City house prices rise at their fastest rate for almost 18 years

Of the 150 cities tracked by the index worldwide, 140 saw prices increase in 2021, up from 122 in 2020.

1 minute to read

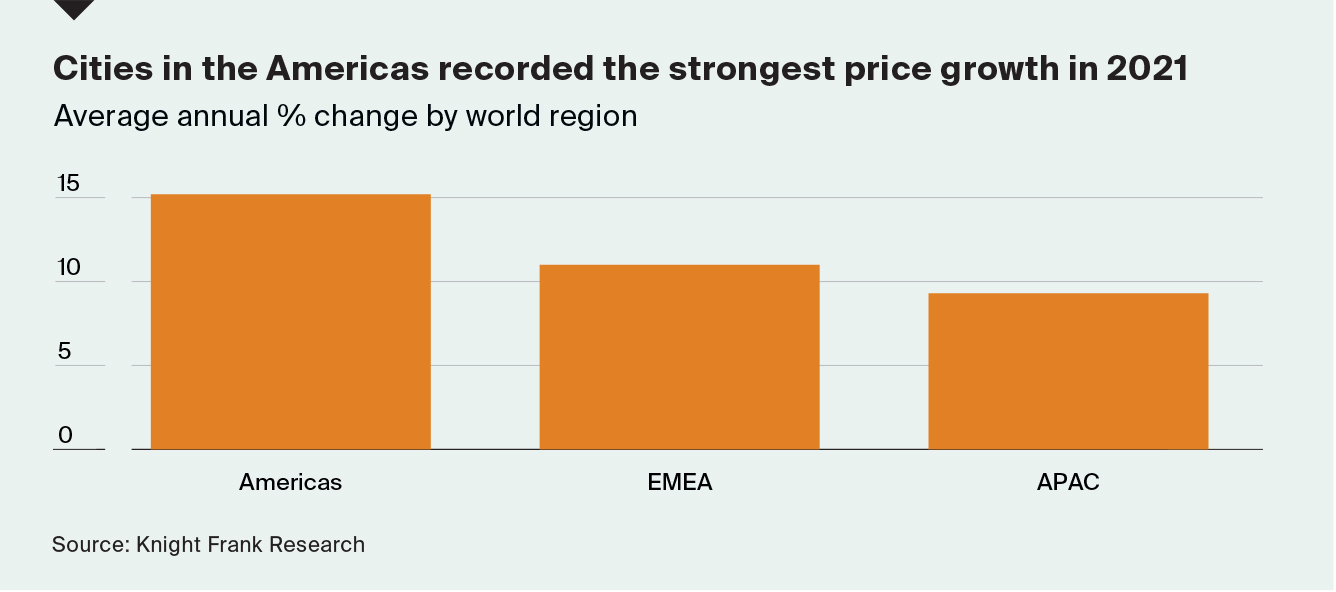

Cities in the Americas registered the strongest jump averaging 15% annual growth compared to 11% in the EMEA region and 9% across Asia-Pacific.

US households not only accrued significant savings during successive lockdowns but the equity in their homes expanded significantly too. In some cases, this wealth has been used to upgrade existing homes or purchase a second property.

A typical home in Phoenix, the US city with the fastest rising prices in 2021, was worth $298,000 at the end of 2020 according to Zillow. By the end of 2021 its value had jumped 32.5% to $394,850, adding almost $97,000 in one year to a homeowners’ pool of equity. This surge isn't atypical of cities in advanced economies.

The question is how long prices will continue to rise at their current pace. Interest rates are starting to rise - New Zealand, the UK and the US have all hiked base rates already in 2022 - consumer sentiment is weakening due to the geopolitical crisis in Ukraine and incomes are not rising in line with inflation.

The switch from a sellers’ market to one with more opportunities for buyers may be closer than we thought at the start of the year.

But even if rates reach 4% in the US and the UK – the figure at which Capital Economics forecasts house prices would start to fall - it is unlikely to stop the urban revival in its tracks.

Knight Frank’s Global Residential Cities Index has outpaced its sister index, the Global House Price Index, which tracks prices at a country/territory level since Q2 2021. We may see a reversal of fortunes with cities riding the upcoming wave of monetary tightening better than national housing markets.