Foreign buyer bans, key elections and where to find growth in a slowing economy

Your international property and economics update tracking, analysing and forecasting trends from around the world.

4 minutes to read

Residential sales

All three of Knight Frank’s global residential indices are rising at their fastest rate for at least a decade. The city edition, the Global Residential Cities Index, which tracks average prices across 150 cities worldwide, is accelerating faster than at any point in the past 18 years.

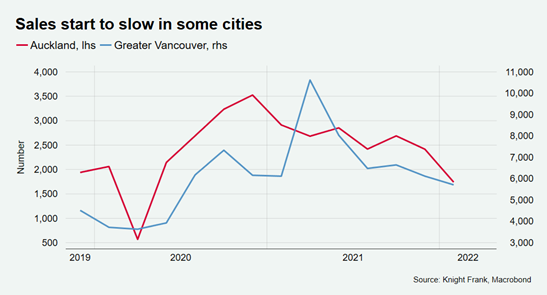

In most markets demand is unwavering, although a handful of cities, Auckland and Vancouver amongst them, are seeing sales volumes decline, in part due to interest rate hikes or new regulations.

We expect more cities to join this group. With mortgages rates going up, the cost of living escalating and geopolitical uncertainty reaching new heights, more cities will start to see sales weaken. However, in most markets we expect price growth to moderate rather than go into reverse.

In normal times, cooling demand would be potential good news for buyers as it allows inventory levels to normalise. It’s early days yet but the supply-side shock still doesn’t seem to be easing as my colleague Tom Bill summarises in his latest analysis of the London market.

Elections

In the French Presidential elections, it's a Macron-Le Pen encounter (again) on 24th April. Two polls this week indicate that Macron is likely to beat le Pen, but only just.

Less than a month later, on 21st May, Australians go to the polls. The incumbent Scott Morrison's centre-right Liberal National coalition are seeking a fourth term in office, but pundits put the opposition Labor Party ahead in the polls.

As candidates hit the campaign trail, the cost of living - and housing’s contribution to it - is inevitably a key part of their manifestos.

Macron pledges to reform housing benefit, increase social housing and remove the taxe d’habitacion (similar to the UK’s Council Tax). Both candidates plan to reform inheritance tax with Le Pen proposing to remove the levy for homes up to €300,000.

A Macron win in France will boost the euro and act as a steadying influence for the European Union (EU) at a challenging time. In contrast, Le Pen is sceptical of the EU and would, reportedly, withdraw from NATO’s command structure.

In Australia, neither party has set out radical changes to their housing policy. Unlike the elections in 2016 and 2019 when property took centre stage, there is more certainty this time round with capital gains tax and negative gearing off the agenda.

Affordability concerns are arguably more pressing in Australia where average prices are up 28% since the start of the pandemic, compared to 14% in France over the same period.

Neither country is likely to see the traditional tapering off of sales in the run up to the election, given the hiatus of the pandemic and the reopening of borders.

Restrictions & cooling measures

Governments around the world have wealthy buyers, particularly foreigners, in their sights.

As we discussed in The Wealth Report 2022, one of the surprises of 2021 was how few governments took significant action to curb house price inflation. I can count them on one hand – Singapore and Seoul.

Fast forward a year and the issue is rising to the top of political agendas.

Last week saw the long awaited announcement that Canada plans to ban foreign buyers for two years.

Governments will no doubt be paying close attention to the ban’s impact and the extent to which it eases what many deem to be essentially a supply-side issue.

The EU is also flexing its muscles, although to what end remains to be seen.

It has ‘urged’ member states to immediately repeal any existing investor citizenship schemes. The EU has long wanted to eradicate both citizenship and residency initiatives, Russia’s invasion of Ukraine has strengthened their argument.

“European values are not for sale” according to Didier Reynolds, the EU’s Commissioner for Justice and Consumers.

From higher taxes to the clampdown on investor visas and potentially more foreign buyer restrictions, we’ll be tracking 2022’s expected flurry of announcements on The Intelligence Lab.

Investors

For investors operating in a high inflation environment, when growth becomes harder to achieve as costs go up and economic growth dwindles, where should they look?

The age-old adage that property is a good inflation hedge is largely a hangover from the 70s. Do prices and rents always move in line with inflation? No, not really. Although, arguably, residential rents have a closer correlation historically than commercial ones - a subject under discussion on a recent Macrobond Financial webinar I took part in.

But there are sectors that offer defensive characteristics. Namely, those that offer shorter leases and a frequent turnover of tenants enabling rents to keep pace with inflation such as build-to-rent and healthcare.

From a residential perspective, it’s also worth considering markets witnessing the delivery of large-scale infrastructure projects, new tax or visa incentives, those with a burgeoning tech sector or seeing significant demographic shifts. Read the Home hotspots article in The Wealth Report 2022 for our handpicked selection of 34 markets we expect to outperform over the next five years.

In other news

The UK Government rolls out the red carpet for crypto (Financial Times), London house prices rise at their fastest rate since 2016 (Financial Times) and in Asian cities the switch from a seller’s market brings opportunities (Bloomberg).