Global Residential Outlook – 24 July 2020

A roundup of the latest data and insight across key global residential markets

5 minutes to read

Key takeaway: With mortgage lending picking up in Europe and the US and cross-border sales now evident in Asia, there is some positivity for housing markets globally. However, there are concerns the economic implications of the pandemic have yet to filter through to consumers’ pockets and although there are some positive indicators from vaccine trials, the number and geographic spread of second spikes suggests uncertainty will persist in the short to medium-term.

Residential Digest

A total of 153 super-prime residential transactions (US$10 million+) took place between 1 March 2020 and 22 June 2020, with a total value of US$3.2 billion, highlighting the resilience of higher-value properties during this unprecedented time. My colleague Flora Harley explores the latest findings for the super-prime and ultra-prime (US$25 million+) market in detail.

Need to know

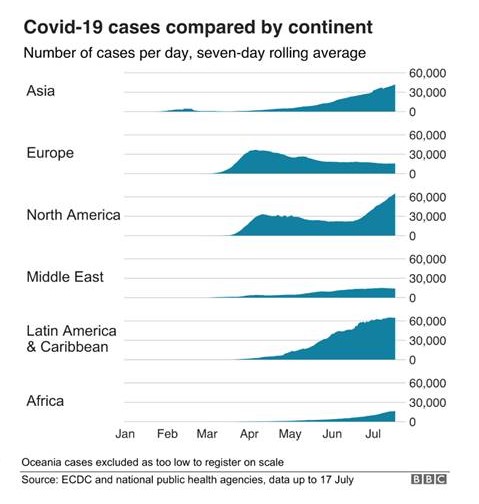

- Confirmed COVID-19 cases have surpassed 15 million globally, while the number of active cases is around 6.1 million. The biggest increases are in the US, Brazil, India and South Africa

- In the last week localised outbreaks have been seen in parts of the UK (Worcester & North Lanarkshire), in France (Marseille and Nice), Spain (Catalonia), Hong Kong, India, Tokyo, Australia (Melbourne), Iran and Israel. In the US, the surge in cases is no longer confined to southern states with Montana and North Dakota seeing some of the largest increases over the last two weeks. California has now overtaken New York as the US State with the largest number of cases.

- Some good news came in the form of a report by UBS, its analysts believe that we have now learned enough about the virus that policymakers are unlikely to re-impose national lockdowns to control the spread of COVID-19.

- Greece has proposed a flat income tax rate of 7% for foreign retirees who transfer their tax residence to Greece. The incentive would be applicable for a decade, but applicants must register by 30 September 2020. The 7% flat rate will apply to all income – rent, dividends and pensions. Candidates will have to come from one of the 57 countries that has a double taxation treaty with Athens and agree to live in Greece for more than six months every year.

- Aside from Barbados’s proposed 12-month welcome visa that we highlighted last week, the World Economic Forum has shared a list of locations that are offering incentives to those willing to relocate, the list covers the US, Japan and Italy.

Europe

In the UK, despite a fall in development land values in the second quarter, there are signs that housebuilding is picking up. Average residential development land prices in prime central London fell 6%, the first quarterly decline since Q1 2019. However, if supply levels remain at or near current low levels there is the potential for a sharp rebound.

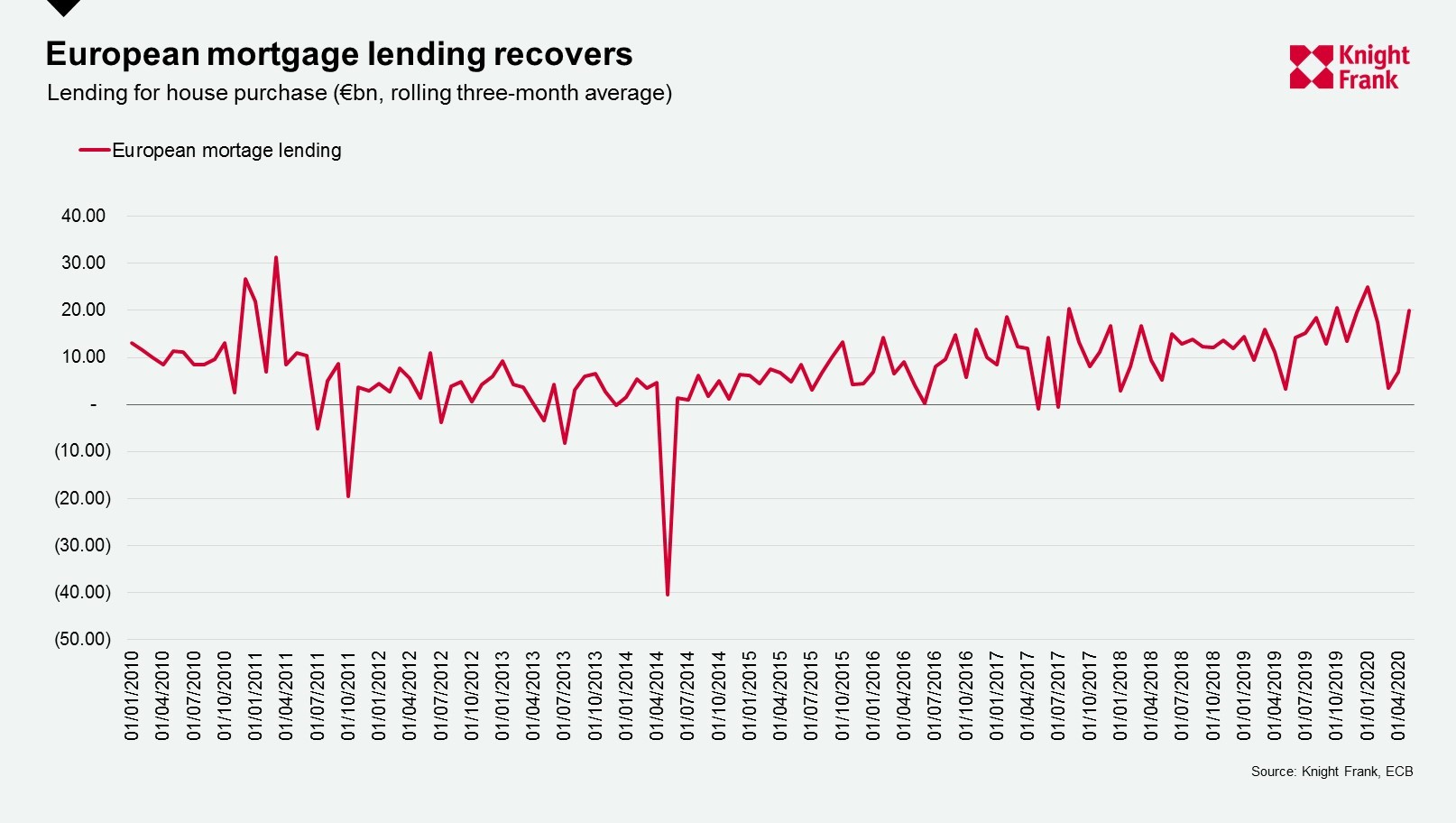

According to the Financial Times, Europe’s housing markets are showing signs of life, mortgage lending recovered in May after falling sharply in March and April and a survey by the European Central Bank shows most banks believe mortgage demand will recover in Q3 2020.

Asia Pacific

Property markets in Asia-Pacific are gradually seeing the return of cross-border viewings and sales as travel restrictions are eased. Mengjie Shi has this summary of the current travel rules between key markets and outlines new ‘travel fast lanes’ between China and Singapore as well as China and South Korea.

With Asian economies starting to recover, Justin Eng highlights the extent to which companies have had to rely on cheap credit, to mitigate cashflow concerns and keep operations running. Globally, companies have sold a record US$2.1 trillion worth of corporate bonds across varying grades as at July 15th, 2020. As Justin points out, many companies are relying on an upcoming surge in consumer demand, but for some that may be a risky business strategy.

In Singapore, our latest Residential Market report confirms that the price of non-landed private residential properties decreased by only 0.6% quarter-on-quarter in Q2 2020. Despite the restrictions on physical viewings, there were 2,253 non-landed private home sales in the three-month period. Of the 2,253 transactions, 71% were new homes.

The new India Real Estate Report takes the pulse of the residential and office sectors across the country and confirms that residential sales in the major eight cities fell by 54% year-on-year in the first half of 2020 to a decade low of 59,538 units. New launches also fell sharply by 46% to 60,489 units. The pricing environment has weakened with developers offering a price discount or some form of a financial benefit scheme to prospective homebuyers.

In Australia, the government has announced plans to extend its JobKeeper and JobSeeker programmes by six months to the end of March 2021, which may help reduce the number of distressed sales, although both payments will be reduced.

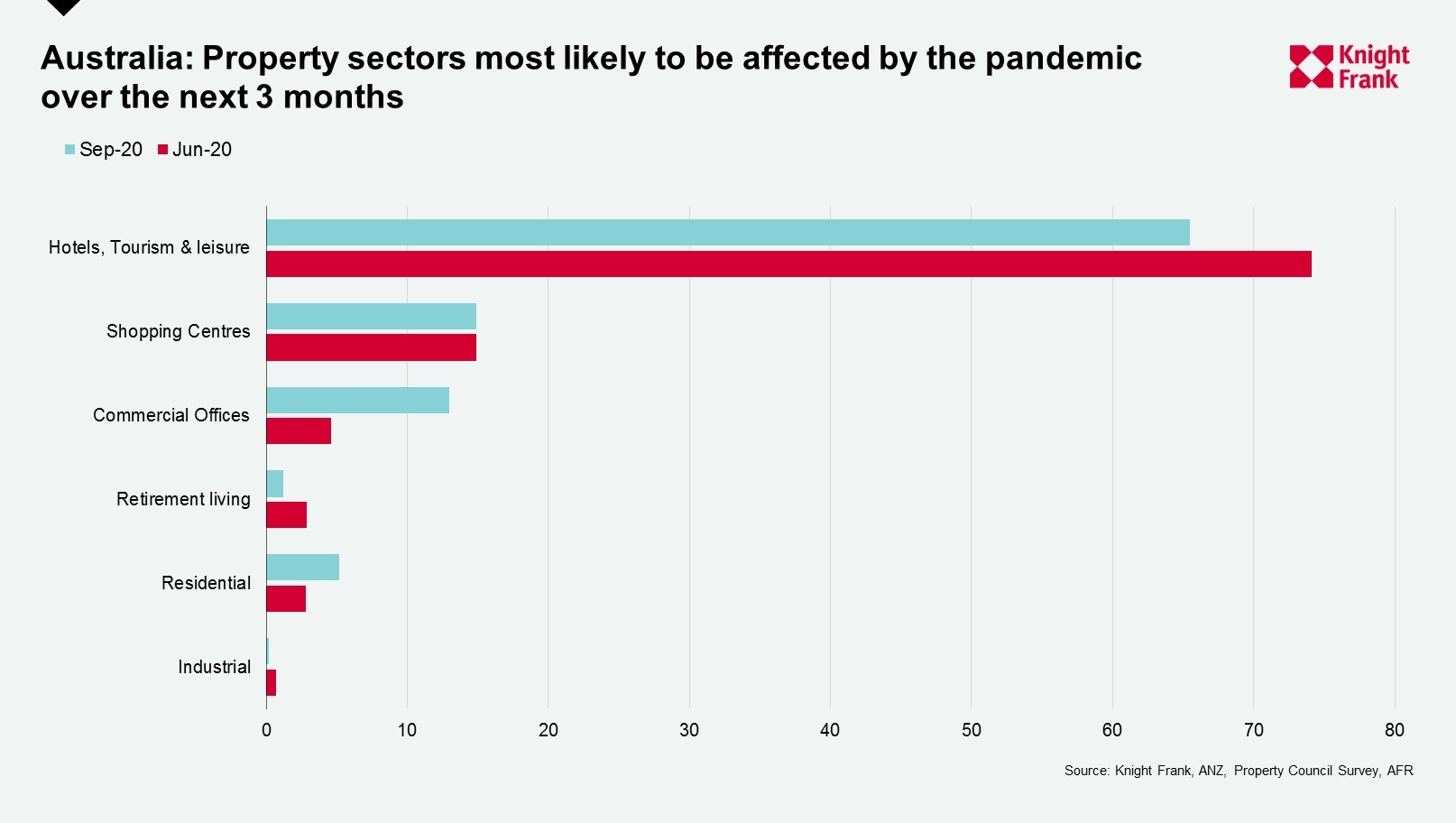

The latest ANZ/Property Council Survey shows a lift in sentiment overall from March’s record low, with the residential sector expected to be one of the less impacted sectors.

US, the Caribbean and Canada

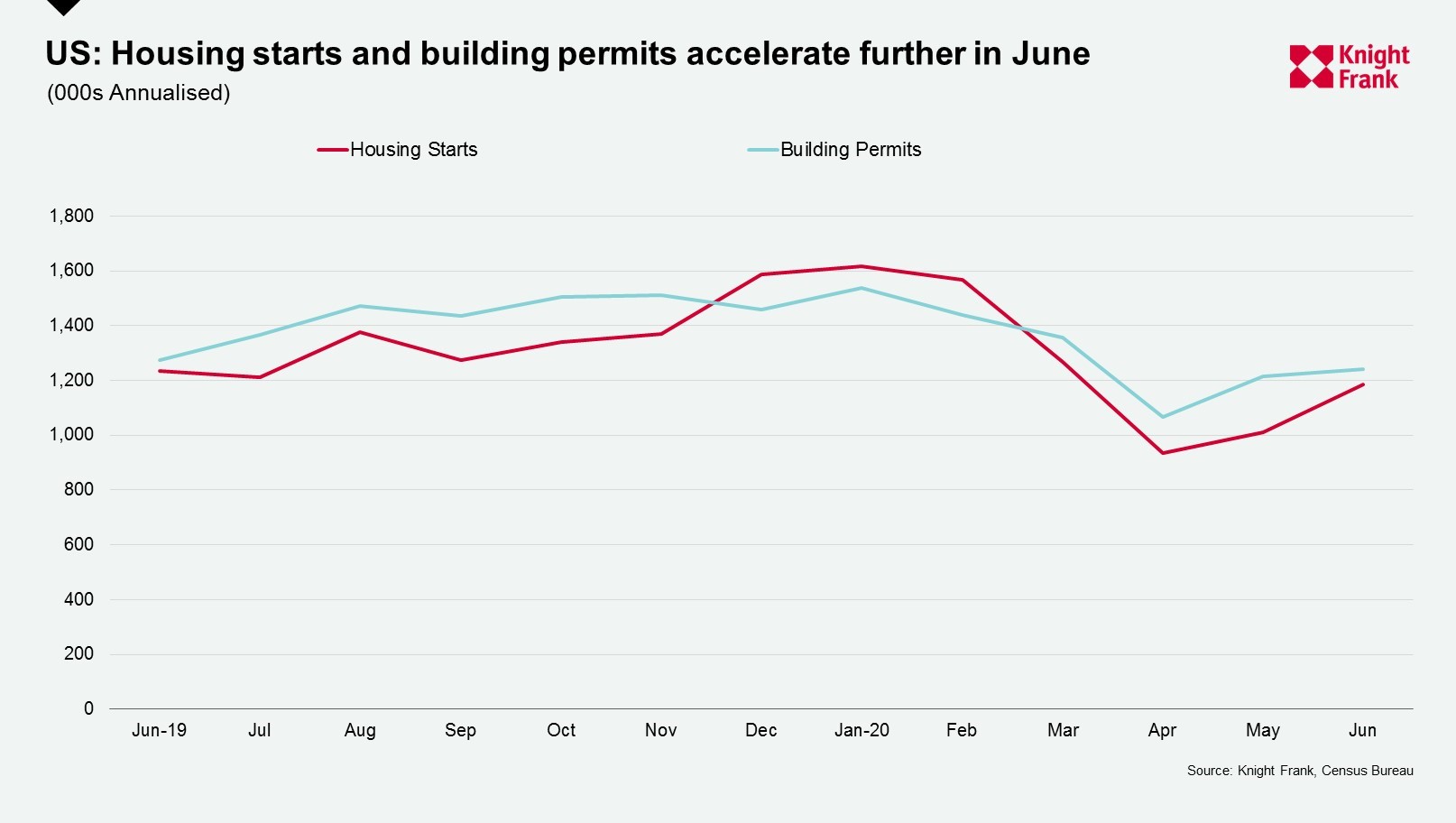

In the US, the construction industry is findings its feet with housing starts improving in June, they now sit only 4% lower than in June 2019. New homes sales are outpacing existing home sales, which are suffering from a lack of inventory, but rising timber prices and new lockdowns suggest new sales are unlikely to return to pre-virus levels by the end of the year according to Capital Economics.

In Canada, mainstream prices increased 0.7% in June month-on-month, the lowest performance for the month of June in 17 years. Halifax (2.7%) was the strongest-performing market with Edmonton (-0.7%) the weakest.

In Vancouver, sales are rising and the average price of homes sold is increasing as buyers target larger, higher value properties in areas such as North Vancouver, Richmond, Port Coquitlam, Ladner and Tsawwassen. By mid-July 1,404 sales had transacted across Greater Vancouver, up from 1,064 at the same point in June.

Russia & CIS

In Moscow, prime sales declined by a third in Q1 2020 compared to Q1 2019, with districts such as

Presnensky and Ramenki accounting for the most sales. Average prices are up 7% since the start of 2020, reaching 864,000 rubles per sq m.

This week’s recommended listening

In our Intelligence Talks global podcast this week, Anna Ward takes a closer look at family offices and private investors to understand how they’re responding in the wake of the Covid-19 outbreak. Anna chats to Rory Penn, Sarah May-Brown, Flora Harley and Anthony Duggan on the markets that high net worth individuals are targeting. Listen on Apple, Spotify or Acast