Global Residential Outlook – 11 September 2020

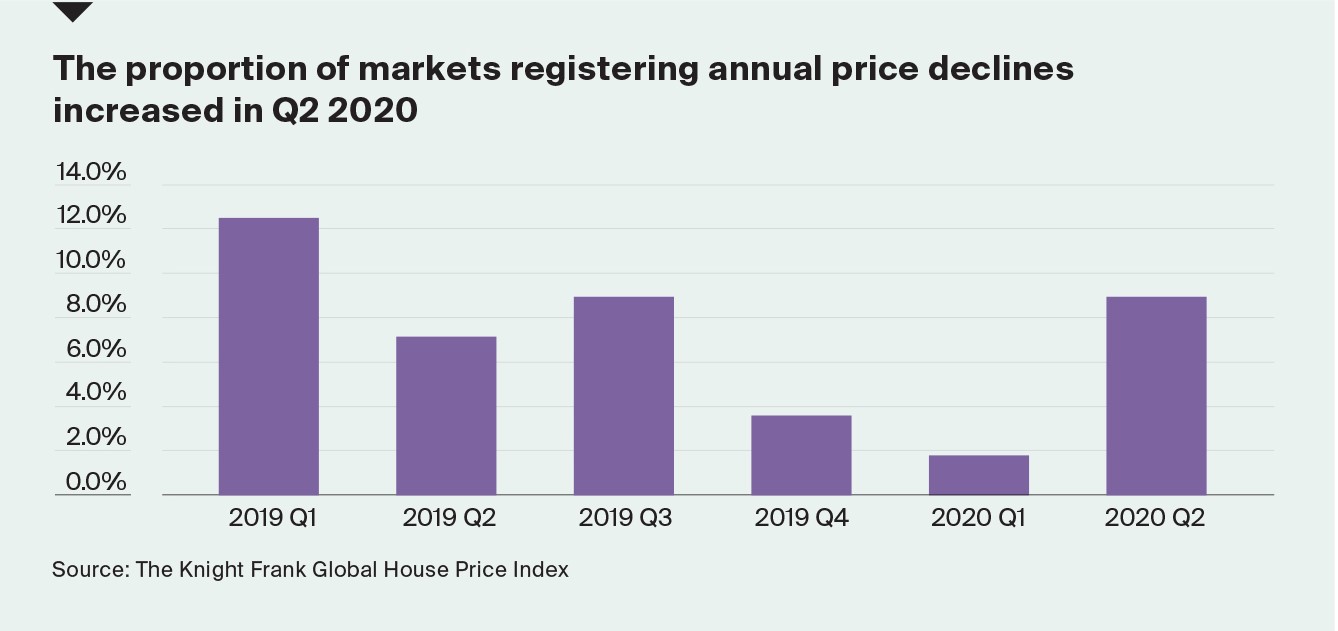

Key takeaway:As we forecast in April, prices are proving more resilient than sales. Our latest look at global house prices shows only 9% of countries saw prices decline year-on-year in the 12 months to June 2020 and seven countries still registered double-digit price increases year-on-year.

5 minutes to read

Need to Know:

- According to UBS, most economic data is being revised higher, as statisticians initially underestimated the ability of people to adapt to the pandemic and productivity levels whilst working from home. There are mixed messages around a further US economic stimulus package as unemployment fell to 8.4% last week reducing the likelihood of such a move but Oxford Economics believes a fiscal package worth around $1.5tn is still likely.

- The government in England has introduced ''regional travel'' corridors, meaning a country's islands may be subject to different quarantine rules to that of the mainland. To date this new measure has only been applied to Greece.

- In Asia Pacific, there are signs that the reopening of borders is under discussion. In Australia, every state and territory except Western Australia agreed in-principle to open their borders by Christmas at a cabinet meeting last week and Hong Kong is in talks with 11 countries to form travel bubbles, amongst them Australia, France, Germany and Singapore.

- On Monday, Boris Johnson gave the EU 38 days to strike a deal, his deadline being 15 October. The UK is planning new legislation that will override key parts of the Brexit withdrawal agreement signed last year with the EU.

Residential digest

Europe

- European countries accounted for eight of the top ten rankings in our latest Global House Price Index, with Baltic and CEE countries well represented. Luxembourg, Lithuania and Estonia led the group in the year to June with annual price growth of 14%, 12% and 12% respectively, although Turkey came top overall with annual growth of 26%.

- With Brexit looming large, we highlight “Five things you need to know about Brexit and residential property markets,” we look at whether or not UK buyers will be eligible for golden visas as non-EU citizens, whether it will be harder for UK nationals to relocate permanently to an EU country and whether there will be limits on the amount of time you can spend at your second home in the EU.

- In Spain, new data shows work began on a total of 996 developments and 27,882 new homes between April and August 2020, with Amenabar, Habitat and Aedas the most active developers.

Asia Pacific

- China’s second-biggest property developer, China Evergrande, is reducing the prices of all new homes by 30% for the next month. According to the South China Morning Post, “it’s an unprecedented step that could kick off a spate of competitive discounts from other housebuilders”.

- In Hong Kong, the Financial Times, using Knight Frank data, confirms that sales have taken a bigger hit than prices, with prices down only 6% since their peak in May 2019. Demand from mainland Chinese and international buyers has dwindled due to Covid-19 but figures from the Hong Kong Monetary Authority underline the resilience of local homeowners with the mortgage delinquency ratio at 0.04% and fewer than 400 homeowners in negative equity.

US and Canada

- With some commentators arguing that Covid-19 has rung the death knell of the city, the New York Times has identified a divergent trend. Instead of city dwellers heading to the suburbs there is a separate group of buyers now choosing to live closer to their jobs in the city centre, these include doctors and medical workers and those who are required to be on site. A number of these workers who were previously content with a 20-minute commute are now preferring a 15-minute walk with no reliance on public transport.

- In the US, the Center for Disease Control and Prevention (CDC) has announced a ban on rental evictions until the end of 2020 for anyone earning less than $100,000 per annum who is unable to pay their rent due to a loss of household income. This is expected to lead to an increase in rental arrears for some landlords.

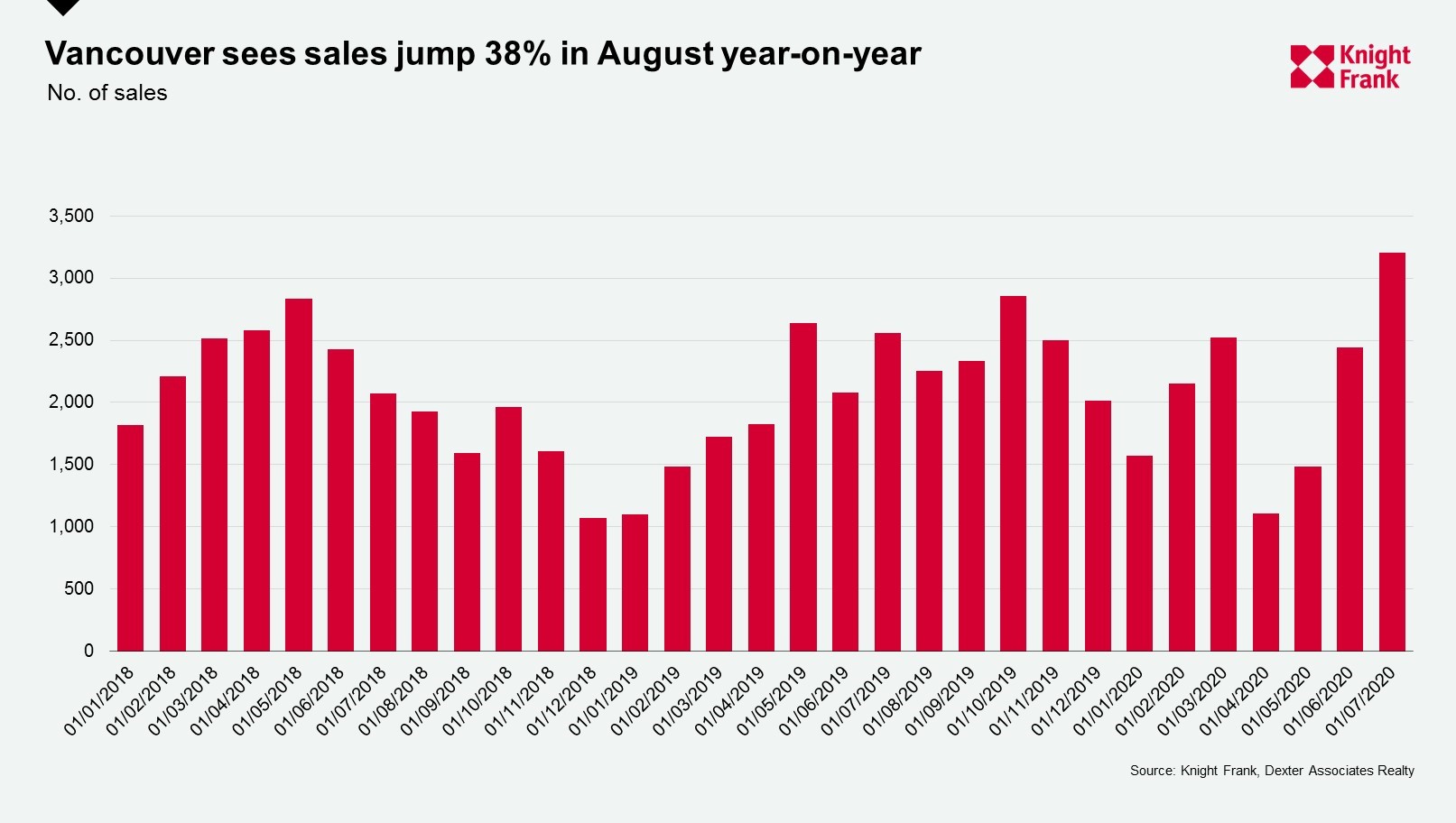

- In Vancouver, sales in August reached their highest monthly rate since August 2015. Some 3,122 properties changed hands in Greater Vancouver in August compared with 3,202 sold in July and 2,256 sales in August 2019. Kevin Skipworth, Managing Director of Dexter Associates Realty comments: “This is not just pent up demand as a result of Covid-19, it is a housing market that had stalled in 2018 and 2019 coming to life”. The housing market received a further boost from the Bank of Canada this week when it announced that despite core inflation nudging 2%, it has no plans to raise interest rates for years.

Africa

- The new Africa Residential Dashboard confirms that 60% of the cities tracked by Knight Frank recorded flat or rising rents in the first half of 2020. The decline in expat demand has been offset by an appetite for better quality living spaces due to the rise in remote working. Lagos recorded the strongest rental increase, up 39% on average due to supply restraints, while Cape Town saw prime rents slip 40% due to the weak economic climate and currency depreciation.

This week’s recommended listening

Our Intelligence Talks podcast is back after a summer break with the first episode of Season 2 now available.

In our first episode, Douglas Larson, Executive Vice President at our New York-based associate partner Newmark Knight Frank, explains why tech giants are continuing to expand in the city; our UK head of residential research Tom Bill discusses the rationale behind our new UK house price forecasts; and Knight Frank Finance Partner, Hina Bhudia, and consultant to Knight Frank, Patrick Gower, also discuss how lenders in the UK are dealing with the rise in demand for mortgages and payment holidays.

Click one of the links below to listen.

Apple: https://apple.co/2R2A47O

Spotify: https://spoti.fi/3lWL70u

Acast: https://bit.ly/2DAsT3E