Covid-19 Daily Dashboard - 18 December 2020

An overview of key economic and financial metrics.

2 minutes to read

Download an overview of key economic and financial metrics relating to Covid-19 on 18 December 2020.

Equities: In Europe, stock performance was mixed. The FTSE 250 (-0.4%) and CAC 40 (-0.1%) are down so far this morning, while the DAX (+0.3%) is positive and the STOXX 600 remained flat. In Asia, the CSI 300 (-0.3%), S&P / ASX 200 (-1.2%) and Hang Seng (-0.7%) all closed lower, while the Kospi and Topix were unchanged. In the US, futures for the S&P 500 and the Dow Jones Industrial Average (DJIA) are down -0.2% and -0.4%, respectively.

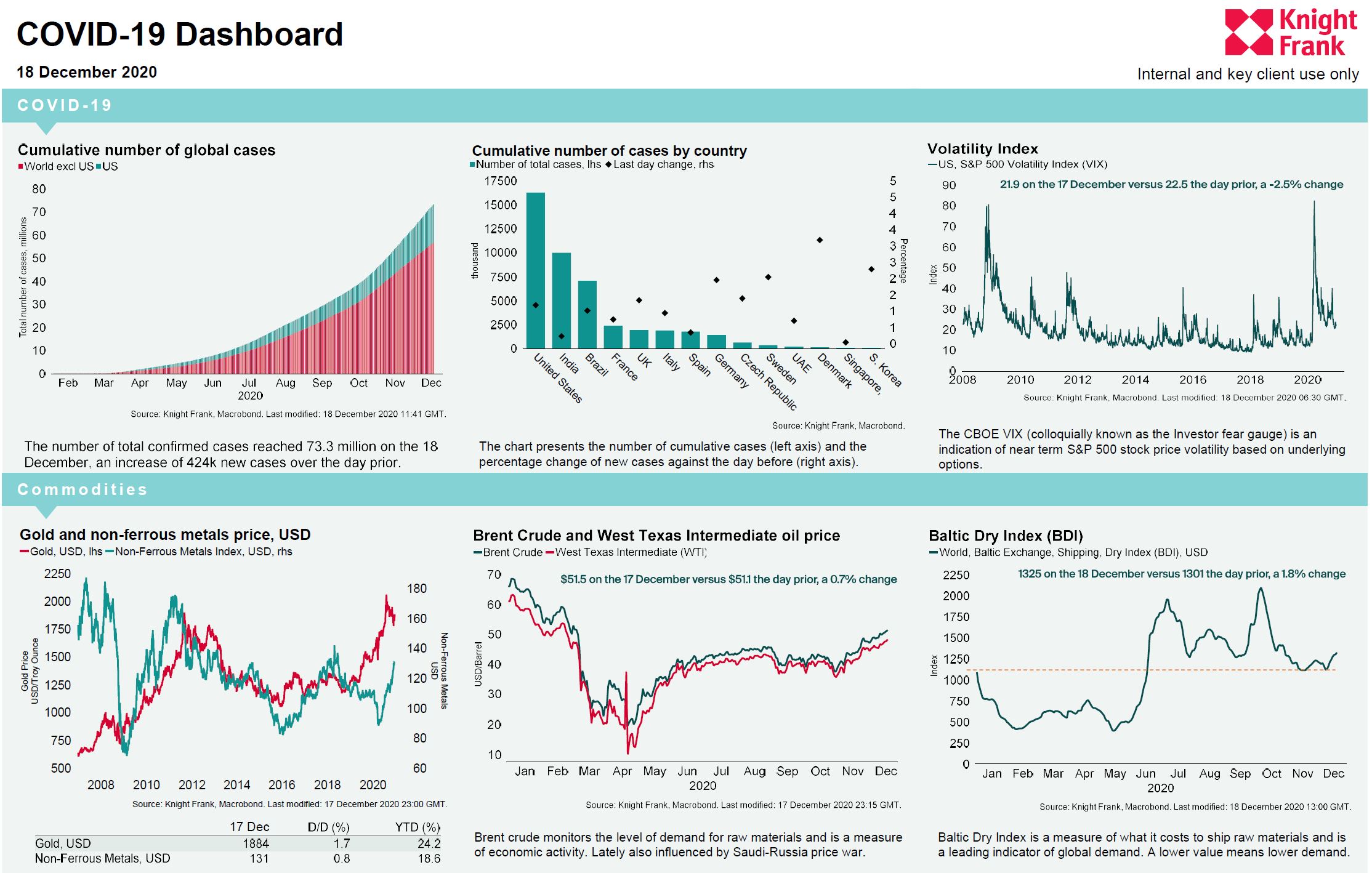

VIX: The CBOE market volatility index has increased +0.5% this morning while the Euro Stoxx 50 volatility index has decreased -3.0% to 22.1 and 20.5 respectively. The CBOE is close to its long term average (LTA) of 19.9, while the Euro Stoxx vix remains below its LTA of 24.0.

Bonds: The UK 10-year gilt yield has compressed -3bps to 0.24%, while the US 10-year treasury yield and the German 10-year bund yield have held steady at 0.93% and -0.58% respectively.

Currency: Sterling and Euro are currently $1.35 and $1.23 respectively. Hedging benefits for US dollar denominated investors into the UK and the eurozone are 0.44% and 1.32% per annum on a five-year basis.

Baltic Dry: The Baltic Dry increased for the ninth consecutive session this morning, up +1.8% to 1325, the highest the index has been since the end of October. Year to date gains in the Baltic Dry are currently at +22%.

Oil: Brent Crude and the West Texas Intermediate (WTI) oil prices broadly held steady at $51.48 and $48.44 per barrel. Both Brent Crude and the WTI are currently at their highest price since February.

Brexit: The odds of a trade deal between the UK and the European Union being signed in 2020 remain volatile. There is currently a 71% likelihood of a deal being signed this year according to Oddschecker, compared to 81% yesterday, 64% one week ago and 73% last month.

US Unemployment: There were 885k new unemployment applications in the week to 12th December, above market expectations of 800k and higher than the previous week’s reading of 862k. This is the largest number of new unemployment applications since early September.

Please note, the Daily Dashboard will take a break from Friday the 18th of December to Monday the 4th of January.