Breaking Down The Wall of Money

For over two years, the strong headwinds of Brexit and Covid-19 have impacted global capital flows to London. As the easing of restrictions on cross-border travel and an improving economic outlook coincides with strengthening investor demand, we explain why global capital flows look set to rise.

2 minutes to read

Investment volumes bounce back

Investment transactions in London offices reached £12.3 billion in 2021, a year-on-year rise of £3 billion and the highest annual change since 2017. This came despite a background of rising long-term interest rates and the new Omicron variant bringing rising infection rates, continued disruption to international travel and a return to more remote working.

International capital inflows also improved, reversing a three-year downward trend to rise by £1 billion and this positive momentum looks set to continue into 2022 with £5.3 billion of deals currently under offer. The pertinent question is whether this recent rise represents a short-term drive to take advantage of attractive pricing relative to other cities, or are we witnessing a more fundamental shift how investors evaluate London’s prospects and the appeal of real estate in general.

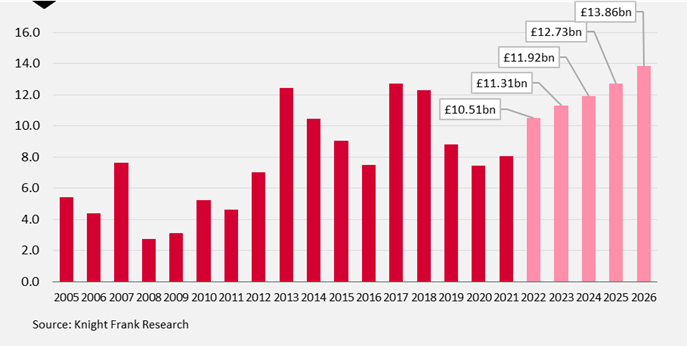

Modelling global capital flows into London. A 17% rise in office investment predicted for 2022

Our latest Active Capital Report employed machine learning techniques to model capital flows at both country and sector levels. These revealed that pent-up demand complimented by the broadening of various investor types provides the backdrop for record cross-border capital flows in 2022 where the UK office sector is expected to register transactions as high as £21.3 billion ($29 billion).

To better understand how deal volume in London may be affected by improving global capital flows, we developed a capital gravity model to forecast future transactions from international investors, using our proprietary transactions data. Along with independent assumptions for key economic indicators, we include variables that explain the proximity of investor countries to the UK and metrics that allow for political, cultural or historic ties to the UK.

Through this modelling, we project capital flows into London offices of £10.5 billion in 2022, a year-on-year increase of 16.8%. Additionally, the cumulative total of international transactions in London over the next five years is forecast to be £60.3 billion, the highest five-year total for over fifteen years. North America is expected to be the region making the largest investment with just over £18 billion, or 30%, of transactions followed by Other South East Asia with £15.69 billion (26%) and Europe with £14.4 billion (24%). Flows from Greater China are forecast to reduce significantly over the same period, accounting for only £8.7 billion of transactions.

London clearly remains strongly attractive to global investors but low levels of stock are an issue. In the short-term, stock levels could be increased by landlords encouraged to take advantage of the current high levels of interest in the sector. In the longer-term, financing opportunities could arise from lower risk repurposing projects.

Chart 1: Rising global capital flows into London

Watch the virtual London Breakfast event on demand.

Download the London Report 2022