Covid-19 IN AFRICA: Focus on Western Africa

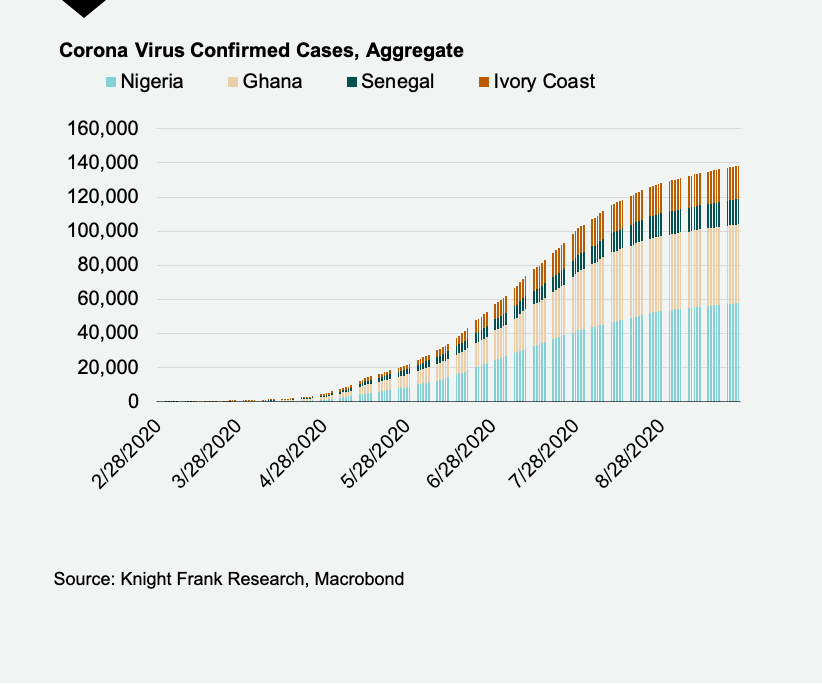

While the region’s rate of Covid-19 infections has declined, we expect West Africa’s economic outlook in Q3 2020 to be impacted by a decline in commodity prices, upcoming elections and reduced financial flows.

4 minutes to read

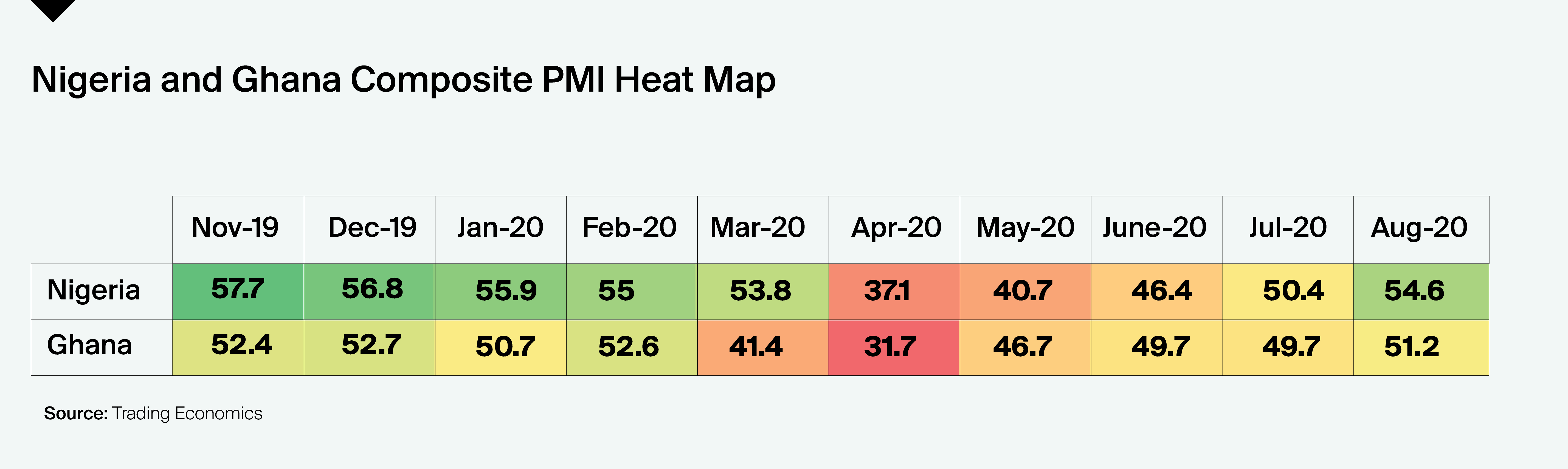

As at Q2 2020, the African Development Bank estimated that West Africa’s economy will contract by 2.0% in 2020, six percentage points below its projected growth rate prior to the pandemic. The recent easing of Covid-19 restrictions has led to recovery in economic activity in the region. Resumption of international travel across Nigeria, Ghana, Senegal and Côte D’Ivoire is anticipated to further boost economic activity across the region. Purchasing Managers’ Index (PMI) data indicates that Ghana’s economy is set to recover in Q3 2020 after recording a decline in Q2 2020. Ghana’s PMI was recorded at 51.2 in August, an expansion, for the first time in five months. However, while Nigeria’s PMI was recorded at 54.6 indicating a positive outlook for Q3 2020, lower oil prices and reduced financial flows are anticipated to continue impacting the country’s economic outlook. Overall, Ghana’s economy is set to record a 1.5% growth rate,while Nigeria’s economy is set to contract by 3.4%.

According to the IMF, Côte D’Ivoire’s economy is set to record a 1.8% growth rate. However, some disruption is expected in Q3 2020 as a result of political turmoil anticipated ahead of the country’s general election. Senegal’s positive handling of Covid-19 has helped cushion the pandemic’s short-term impact on the economy attributed to the economy’s reliance on international travel and the tourism sector. As a result, Senegal’s economy is set to record a 2.9% growth rate according to the IMF.

Source: Trading Economics

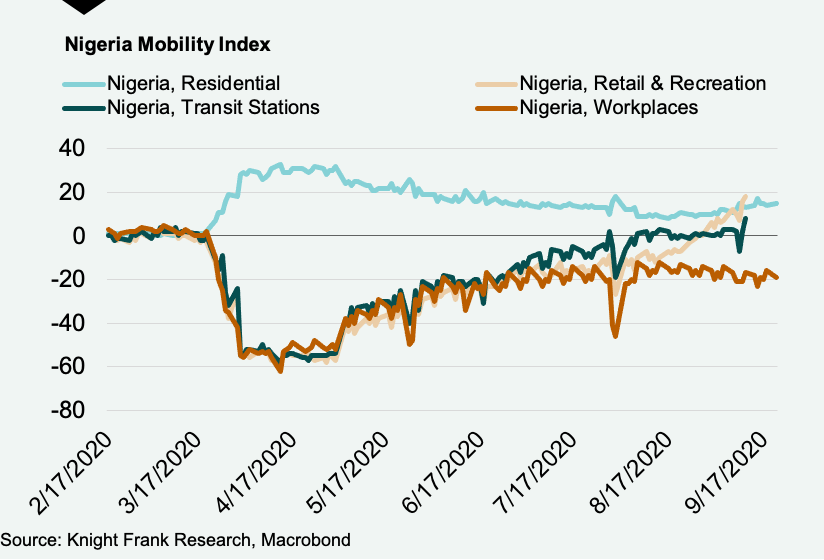

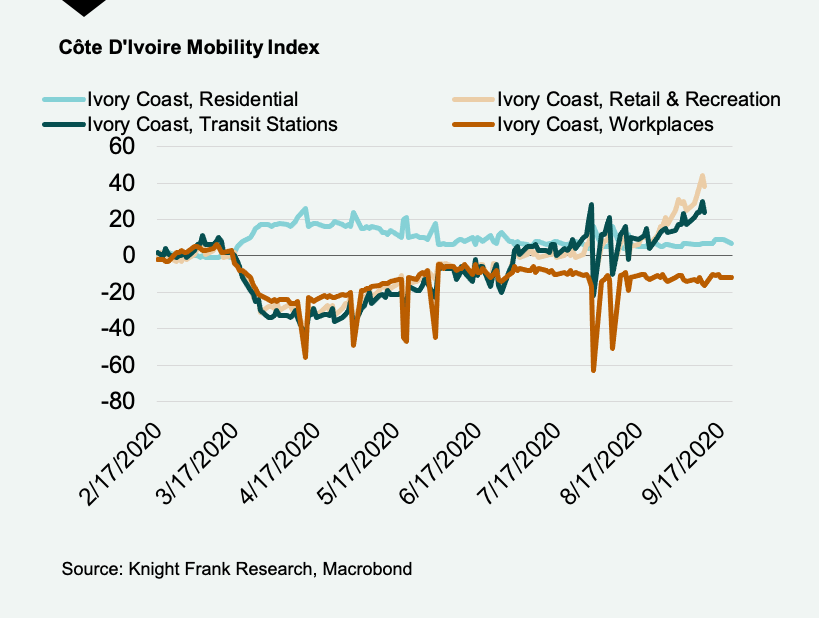

Data Watch: Google Mobility Index

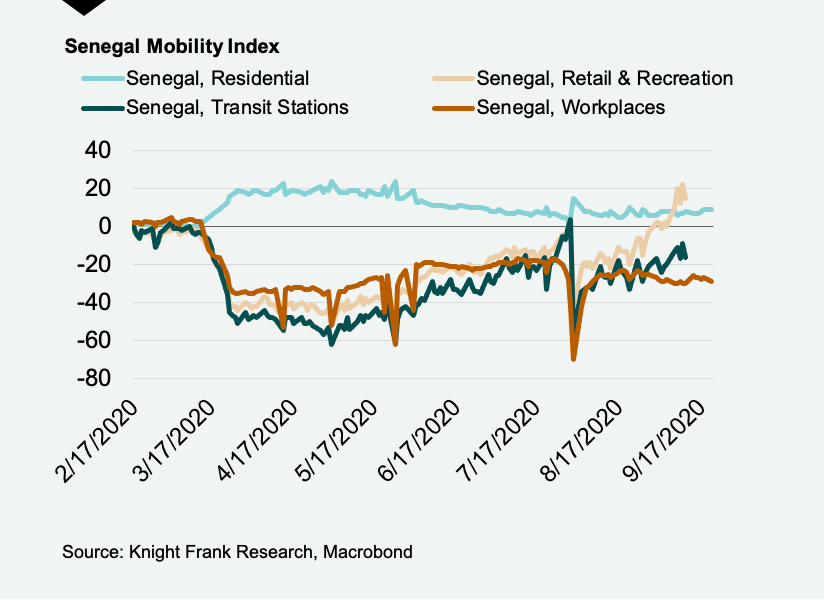

Mobility data from Google’s mobility index indicates that in the last one month, activity across retail, workplaces, and transit stations has receded towards its pre-Covid baseline across Nigeria, Senegal, Ghana, and Côte d’Ivoire.

Whilst retail activity saw a sharp decline in early April as a result of movement restrictions imposed, it has been quicker to bounce back across the region. Retail activity resumed to above baseline levels in Nigeria, Ghana, Senegal, and Côte d’Ivoire by mid-September. The impact of the initial reduction in retail activity remains fragmented across the region. Whilst in Lagos, footfall in Grade A malls has declined by as much as 60%, retail activity in Accra, continues to be vibrant especially in the East Legon and Labone areas, with prime rents remaining stable at about US$30.0 per square metre per month. Retail rents also remained relatively stable in Abidjan and Dakar and were recorded at US$25.0 per square metre per month and US$23.5 per square metre per month, respectively.

Workplace activity across the four countries remained significantly below the baseline in the period under review as most occupiers continued to work remotely. These reduced levels of occupancy are anticipated to result in further softening in office rents in Accra and Lagos. In the first half of the year, prime office rents declined by 6% on average in both cities. Over the past month, Abidjan also recorded a slight decline in prime office rents of about 2.5%, while prime office rents in Dakar have remained relatively stable. Time spent in residential areas, albeit reduced from highs in lockdown periods, remained above its baseline. Across all markets we have observed a supply deficit of executive “ultra-prime” properties (4+ bedroom stand-alone homes) leading to a growth in prices across this market niche, while wide availability of mid-range options such as 2-3 bedroom apartments has flooded the market due to increased vacancies as a result of multinationals exiting the markets.

Overall, average prime residential rents increased across Dakar as well as Lagos. However, Accra and Abidjan recorded a drop-in rent of up to 20% in their mid-range residential sector.

In anticipation to the election, Abidjan is expected to record multiple land transactions aimed at leveraging on the current low prices in the residential sector which are expected to increase once the situation stabilises. Limited market activity is expected in the office sector as most of the larger pending deals remain on hold until the end of the year.

We will continue to bring you this update over the next few weeks focusing on the different regions in Africa. If you have any comments or if we can help further in any way, please do not hesitate to get in touch via the contact details below.

Arturo Pavani

Head of Research

Knight Frank-EMC

Arturo.Pavani@knightfrank-emc.com

Tilda Mwai

Researcher for Africa

tilda.mwai@me.knightfrank.com