Will super-prime market remain resilient in 2022 after a record year?

The pandemic-induced trends in residential markets fuelled a record year for super-prime sales (US$10m+) globally in 2021, but how long will this continue?

3 minutes to read

Across our ten top-tier markets in 2021 some 2,117 sales were recorded in this market segment, more than double the 976 in 2020, and representing a total sales volume of US$37.9bn.

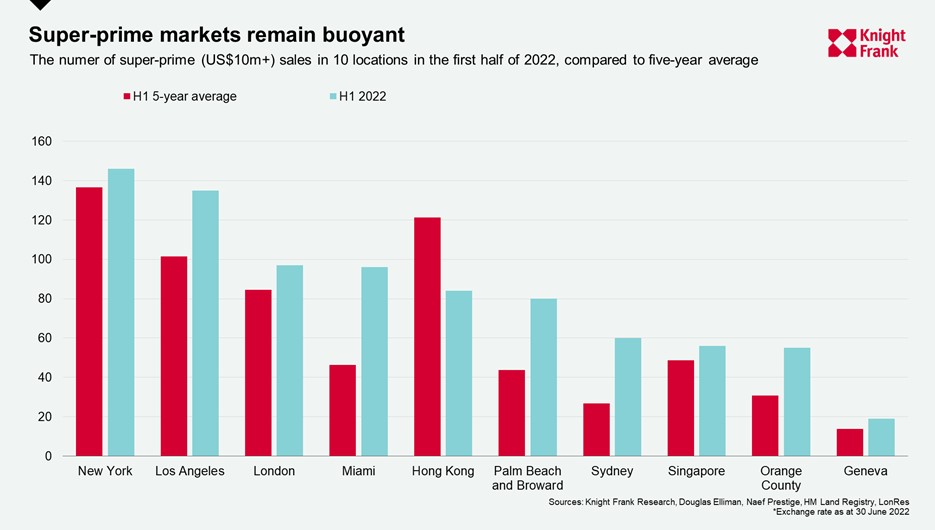

Despite the mounting economic headwinds, super-prime markets have remained resilient in the first half of 2022. Across our key global locations there has been a total of 828 sales, totalling US$14.9bn, in this segment, 27% above the five-year average.

“2021 was very much an anomaly across housing markets globally and the super-prime segment was no exception. We see 2022 as very much a transition year with some pandemic trends continuing to play out whilst being met with rising headwinds,” noted Paddy Dring, Knight Frank’s global head of prime sales.

New York prime real estate

New York firmly cemented its comeback. After a record-breaking year in 2021, with 446 sales, the momentum has continued this year with 146 sales above US$10m in the first six months – and 20 of those are in the ultra-prime (US$25m+) bracket.

The demand for prime real estate in the city that never sleeps has seen prime prices return to positive growth in 2021 which has strengthened in 2022.

A notable trend in global markets in 2021 has been the outperformance of North American cities and the data confirms this has continued.

Los Angeles holds the number two spot for the first time in super-prime sales and is top for ultra-prime. The City of Angels registered 135 sales above US$10m in the first half of 2022, and 22 of these were above

US$25m, this is on the back of outperforming the usual top spot holders London and Hong Kong.

In addition, Miami leapfrogs Hong Kong to claims fourth spot with 96 super-prime sales totalling almost US$1.7bn. Miami is expected to be one of the strongest performing prime markets with 12% prime price growth forecast in 2022.

Each market has its own unique drivers of demand, be it lifestyle or relative value but all share common themes – namely, the reopening of cities and a unified shift in lifestyles as the wealthy continue to seek out larger homes and more amenity-rich locations.

In addition, Dring notes that: “buyers are increasingly looking towards property as a safe-haven investment as we chart more uncertain times. At the top end of the market there tends to be less sensitivity to rates due to lower leverage and many markets are still seeing a shortage of stock which is supporting prices.”

Bigger, but lateral living

Whilst the wealthy have been seeking spacious urban living, 2020 saw demand peak for single-family residences/houses in many markets.

Across the ten locations in the first half of 2022, 65% of sales were for single-family homes, compared to 70% in 2020. London stands out as one market that bucked the trend with 78% of super-prime sales being houses – a new record.

At 45% the proportion of super-prime apartment sales sits below pre-pandemic levels, however we may see more demand for lateral living as an urban foothold in the second half of 2022.

“The balance of demand is still tipped in favour of houses in London but over the last year we have seen this normalise to a more equal balance as city living regains its momentum. In New York particularly we have seen UHNWIs upsizing but focussing on apartments in prime locations,” mentions Dring. The data confirms this trend, some 92% of super-prime sales so far this year in New York have been apartments – a new record.

Whilst it is likely that the second half of 2022 is likely to be more muted, as Dring points out, we are still in a transition from extraordinary circumstances and activity. Yet with continued supply constraints and other factors, we expect prime markets to continue to remain active and soften to more normal patterns in 2023 – super-prime markets whilst more nuanced are subject to the same forces.

Discover more

To keep up to date with the latest on prime residential markets globally, sign up to our email newsletters here.