Daily Economics Dashboard - 25 February 2021

An overview of key economic and financial metrics.

2 minutes to read

Download an overview of key economic and financial metrics on 25 February 2021 2020.

Equities: In Europe, the STOXX 600, DAX and CAC 40 are all broadly flat this morning, while the FTSE 250 is down -0.2%. Meanwhile in Asia, the KOSPI (+3.5%), Hang Seng (+1.2%), TOPIX (+1.2%), S&P / ASX 200 (+0.8%) and CSI 300 (+0.6%) were all higher on close. In the US, futures for the S&P 500 are -0.2% this morning.

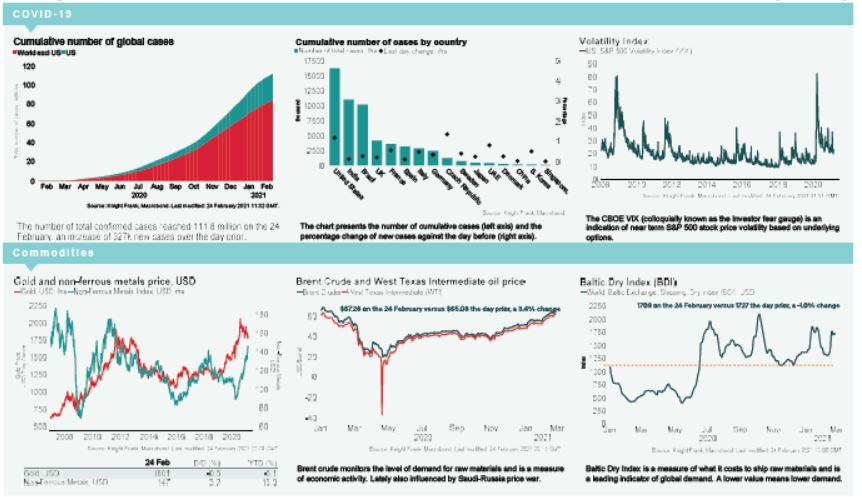

VIX: After decreasing -8% over Wednesday, the CBOE market volatility index has increased +7.8% this morning to 23.0, remaining above its long term average (LTA) of 19.9. Meanwhile, the Euro Stoxx 50 volatility index is broadly flat at 21.4, below its LTA of 23.9.

Bonds: The US 10-year treasury yield has softened +9bps to 1.47%, while the UK 10-year gilt yield is up +7bps to 0.81% and the German 10-year bund yield has added +5bps to -0.25%. The UK gilt yield, US treasury yield and German bund are at their highest levels since July 2019, January 2020 and March 2020, respectively.

Currency: Sterling and the euro are currently $1.41 and $1.22, remaining at their highest levels since January and April 2018, respectively. Hedging benefits for US dollar denominated investors into the UK and the eurozone are at 0.47% and 1.51% per annum on a five-year basis.

Oil: Brent Crude and the West Texas Intermediate (WTI) have both increased +0.3% to $66.43 and $63.41, their strongest levels since June and April 2019, respectively.

Baltic Dry: The Baltic Dry is down -1.0% on Wednesday to 1709, -8% below the four-month high seen in mid January 2021. Prices have been pushed downwards by capesize rates which declined -6.8% yesterday, as well as panamax rates which fell -1.3%.

Copper: The price of copper, a key industrial material, has surpassed $9,500 a tonne and is currently at its highest level in almost a decade, with prices increasing close to +100% from its pandemic low in March 2020.

US Unemployment: There were 730k new unemployment applications in the week to 10th February, below market expectations of 838k and lower than 841k last week. This is the largest weekly decline since the week ending 29th August and the lowest number of jobless claims in three months.