Clustering innovative companies – where is best to succeed?

Clustering of innovative companies in high-growth sectors has been placed front and centre of UK industrial policy. Where are they likely to form and what is their focus?

2 minutes to read

Clustering innovative companies – where is best to succeed?

Clustering of innovative companies in high-growth sectors has been placed front and centre of UK industrial policy. Where are they likely to form and what is their focus?

What is clustering and why is it important?

“Make the UK a world leader in cluster development” was the call to action coming out of the latest CBI conference in November 2021.

Clustering – the geographic concentration of interconnected companies and institutions in a particular field – is being advocated as the best way to drive innovation and, in turn, economic growth across the UK. This trend is further evidenced in the much anticipated Levelling Up paper which advocates for the creation of regional centres of excellence.

Whilst clustering isn’t a new concept, it is evolving and extending as a central element of the emergent levelling-up agenda. These clusters are built through the combination of local strengths and high-growth, emerging sectors or collaborative attempts to tackle big societal and environmental challenges. They are increasingly inter-linked to enable the sharing of best practice and resources.

Where are they likely to form and what is their focus?

Answers to such questions will be crucial insights for the supply-side, in order to build the right product in the right location, to facilitate growth and maximise returns. They will also be crucial for the occupier in deciding where to locate to access the best talent, knowledge and broader ecosystem required for success.

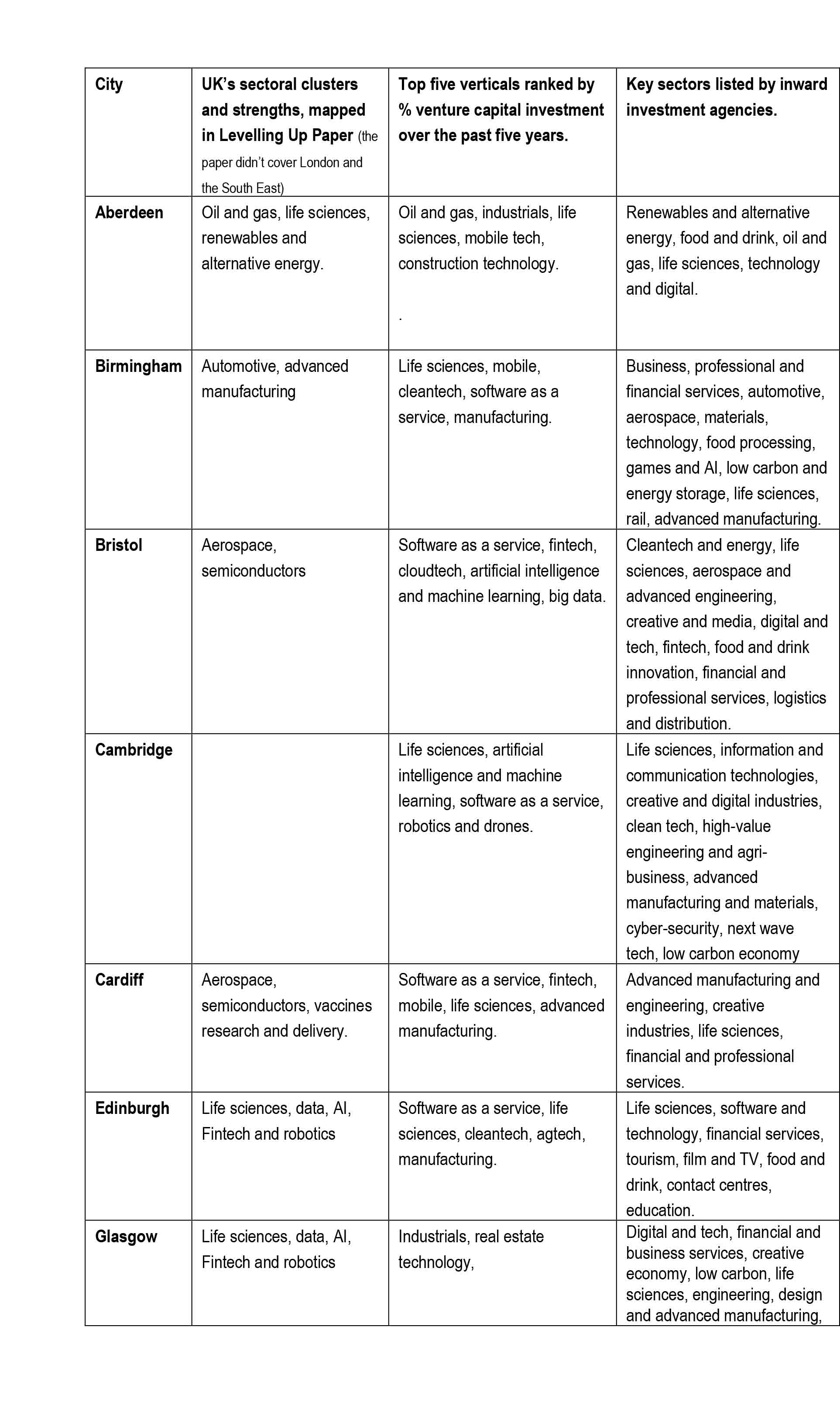

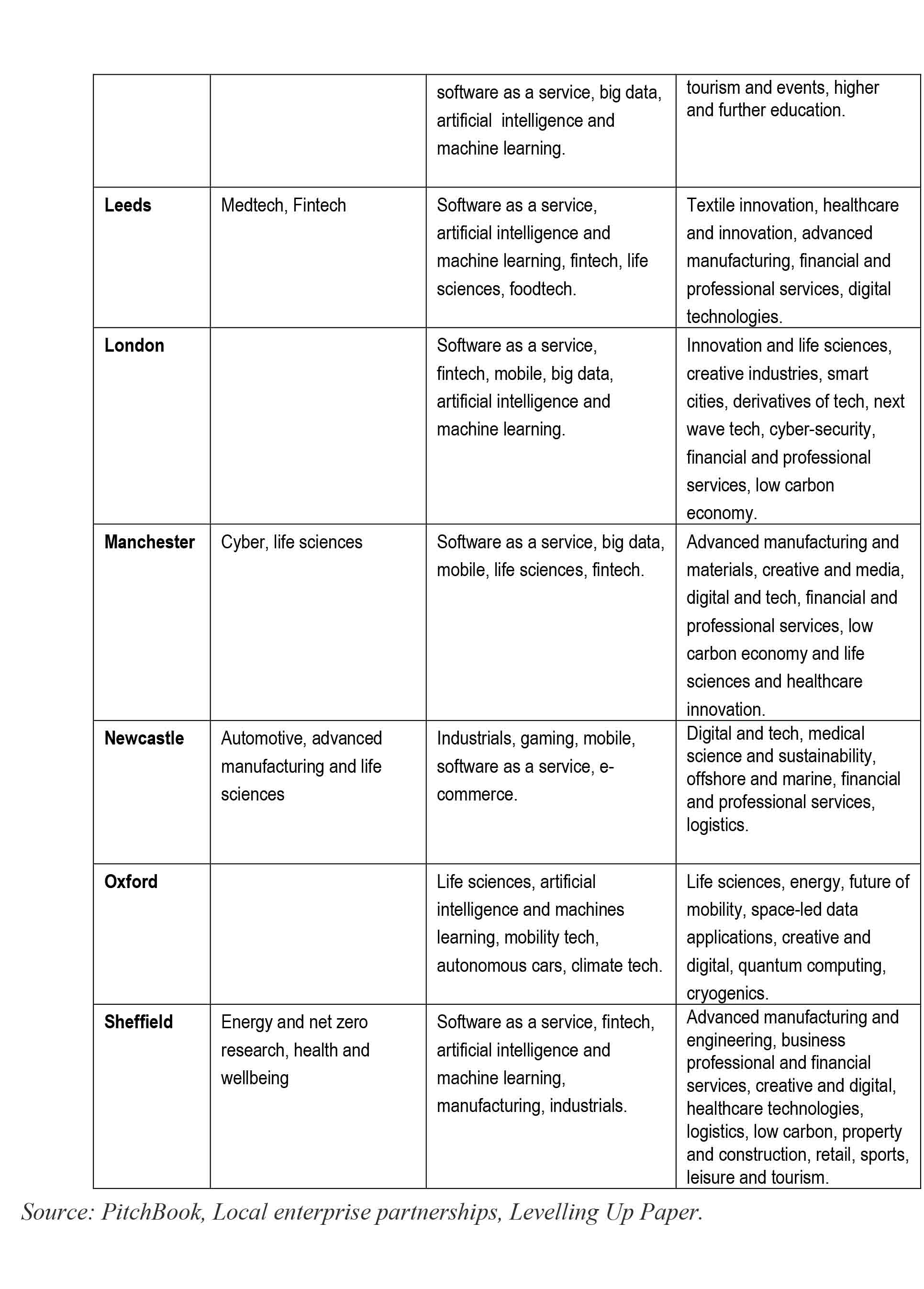

To help answer this question we have undertaken a detailed analysis of the UK’s main office markets and identified:

- The top five verticals ranked by % venture capital investment over the past five years.*

- Key sectors listed by inward investment agencies.**

- UK’s sectoral clusters and strengths, mapped in the UK’s levelling up paper.***

*Relevance: Venture capital investment fuels the growth of start-ups and innovation-led activity.

**Relevance: This analysis identifies local industry expertise as well as those sectors that will receive the most public investment and support to enable their continued growth.

*** The clusters are locations in the UK identified as potential priorities for investment and for harnessing existing economic assets for levelling up.

Source: PitchBook, Local enterprise partnerships