Leading Indicators | Recession | CRE Lending | Total Return Forecasts

Leading Indicators | Recession | CRE Lending | Total Return Forecasts

2 minutes to read

Here we look at the leading indicators commodities, trade, equities and more. in the world of economics. Download the dashboard for in-depth analysis into commodities, trade, equities and more.

Will the UK avoid a recession?

Positive PMIs point to growth for the UK construction and services sectors. Indeed, the UK construction PMI increased to 54.6 in February, its strongest level since June and better than market forecasts of 49.1, which had implied a contraction. Meanwhile, the UK services PMI increased to 53.5 in February, its strongest level in eight months. Both PMIs are therefore firmly indicating that the economy continues to grow. These recent business sector results, combined with an improved consumer outlook, mean that economic forecasters are beginning to raise GDP forecasts for the UK. Some now expect it to avoid a recession this year. This has been reflected in stronger property performance forecasts, as discussed below.

Lending to commercial real estate remains positive, but is moderating

Net lending to commercial real estate reached £148m in January, higher than the £80m lent in December, according to the Bank of England. Despite this, lending to standing property fell to its lowest level since August at £246m in January. On a three-month rolling average basis, net lending fell for the second successive month, indicating that some momentum may have been lost. Generally, lenders remain well capitalised - funding remains available, albeit at a higher cost, given that swap rates remain elevated. Higher debt costs may lead to opportunities for equity injection or partnering as well as assets being bought to the market for sale, should the investors choose not to refinance.

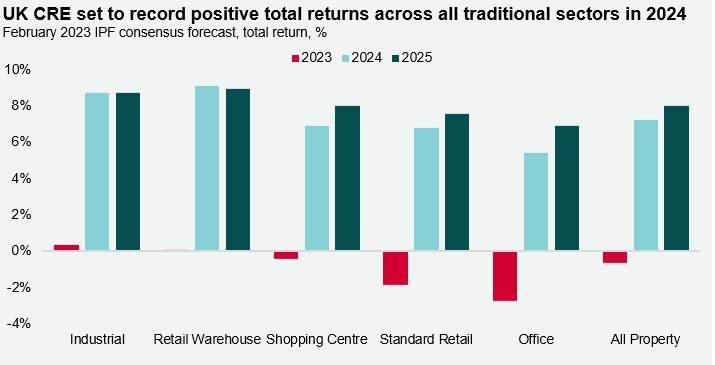

Improved UK total return outlook

The latest IPF Consensus forecast outlined improved commercial property forecasts in 2023 and 2024, in line with wider improvements to the UK economic outlook. All UK Property total return projections for 2023 increased by 175bps to -0.6% in February, with total return forecasts revised higher across all sectors. This was driven by an uplift to the capital value outlook. All Property capital values are expected to decline by -5.5% this year, compared to a -7.7% decline last forecast in November. Despite a more positive outlook for 2023, Industrial is the only sector expected to deliver a positive total return at 0.4%. Between 2023-2027, both Industrial and Retail Warehouses are expected to outperform with a total return of 6.5% per annum, followed by Shopping Centres (5.7% p.a), Standard Retail (5.0%) and Offices (4.4%).

Download the latest dashboard here