Daily Economics Dashboard - 24 March 2021

An overview of key economic and financial metrics.

2 minutes to read

Download an overview of key economic and financial metrics on 24 March 2021.

Equities: Globally, stocks are mixed. In Europe, declines have been recorded by the DAX (-0.5%), CAC 40 (-0.4%) and STOXX 600 (-0.3%), while the FTSE 250 is the exception, up +0.1% this morning. In Asia, the TOPIX (-2.2%), Hang Seng (-2.0%), CSI 300 (-1.6%) and KOSPI (-0.3%) all closed lower, however the S&P / ASX 200 was +0.5% on close. In the US, futures for the S&P 500 and the Dow Jones Industrial Average are +0.4% and +0.3%.

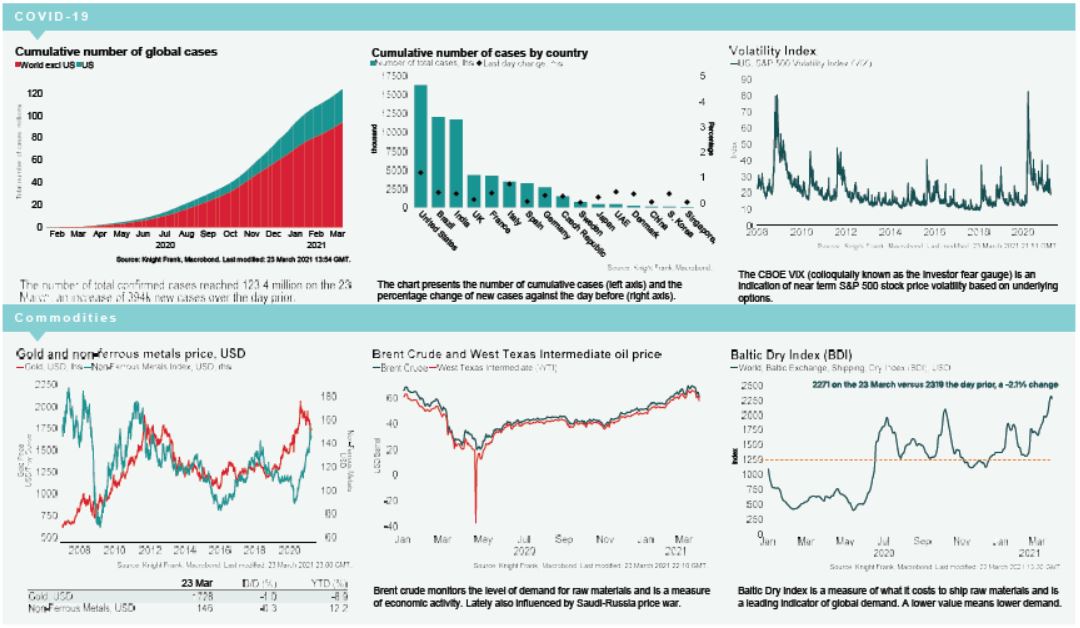

VIX: After increasing +8% over Tuesday, the CBOE market volatility index is largely unchanged this morning at 20.2. Meanwhile, the Euro Stoxx 50 volatility index nudged higher, up +2.3% to 18.0, below its LTA of 23.9.

Bonds: The UK 10-year gilt yield and German 10-year bund yield are both -2bps lower at 0.75% and -0.36%, while the US 10-year treasury yield is flat over the morning at 1.63%.

Currency: Both sterling and the euro have depreciated to $1.37 and $1.18, respectively. Sterling and the euro are at their lowest levels since February 2021 and November 2020. Hedging benefits into the UK and Eurozone are currently 0.57% and 1.69%, respectively on a five year basis.

Oil: Brent Crude and the West Texas Intermediate (WTI) are both +2.9% higher this morning, at $62.53 and $59.44, respectively.

Baltic Dry: The Baltic Dry decreased for the first time in seven sessions on Tuesday, down -2.1% to 2271. Prices were pushed down by weaker demand for all vessel segments, including capesize rates which declined -3.2% and panamax rates which were -2.5% lower yesterday.

UK PMIs: Flash estimates of the manufacturing PMI for March is 57.9, above expectations of 55.0 and higher than February’s 55.1. This is its strongest growth in factory activity since November 2017. The services PMI moved from contractionary to expansionary (above 50) territory in March, increasing from 49.5 in February to 56.8, above market expectations of 51.0. This marks the first time the services PMI has been in expansionary territory since October 2020 and the first time the services PMI has been higher than the balance of the manufacturing PMI since the pandemic began.