buying the greenback.

Either way, the recent volatility has made prime UK property more attractive for overseas buyers.

The exchange has fallen from US$1.71 at the start of July 2014, which highlights the size of the relative discount for US buyers and those denominated in pegged currencies such as the Hong Kong Dollar and currencies in many parts in the Middle East.

It is only part of the story though, with property prices also having fallen due to political uncertainty, tax hikes and international travel restrictions. Average prices in prime central London fell 13% over the same eight-year period.

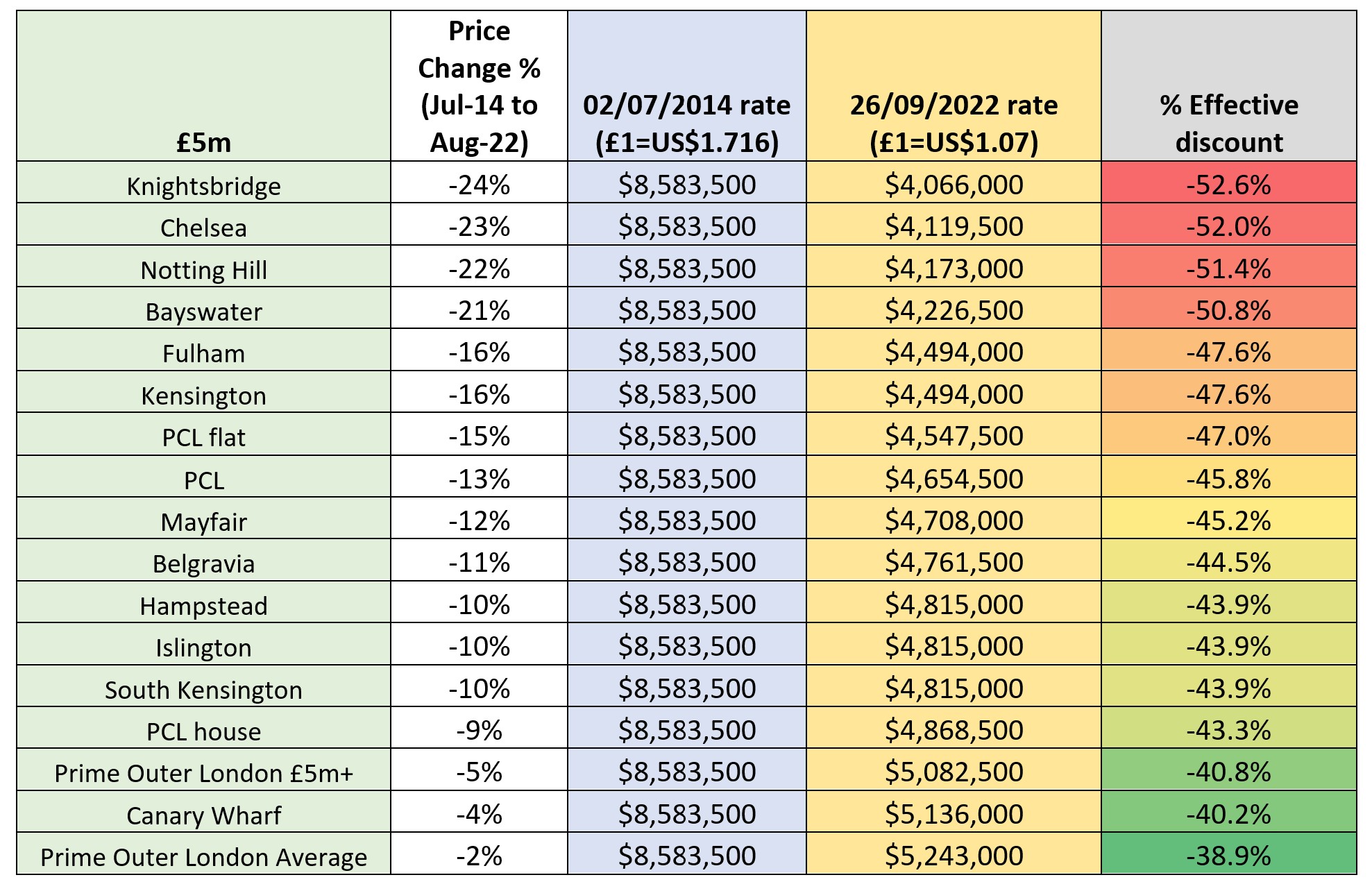

When you combine the effect of falling property prices and a weaker pound, the discounts on offer can reach surprisingly high levels, as the table below shows.

The largest discount can be found in Knightsbridge, an area of the capital where prices are still 24% below their 2014 level. Combined with the currency movement, a US buyer would have benefitted from an effective discount of 53% this week compared to July 2014.

Buying a £5 million property in Knightsbridge would have previously required US$8.6m, a figure that had shrunk to US$4.06m.

Discounts are smaller in areas including Islington and Canary Wharf as prices have not fallen by as much over the period. For similar reasons, flats provide a steeper discount than houses in PCL.

The discounts have grown wider at a time when international travel is approaching its pre-pandemic levels from many areas.

International arrivals at Heathrow in June were only down by 17% on the same month in 2019. That compares to an equivalent drop of 87% last June, although the figure is still below half from the Asia Pacific region.

The relative price discount and re-emergence of international travel are two of the reasons we believe price growth prime central London will outperform other areas of the UK in the next five years.