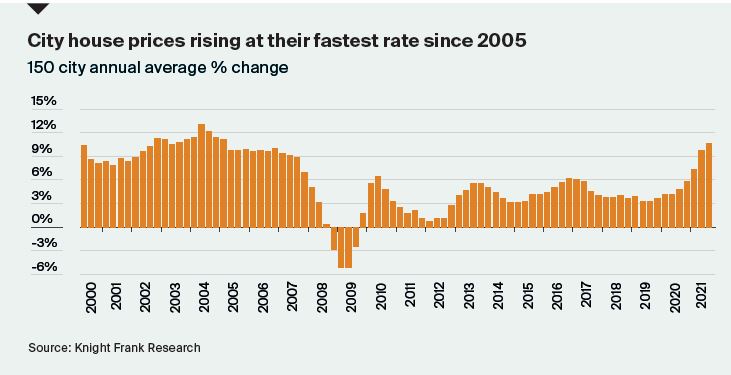

Globally, city house prices rise at fastest rate for almost 17 years

Average prices across 150 cities worldwide are rising at their fastest rate for almost 17 years. On average prices increased by 10.6% in the year to Q3 2021.

1 minute to read

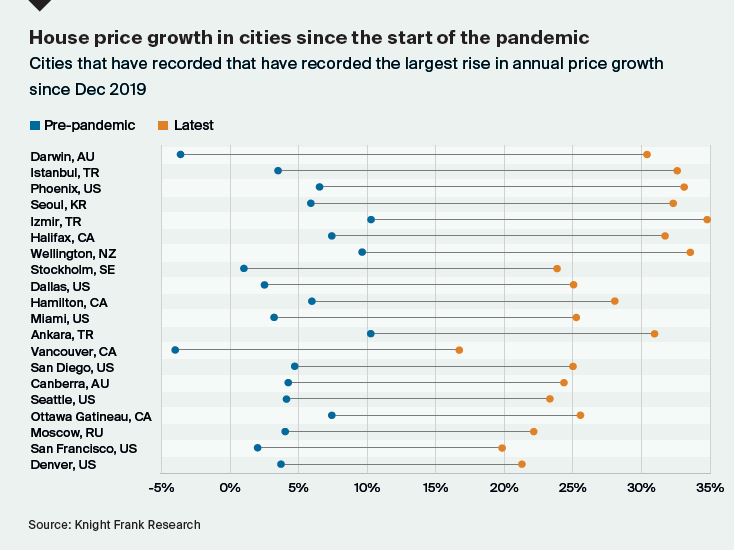

The Turkish city of Izmir leads the annual rankings this quarter with price growth of 34.8%. Of the 150 cities tracked, 93% saw prices increase over the 12-month period and 44% saw prices increase by more than 10%.

New Zealand, US, Canadian and Australian cities rank strongly with Wellington (33.5%), Phoenix (33.1%), Halifax (31.7%) and Hobart (30.9%) their respective frontrunners.

Despite the bullish performance of the index overall, 51 cities saw their rate of annual price growth decline between June and September, Moscow, Tel Aviv and Perth were amongst some of the biggest fallers.

In China, where indebted developers such as Evergrande and Kaisa are facing growing pressure, the government has taken steps to support the housing market. Of the 15 Chinese Mainland cities tracked by the index, nine saw their rate of annual price growth decline between June and September with Guangzhou witnessing the largest dip.

Darwin and Dubai represent the most improved markets. The Australian state capital saw annual price growth jump from 19.1% in June to 30.4% in September whilst Dubai, a city that has seen seven years of negative price growth, saw a marked shift with annual price growth reaching 6.1% in September, up from -4.4% in June. The UAE’s handling of the pandemic, its offer of spacious coastal living, and visa initiatives are attracting expats and driving demand.

The outlook

Prices have been pushed higher by government stimulus, savings accrued during lockdowns, a pandemic-induced reassessment of lifestyles as well as low interest rates. What happens next depends on the speed at which interest rates start to rise, the impact of Omicron and the stickiness of higher inflation, which could reduce disposable incomes and lead to weaker buyer sentiment.

Photo by Joshua Rawson-Harris on Unsplash