Aspirations of Saudi citizens shifting market dynamics

Survey shows disparity between ambition and reality from how homeowners plan to finance their residential purchases and how they intend to use their new homes.

2 minutes to read

Knight Frank’s 2022 Saudi Arabia Real Estate Market Survey found (48%) have a budget of between SAR 750,000 and SAR 2.2 million (US$ 200,000 – 600,000) for their first home purchase. In a surprising contrast, the new build property types that have been identified as the most highly sought-after by this group are villas (30.2%), followed by three and four-bedroom apartments at 24% and 18.1%, respectively.

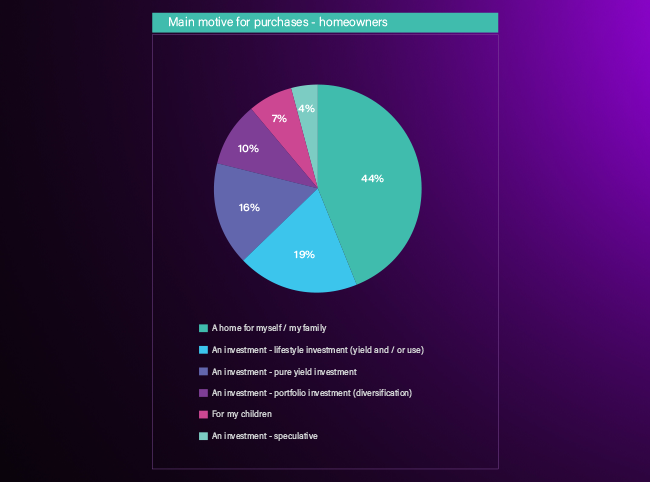

“44% of homeowners want to buy a second home”

Ambition and reality creating interesting market dynamic

Over a third (35%) of tenants nationwide said their budgets were representative of their total expected spend, rather than being representative of just a down payment. Average two-bedroom apartments in Riyadh, of a good quality, sell for over SAR 750,000, while three or four-bedroom villas usually sell for in excess of SAR 2.3 million, highlighting the discrepancy between tenants’ ambitions and market realities.

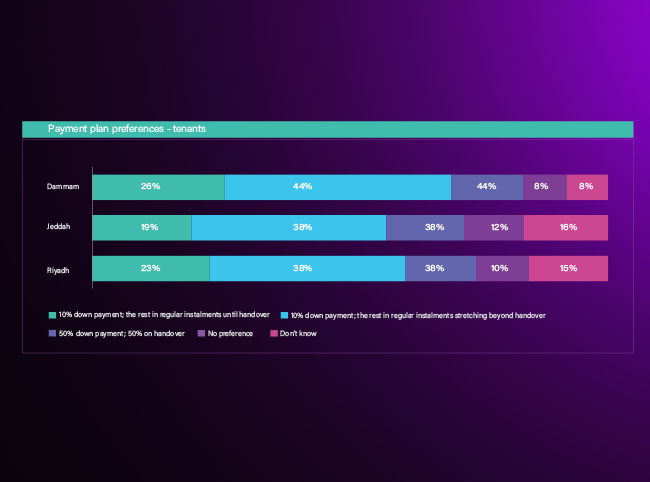

The survey shows 51% of tenants are also looking for developers to offer financing options, with this view echoed across the country.

Further evidence of the financial reality for would-be first time buyers is also reflected in the fact that 39% expect to be offered payment plans that stretch beyond handover. This reality is even more prevalent amongst millennials (those aged between 18-35), with 63% of tenants in this cohort looking for post-handover payment plans.

Second home buyers’ appetite

For homeowners looking to snap-up another home, 49% say the main motive will be for investment purposes, with yields topping the list of specific investment considerations. A further 44% say it will be for themselves and their families, hinting for the first time at the substantive size of the Kingdom’s second homes market.

This group also had a higher share of those whose budgets would be representative of their equity contributions (46%), suggesting that not only is there a growing appetite for second homes, but that there is growing demand for luxury second homes in the Kingdom.