UK house price growth peaks as cost pressures mount and demand softens

First negative monthly reading in 12 months as housing market continues to cool.

3 minutes to read

House prices fell by 0.1% from June to July, which was the first decline in a year, according to Halifax.

It meant that the annual rate of change narrowed from 12.5% a month earlier to 11.8%. The lender added that while it was only a month’s data, a slowdown in annual house price growth had been expected for some time.

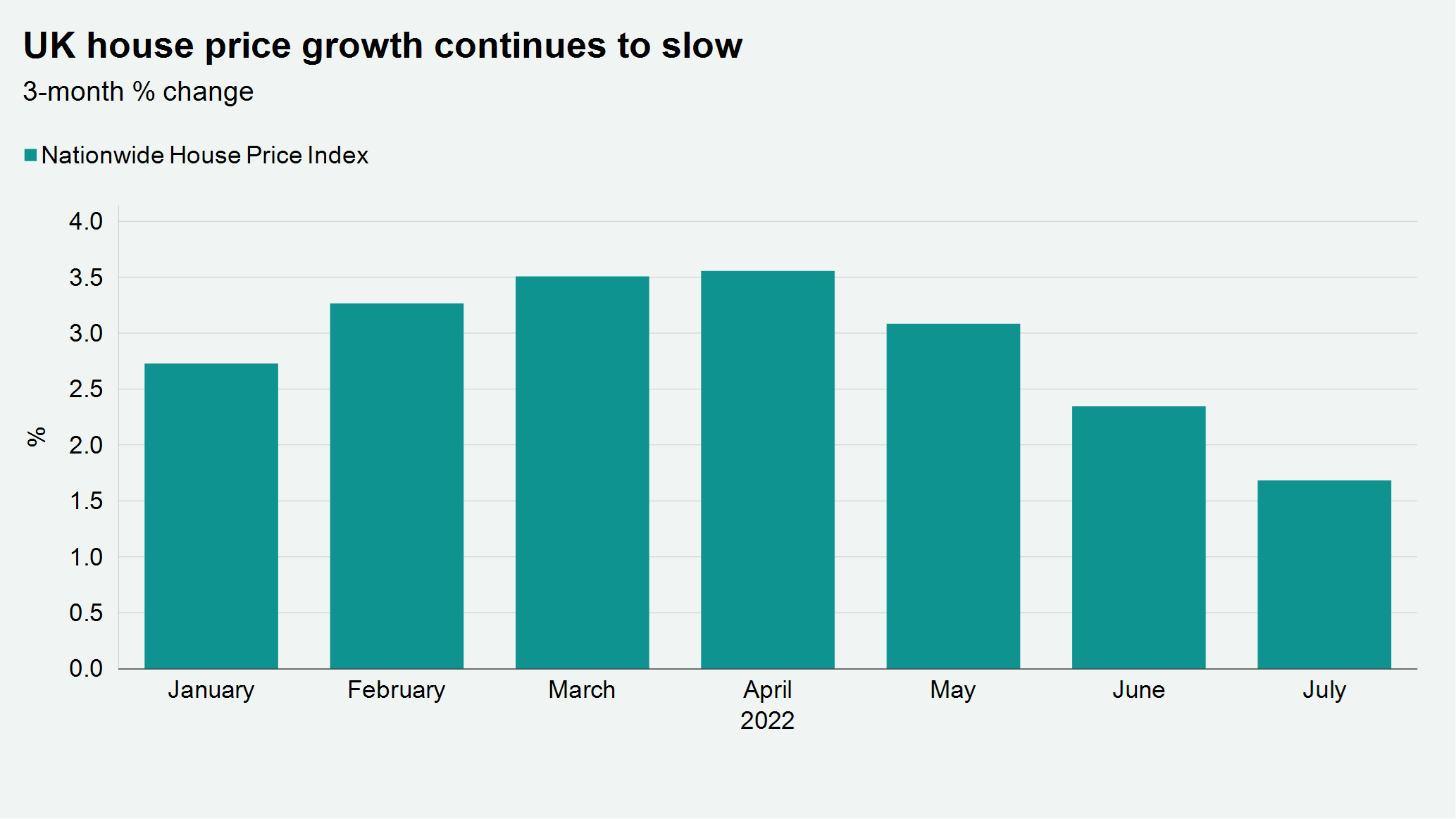

While Nationwide reported annual house price growth of 11% in July, the monthly change was just 0.1%. It saw the three-month change fall to 1.7% a reading that has been in decline since April (see chart).

Price growth has been slowing in recent months as demand softens to some extent, however low levels of supply have extended the time it has taken for the market to calm down, as we forecast it will.

The latest RICS Sentiment Survey illustrates this perfectly. All respondents saw prices increase in July due to limited supply, which at an average of 36 properties for sale per estate agency branch remains at an historic low.

However, while a net balance of survey respondents saw house prices increase in the month (+63) it is down from a high of +78 in April (though it remains significantly above the long run average of +13).

These readings were taken before the Bank of England made a 50bps increase to the bank rate – the biggest hike in 27 years - taking it to 1.75% in an attempt to rein in inflation, which is at a 40-year high of 9.4%

Mortgage approvals for purchase, a leading activity of future activity, declined for the fifth month in a row to 63,726 in June, according to the Bank of England. However, this remains close to the 12-month pre-pandemic average of 66,700 and the monthly pace of change remains gradual – monthly approvals in June were just 13% lower than in January.

Prime London Sales

The number of offers accepted across the capital last month was the highest figure in a decade, underlining the current strength of appetite for higher-value property in London.

A combination of factors has led to the pipeline being stronger than it was in the final months of the stamp duty holiday in 2021.

First, international travel is resuming. Second, prime London markets are relatively good value as buyers continue to reassess how and where they live after Covid. There is also a creeping sense that investors are looking more closely at safe-haven assets, which has traditionally benefitted the prime London property market.

Prime London Sales Report July

Prime London Lettings

The prime London lettings market remains a long way from normality. While demand is robust as the economy re-opens and tenants reassess how and where they live, supply remains tight.

There have been tentative signs of stock levels rising in pockets of London but not to the extent that it is anything other than a landlord’s market still.

Indeed, the imbalance between supply and demand widened last month. The arrival of international students and corporate tenants this summer will further fuel the imbalance.

Prime London Lettings Report July

The Country Market

Price growth slowed in the UK country house market in the three months to June, as buyers become more circumspect against the backdrop of rising living costs and the rebuilding of supply.

Average prices rose by 0.7% in the second quarter, compared with 3.5% in the three months to March.

It was the weakest quarterly growth since the market reopened in May 2020 after its enforced closure. It meant the annual change fell from 11.3% in March to 8.2%.

Price growth peaks in country market due to improving supply and buyer caution

Discover more

Get more expert analysis, comment and opinion on the residential property market.