Global prime residential price forecast: Miami on top in 2022

Knight Frank’s global research teams reveal their prime residential price forecasts for the year ahead.

8 minutes to read

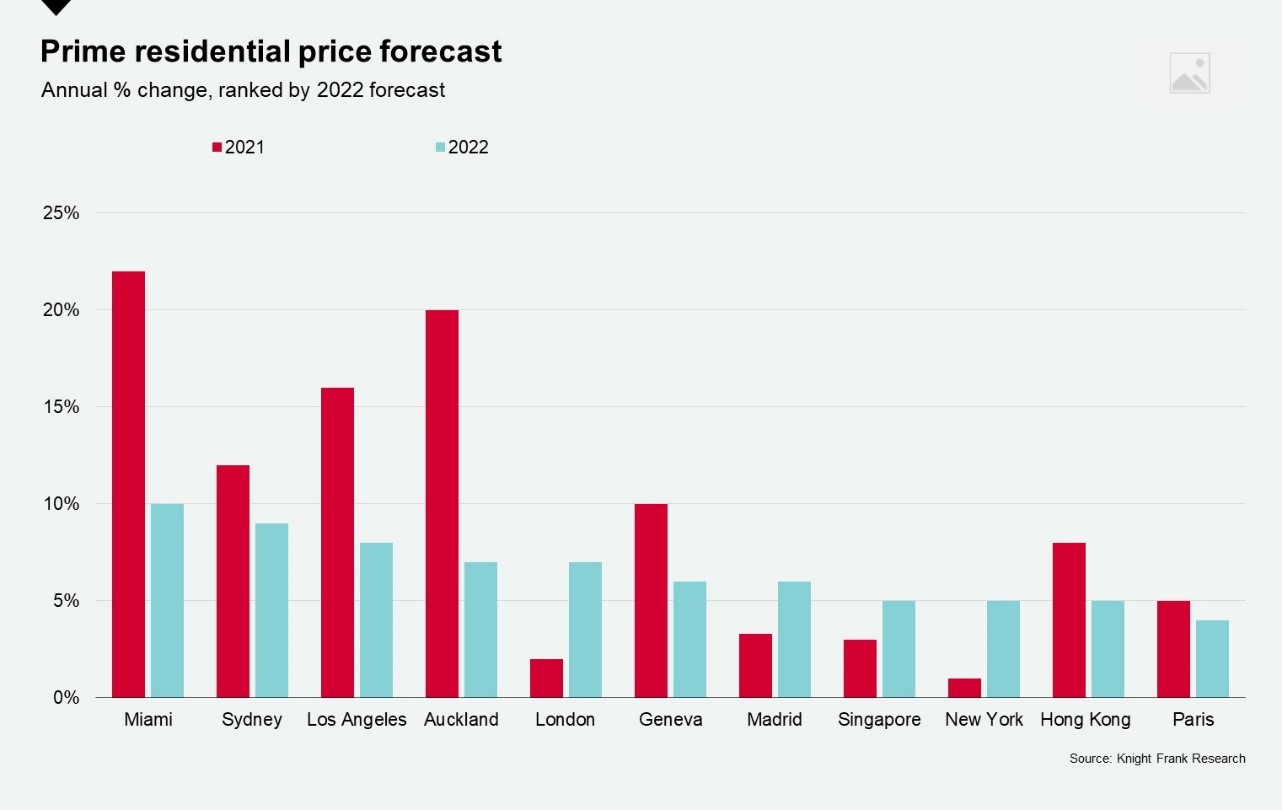

Miami leads Knight Frank’s prime residential price forecast for 2022 with luxury prices expected to rise 10% over the year.

Florida’s low tax regime, Miami’s competitive prices and the appeal of coastal living during the crisis has boosted demand. Palm Beach County alone has seen 35 sales above $30 million, 20 above $40 million and two above $100 million since the start of the pandemic, according to Miller Samuel.

In the US, wealth has been boosted by a sharp increase in the value of real estate and stocks, aggregate household net worth has increased by a staggering $24.8 trillion, or 21%, during the pandemic, according to Oxford Economics.

|

2021 (e) |

2022 (f) |

| Miami |

22% |

10% |

| Sydney |

12% |

9% |

| Los Angeles |

16% |

8% |

| Auckland |

20% |

7% |

| London |

2% |

7% |

| Geneva |

10% |

6% |

| Madrid |

3% |

6% |

| Singapore |

3% |

5% |

| New York |

1% |

5% |

| Hong Kong |

8% |

5% |

| Paris |

5% |

4% |

Sydney surges

Sydney occupies second place in our forecast with prime prices forecast to rise 9% in 2022. The reopening of borders, the return of investors and a growing appetite amongst domestic buyers for second homes on Australian soil, underlined by recent lockdowns and travel bans, will see prime prices accelerate.

Los Angeles sits in third place, record low inventory levels, strong demand for large family homes and the continued availability of low mortgage rates are expected to result in growth of around 8% in 2022.

Auckland and London (both 7%) complete the top five markets in our 2022 forecast. For Auckland, 7% represents a marked slowdown as the government takes steps to rein in speculative activity, for London, it will represent the city’s strongest rate of growth for eight years. An end to lockdowns, a reopening of travel, the winding up of the stamp duty holiday and the absence of political turmoil over Brexit will see a normalisation of market conditions. Plus, sizeable discounts of 20%-30% exist for euro and US-denominated buyers when taking price and currency shifts into account since the EU Referendum in June 2016.

In Hong Kong, prime price growth is expected to moderate from 8% in 2021 to 5% in 2022. The economic slowdown on the Chinese mainland, along with a slump in the Hang Seng, are constraining factors, but luxury prices remain at an all-time high and an influx of purchasing power from the Chinese mainland is expected once the border reopens.

In contrast to Hong Kong, Singapore is expected to see prime price growth strengthen year-on-year reaching 5% in 2022. The limited inventory of large luxury homes in the Core Central Region, coupled with the release of pent-up demand once travel measures ease, will see sales activity and prices accelerate.

After London, Geneva is set to be Europe’s top performer with prime price growth of 6% forecast in 2022. With taxes high on the agendas of global policymakers, Switzerland is likely to attract a fresh cohort of wealthy buyers looking not just at the tax benefits, but the privacy and lifestyle the country affords.

With Madrid and Paris forecast to see price growth of 6% and 4% respectively in 2022, this would represent each city’s strongest annual performance since 2018 and 2019 respectively.

Price growth set to moderate in 2022

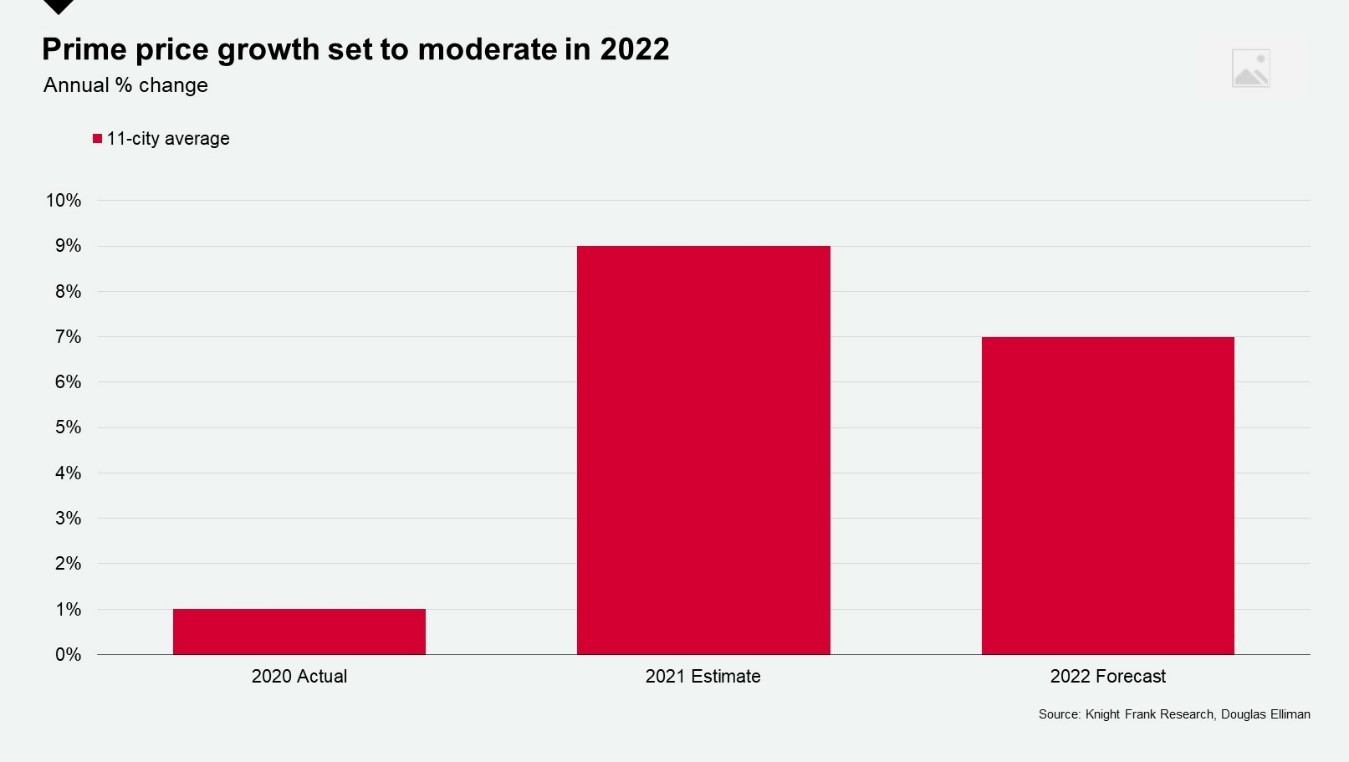

“The best of the global recovery is now in the rear-view mirror,” according to Capital Economics, and to some extent the same is likely to be true of prime property markets. Prime prices will continue to rise but the rate of growth will soften.

The chart below shows the average performance of all 11 cities. Prime prices increased by 1% on average in 2020, are expected to end 2021 9% higher before rising by 7% in 2022.

Although cities such as Auckland and Los Angeles posted stellar growth in 2020, most stuttered due to lockdowns and market closures. The pandemic-driven boom has been most evident in 2021 as markets reopened, accrued savings spurred on house moves or second home purchases, and homeowners reflected on where they wanted to be and how they wanted to live. Overall, we expect prime price growth to moderate in 2022 but there will be some exceptions.

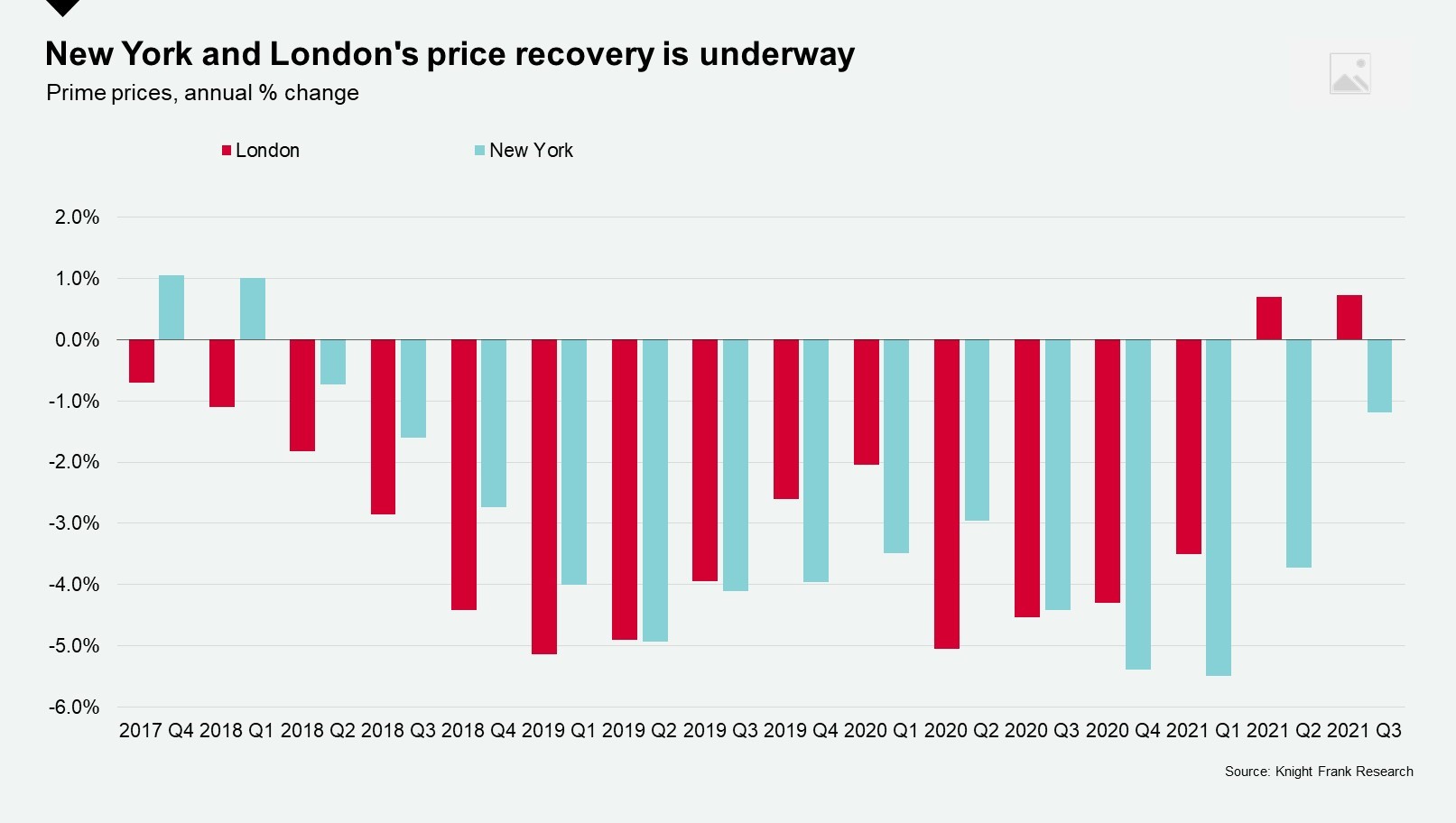

Since the start of the pandemic we’ve monitored cities’ performance closely and the story is an evolving one. The narrative has pivoted from “cities are dead” to “smaller, secondary cities are king” and now “metropolises are back”. Behemoths like New York and London look to be awakening from their slumber with the pace of prime sales quickening and annual prime price growth moving into positive territory for the first time in three and six years respectively.

Key drivers of price growth in 2022

- Normalisation of travel will influence all high-net-worth individual buyer groups: owner occupiers, investors and second home purchasers

- Interest rate rises will be less influential at the prime end of the market where cash purchasers still dominate in several cities

- Inventory levels are at record lows in some prime markets and new construction has been delayed due to the pandemic and blocked supply chains - Sydney, Los Angeles and Singapore have been particularly affected

- Amassed savings in developed nations are not yet depleted and wealth has appreciated due to the rise in the value of assets, both real estate and equities

- Second homes in liquid and transparent markets are in demand as high-net-worth individuals look to make up for lost time with family & friends

Trends to watch

- The Chinese mainland’s slowdown: The Chinese leadership look steadfast in their goal to control developer financing and restrict credit growth in its push towards ‘common prosperity’. Evergrande’s collapse is unlikely to kickstart widespread contagion but the direction of policy suggests more muted price growth in the medium term.

- Stepping away from stimulus: With some central banks taking cautionary steps away from ultra-accommodative monetary policy asset prices will no longer be artificially inflated.

- Higher taxes: Singapore is considering a wealth tax, President Biden has proposed increasing the top rate of tax for highest earners, the UK is reviewing its capital gains taxes and Spain plans to introduce a rent cap for landlords with multiple properties.

- Red tape: Property cooling measures, non-resident restrictions and tighter regulation of holiday rental platforms, such as Airbnb, are high on the agendas of city authorities.

- Rental recovery: Top tier cities are seeing rents and demand accelerate as CBDs reopen. Buy-to-let and institutional investment will increase where the numbers stack up.

- Greenback to strengthen: The US dollar is forecast to maintain its current strength* (USD/EUR 1.15, USD/GBP 1.34) into 2022 as global economic uncertainty rises and the Federal Reserve looks to tighten monetary policy

*As at 15 Nov 2021

Local Insight

Sydney, Michelle Ciesielski, Head of Residential Research

“Contributing to Sydney’s prime values, the super-prime market is performing exceptionally well with many suburban records being achieved, especially for those homes located close to the water.”

Hong Kong, Martin Wong, Head of Research & Consultancy, Greater China

“Despite the relatively low yield, luxury residential properties in Hong Kong will remain attractive assets for investors looking for capital appreciation over the long-term, supply is limited, and the resale market remains stable.”

Singapore, Leonard Tay, Head of Research, Singapore

“Singapore’s prime market in the Core Central Region has been kept in check by the lack of new development launches and pandemic-induced travel restrictions but we expect sales volumes to recover from late 2021 as travel corridors reopen.”

London, Tom Bill, Head of UK Residential Research

“What we will witness in prime central London is the resumption of a long-overdue recovery in prices that was halted by the pandemic. In the first two months of 2020, following the general election and before Covid-19, there were unmistakable signs the market was going to have a very strong year.”

New York, Georgina Atkinson, US residential sales, Asia Pacific & The Middle East

"It comes as no surprise that Miami tops our Prime Global Forecast for 2022. Bidding wars have now risen to their highest market share on record as the market pace in Q3 2021 was the fastest recorded. Sales continue to surge and there is a chronic lack of inventory. These metrics have been driven further by low mortgage rates, the federal SALT tax, and the widespread adoption of the remote working lifestyle.”

Subscribe to Knight Frank’s Research covering all property market sectors and world regions.

Explore Knight Frank’s House View. Updated monthly, it sets out the research team’s view on the trends shaping property markets globally.

Disclaimer

© Knight Frank LLP 2021. This document has been provided for general information only and must not be relied upon in any way. Although high standards have been used in the preparation of the information, analysis, views and projections presented in this document, Knight Frank LLP does not owe a duty of care to any person in respect of the contents of this document, and does not accept any responsibility or liability whatsoever for any loss or damage resultant from any use of, reliance on or reference to the contents of this document. The content of this document does not necessarily represent the views of Knight Frank LLP in relation to any particular properties or projects. This document must not be amended in any way, whether to change its content, to remove this notice or any Knight Frank LLP insignia, or otherwise. Reproduction of this document in whole or in part is not permitted without the prior written approval of Knight Frank LLP to the form and content within which it appears