UK house price growth slows in April, but supply squeeze continues

Double-digit annual growth persists against a backdrop of resilient demand.

4 minutes to read

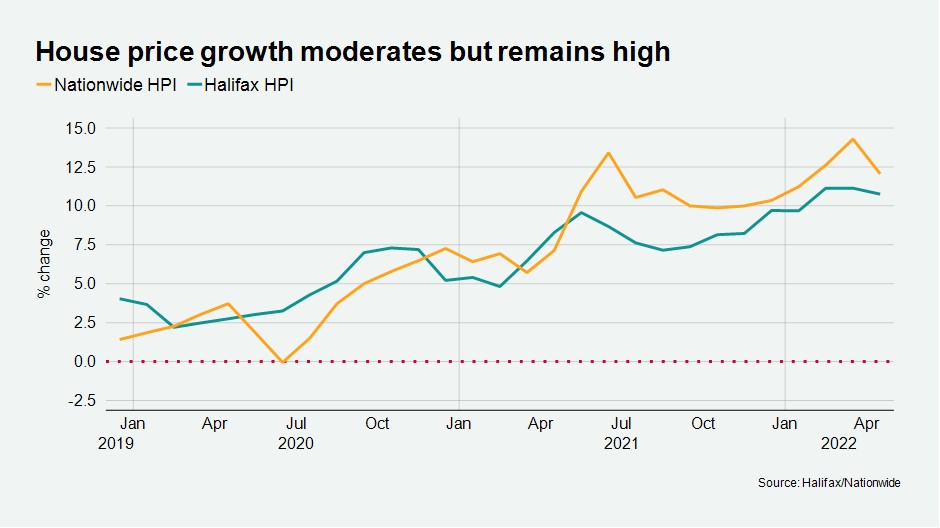

House price growth appears to have finally hit its peak, with both Halifax and Nationwide reporting an annual slowdown in April.

However, with supply continuing to lag demand, any course change will likely be by degrees rather than dramatic.

Nationwide reported house price growth had slowed to 12.1% in April from 14.3% in March. This was a monthly increase of 0.3% compared with 1.1% in March.

Despite mounting economic uncertainties, the lender’s own survey of consumers underlined that housing market activity looks set to persist at a high level through the next few months.

Nationwide found 38% of respondents were either in the process of moving or considering a move. It added that this was higher than during the height of the pandemic in April 2021. Space remained a priority for most buyers, although the focus on rural rather than urban living has diminished.

Halifax said prices in the 12 months to April were up 10.8%, compared with 11.1% in March (see chart). It added that average house prices had increased by more than £47,000 during the past two years, something that had taken the five and a half years to April 2020 to previously achieve.

We expect mainstream house price growth to fall back to single digits this year, as the rising cost of borrowing and living calms demand.

That said, while mortgage approvals for purchase are 15% lower than in March 2021 – a time when the stamp duty holiday was driving activity - at more than 70,000 in April they remain above the monthly average of 66,000 in the year to March 2020.

Sentiment around current and future house prices remained unchanged in April, according to IHS Markit’s survey. The readings for both, +61 and +66 respectively, remain well above their pre-pandemic level, with house buyers remaining optimistic, for now.

Data from RICS also supports the idea that the speed of rebalancing is likely to be gradual. Its April sentiment survey found +10 of respondents had seen an increase in new buyers.

However, last month’s first positive reading in 12 months for new instructions has proved short-lived. New instructions to sell were -1% in April. With supply tight and stock low, 80+ of respondents cited an increase in house prices in the month.

Prime London Sales

Average prices in prime outer London rose by 1.9% in the three months to April, which compared to 2.1% in March. It was the first such slowdown this year.

Meanwhile, prime central London prices remain in steady recovery mode, with quarterly growth reaching 1% in April, the highest such figure since July 2015.

“The property markets in central and outer London are increasingly on different trajectories,” said Tom Bill, head of UK residential research at Knight Frank. “Price growth in outer London is moderating as the race for space becomes less frenetic and rising mortgage rates and the higher cost-of-living take their toll. Meanwhile, prime central London is recovering after six subdued years and a relatively quiet pandemic.”

Prime London Sales Report: April 2022

Prime London Lettings

Rental values in prime areas of London are now 9% higher than they were before the pandemic, as low supply and high demand produce an imbalanced market.

The number of market valuation appraisals (a leading indicator of supply) was 40% below the five-year average in April, while the number of new prospective tenants registering was 57% higher over the same period.

The disparity contributed to a 29.2% annual rise in rental values in prime central London (PCL) in April. The equivalent rise in prime outer London was 23.5%. The increases were magnified by the fact rents hit their low point during the pandemic in early 2021 due to a glut of short-let property on the long-let market. Supply has since become scarcer while demand has been extremely strong.

Prime London Lettings Report: April 2022

The Country Market

Prime regional prices grew at their strongest annual rate since Q3 2009 in March, taking average values to a new high.

The annual change was 11.3%, which was up from 10.6% in December. On a quarterly basis, prices increased by 3.5%, which was the strongest rate since Q2 2021.

It lifted the Prime Country House Index 1% above its previous peak in the third quarter of 2007, before the global financial crisis led to a slump in property values.

Prime Country Index Q1 2022

Subscribe for regular updates

Sign up for regular updates with the latest from the market.

Subscribe here