Singapore's bright growth trajectory in 2022

The cooling measures announced in December 2021 caused concern as to whether collective sales would be affected in 2022. However, that is not the case in what we have observed in the first quarter of 2022.

3 minutes to read

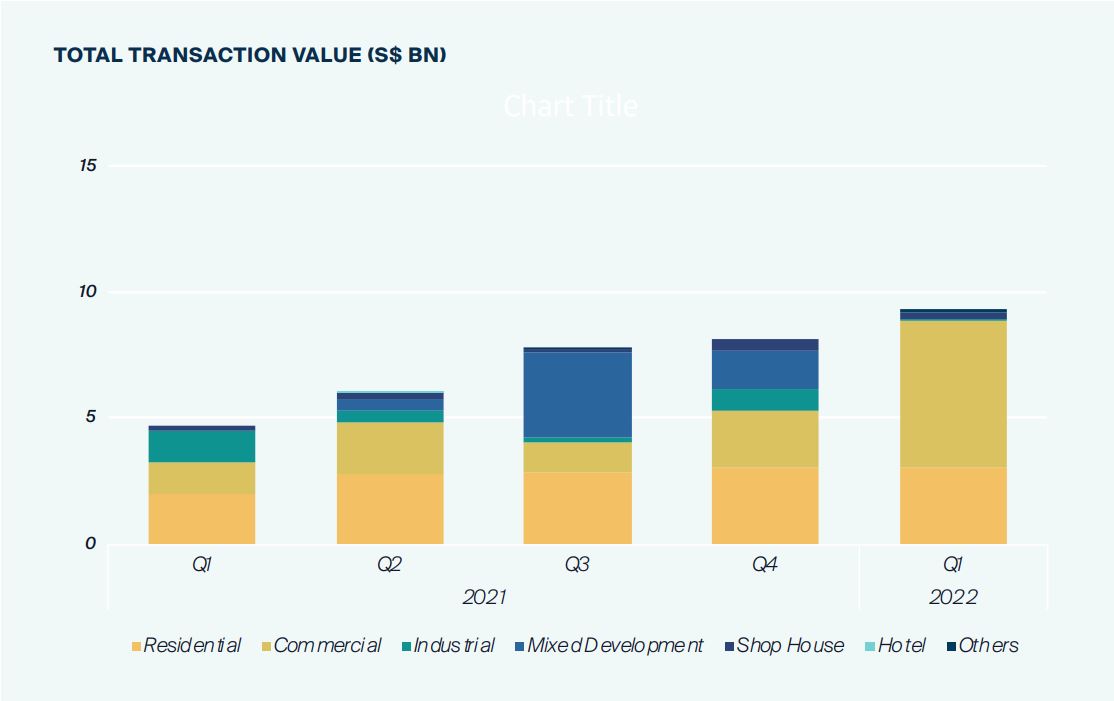

The first quarter of 2022 registered a total of S$9.4 bn investment sales, maintaining the encouraging pace set in the later half of last year (see graph). The award of Government Land Sales (GLS) sites coupled with significant commercial deals primarily led the y-o-y uptick in sales in Q1.

Observations from Singapore's commercial market

Lendlease Global Commercial REIT’s acquisition of the remaining stake in Jem, at approximately S$1.4 bn (S$2,329 psf), topped the list for the quarter, with commercial sales totalling S$5.8bn (Exhibit 2).

As additional buyers’ stamp duty (ABSD) is not required for commercial properties, investors of various risk appetites moved into this segment of the market.

Observations from Singapore's residential market

Within the residential market, the lack of available inventory led to a narrowed pool of potential accommodation choices for prospective buyers looking to move or upgrade their homes.

The investment value for the residential segment totalled S$3.1 bn during Q1 2022.

Are December 2021's cooling measures a cause of concern for Singapore investors?

The cooling measures announced in December last year caused concern as to whether collective sales would be affected in 2022. Three months on, despite some initial worries, many homeowners are still hopeful for a successful collective sale.

There has been a series of strata developments that were launched for sale as well as those that are close to achieving the 80% consensus.

While GLS sites provide developers with greater convenience and a quicker timeline in terms of the development process, the parcels of land available for tender this year are of larger sites.

For developers who are on a lookout for prime locations that are within close proximity to key amenities and are priced at a sweet spot of less than S$500mn, the collective sales market remains the only viable alternative for land replenishment.

Despite the cooling measures, developers are still in search for development land against a backdrop of dwindling saleable inventory and strong occupier buyer demand. For sellers, it is imperative that existing homeowners remain cognisant of the current market conditions and manage their price expectations to raise the chances of sealing a collective sale deal before the current season of buyer demand subsides.

As the unsold residential stock continues to be depleted, leaving many a homebuyer with limited options, the investment market is projected to be led mainly by merger and acquisition deals by REITs, as well as land sales from land-starved developers who are keenly vying for available GLS plots or prime collective sales sites.

Further relaxation of COVID-19 measures to benefit Singapore in 2022

The further relaxation of COVID-19 measures from 29 March 2022 will benefit Singapore, especially with the Vaccinated Travel Framework from 31 March 2022 onwards anticipated to attract a higher inflow of investors.

This could potentially increase the demand for luxury non-landed homes as well as inject life into the hospitality sector that has for two years bore the brunt of the pandemic.

With the sale of Hotel Clover in March, more of such deals could follow suit as investors and hoteliers regain confidence in this new era of endemic living.

Additionally, the revisions in the size of gatherings from five to ten could provide investors and developers alike to consider retail developments where footfall would increase with more consumers returning to malls.

As such, the retail and hospitality sectors are anticipated to see more interest and the beginnings of recovery in 2022.

Total transaction value from Q1 2021 to 2022

Drivers for Singapore

- Institutional investors needing to deploy ample funds

- Newly-minted UHNWI

- Family Offices

Sectors to watch in Singapore

- Office

- Residential

- Retail

- Hospitality

___

This piece was originally published in 'Rising Capital in Uncertain Times' Active Capital Asia-Pacific Perspective (June/July 2022)'. The report aims to provide an insight into how the real estate market in Asia-Pacific performed historically and how it is predicted to play out in 2022, thereby acting as a guide for investors.

It also highlights an important theme – Environmental, Social and Governance (ESG) – for investors that are looking to expand their ESG foothold in their portfolios.