Covid-19 Daily Dashboard - 22 October 2020

An overview of key economic and financial metrics.

2 minutes to read

Download an overview of key economic and financial metrics relating to Covid-19 on 22 October 2020.

Equities: Globally, stocks are mostly down. In Europe, declines have been recorded by the DAX (-0.8%), STOXX 600 and CAC 40 (both -0.8%), as well as the FTSE 250 (-0.1%). In Asia, the Topix (-1.1%), Kospi (-0.7%), CSI 300 and S&P / ASX 200 (both -0.3%) all closed lower, while the Hang Seng (+0.1%) was the only index up on close. In the US, futures for the S&P 500 are down -0.3%.

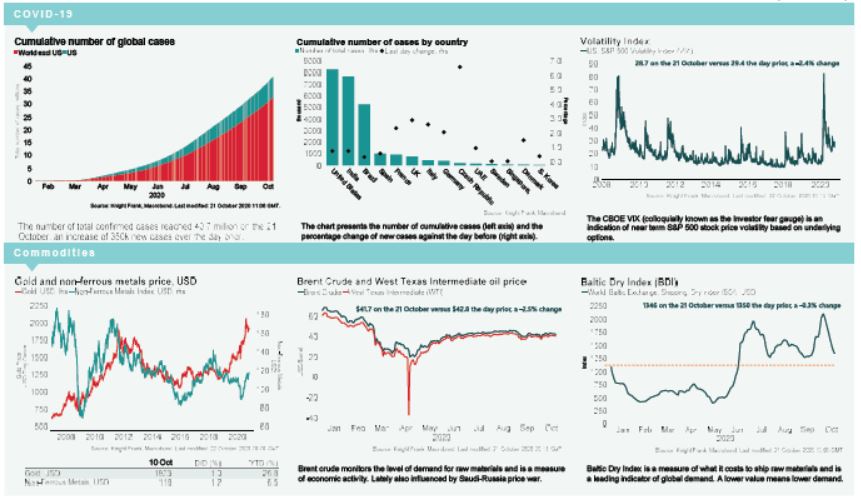

VIX: After declining -2.4% yesterday, the CBOE market volatility index has increased +2.7% to 29.4, the highest it has been since the beginning of September. Meanwhile the Euro Stoxx 50 volatility index has decreased, down -0.8% to 29.2. Both indices are elevated compared to their long term averages of 19.9 and 23.9.

Bonds: The UK 10-year gilt yield has softened +3bps to 0.26%, while the US 10-year treasury yield has compressed -1bp to 0.82% and the German 10-year bund yield is flat at -0.59%.

Currency: Sterling and the euro are currently $1.31 and $1.18, respectively. Hedging benefits for US dollar denominated investors into the UK and the eurozone are at 0.39% and 1.24% per annum on a five-year basis.

Baltic Dry: The Baltic Dry decreased for the 11th consecutive session yesterday, declining -0.3% to 1,346, its lowest daily decline since the start of the rout on 7th October.

Copper: The price of copper surpassed $7,000 a tonne for the first time since June 2018 yesterday, reaching $7,034 a tonne. Prices have been pushed upwards due to a strong demand in China, with the metal emerging as a key way for investor exposure to sustainable energy, including wind, solar, batteries and electric cars, according to the FT.

Airline Industry: The owner of British Airways, IAG, has announced the airline will undertake no more than 30% of its usual flights between October and December, compared to last year. IAG, which also owns Iberia and Aer Lingus, reported an -83% annual decline in revenue from €7.3 billion in Q3 2019 to €1.2 billion in Q3 this year. Ryanair has also reduced its winter flight schedule to 40% of last year’s capacity and Cathay Pacific, an Asian airline, has announced it expects to offer less than 50% of its usual capacity next year.