Monthly UK Residential Property Market Update – September

Tight supply continues to support house price growth despite the fading impact of the stamp duty holiday

4 minutes to read

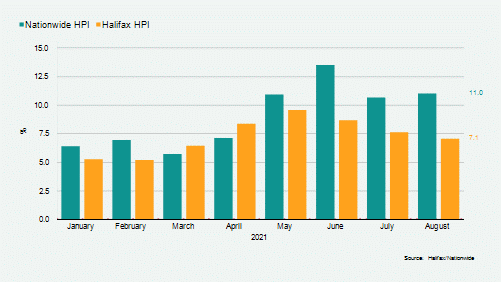

Halifax reported annual house price growth of 7.1% in August. This took the average price of a property in the lender’s index to a record high of £262,954. However, it came after a modest monthly average price rise of 0.7% between July and August. The annual rise was the lowest in five months.

While much of the impact from the stamp duty had now left the market – and will end entirely in September – the lender said structural changes ushered in by the pandemic, such as the demand of more space for home working, will likely endure.

Nationwide’s August figures featured a ‘surprise’ 2.1% month-on-month increase in average prices. It was the second highest monthly gain in 15 years (after a 2.3% increase in April of this year) and took the annual price change to 11% in August, up from 10.5% in July.

The latest RICS Sentiment Survey suggested a further softening of activity in August. Nationally, buyer enquiries were -14% for the month (July -9%) and the net balance for agreed sales was -18%. However, with new listings down 37% in August (-45% July) the indicator has now been in negative territory for eight of the nine months of 2021.

Against the backdrop of a brightening economic picture, households remain very positive about house prices. The August Markit House Price Index recorded a score of 66.2 for future prices, up from 65.8 in July. Expectations around current house prices dipped from 60.2 in July to 58.5. However, anything over 50 represents an expectation of house price growth. August’s index remains higher than before the UK’s first national lockdown in March 2020 for both measures.

While mortgage approvals for home purchase declined to 75,152 in July from 80,272 in June, and are at their lowest level since July 2020, they remain 13% ahead of the average for the 12-months to March 2020.

New data from the UK House Price Index shows that annual house price growth was at its lowest level since January in July of this year at 8%. The performance came the month after the stamp duty deadline, which led to a peak in residential property transactions and pushed annual house price growth to 13.5% in June. The 3.7% monthly fall from June to July was, on a non-seasonally adjusted basis, the second biggest since the series began in 1968. The largest monthly decline was a 3.8% contraction in October 1992, the month after the UK's forced withdrawal from the European Exchange Mechanism, which came to be known as 'Black Wednesday'.

We expect there will be single-digit annual growth in the UK property market this year as the frenetic pace of activity caused by the stamp duty holiday calms down, but market conditions remain strong.

Prime London sales

Following the substantial winding down of the stamp duty holiday in June, the number of sub-£2 million exchanges in July was 30% below the same month in 2019. By August, the equivalent decline had narrowed to 5%, Knight Frank data shows.

Above £2 million, a section of the market where activity was less affected by the maximum £15,000 saving, exchanges were down by 5% versus July 2019 and 3% compared to August 2019.

The predictable result, as the autumn market approaches, is a tightening of supply, particularly below £2 million, due to the frenetic pace of activity in the run-up to June. The number of market valuation appraisals below £2 million has dipped since March as activity was squeezed into the months leading up to the end of the stamp duty holiday.

Prime London Sales Report: August 2021

Prime London lettings

To underline the strength of demand in the prime London lettings market, the number of new prospective tenants registering with Knight Frank in August was 73% higher than the same month in 2019.

Strong demand and low supply, which have been exacerbated by the pandemic, mean landlords are now in the driving seat and the switch from a tenant’s market has been swift.

Supply is low because, in similar fashion to parts of the sales market, the shelves have emptied quickly due to strong demand. Furthermore, many would-be landlords sold in order to take advantage of the frenetic sales market in the first half of the year caused by the stamp duty holiday.

On top of that, the flood of short-let properties that came onto the long-let market and helped initially create a tenant’s market has dried up as staycation restrictions have been lifted.

Prime London Lettings Report: August 2021

Country Market

While the ‘escape to the country’ trend has dominated the last year, there are signs that a resurgence in town and regional city living is underway.

The percentage of town and city sales of all UK transactions outside of London was 42% in the second quarter of 2021, the highest figure in Q2 for ten years.

The momentum continued in July and August. The ten-year average for town and city sales as a percentage of UK sales outside of London is 37%. However, the combined percentage of town and city sales of all UK transactions outside of London for July and August was 40%.

Demand for towns and cities grows as buyers look for best of both worlds