When will housing delivery in England recover to pre-pandemic levels?

Housing delivery in England & Wales took a sharp hit in 2020 due to the onset of the pandemic. But what can we glean from last year’s figures?

3 minutes to read

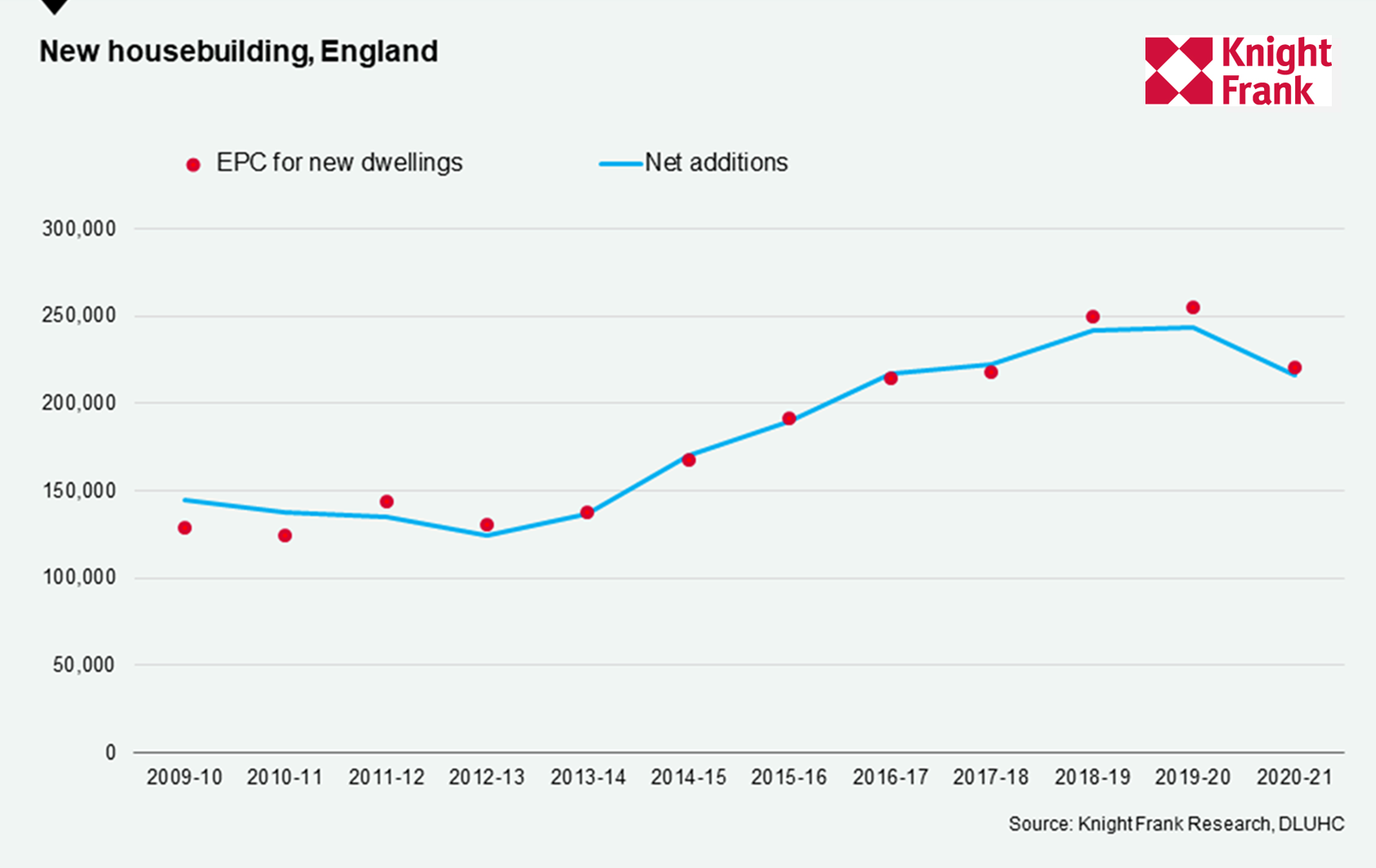

So far, we know that net additions in 2020/21 fell on year by 11% to 216,489, the lowest level on record since 2015/16 after six consecutive years growth.

Measuring EPCs

To get a picture of housing output levels during the current financial year, we have analysed new data capturing energy performance certificates (EPCs) granted to new homes. Historically, EPC records have proven to be a good forward indicator of supply, as the below chart shows.

In 2020/21 there were 220,726 EPCs recorded, broadly on par with the net additions total for that year of 216,489. Pre-pandemic, net additions stood at over 240,000 for the previous two years, matched closely by the number of EPC registrations.

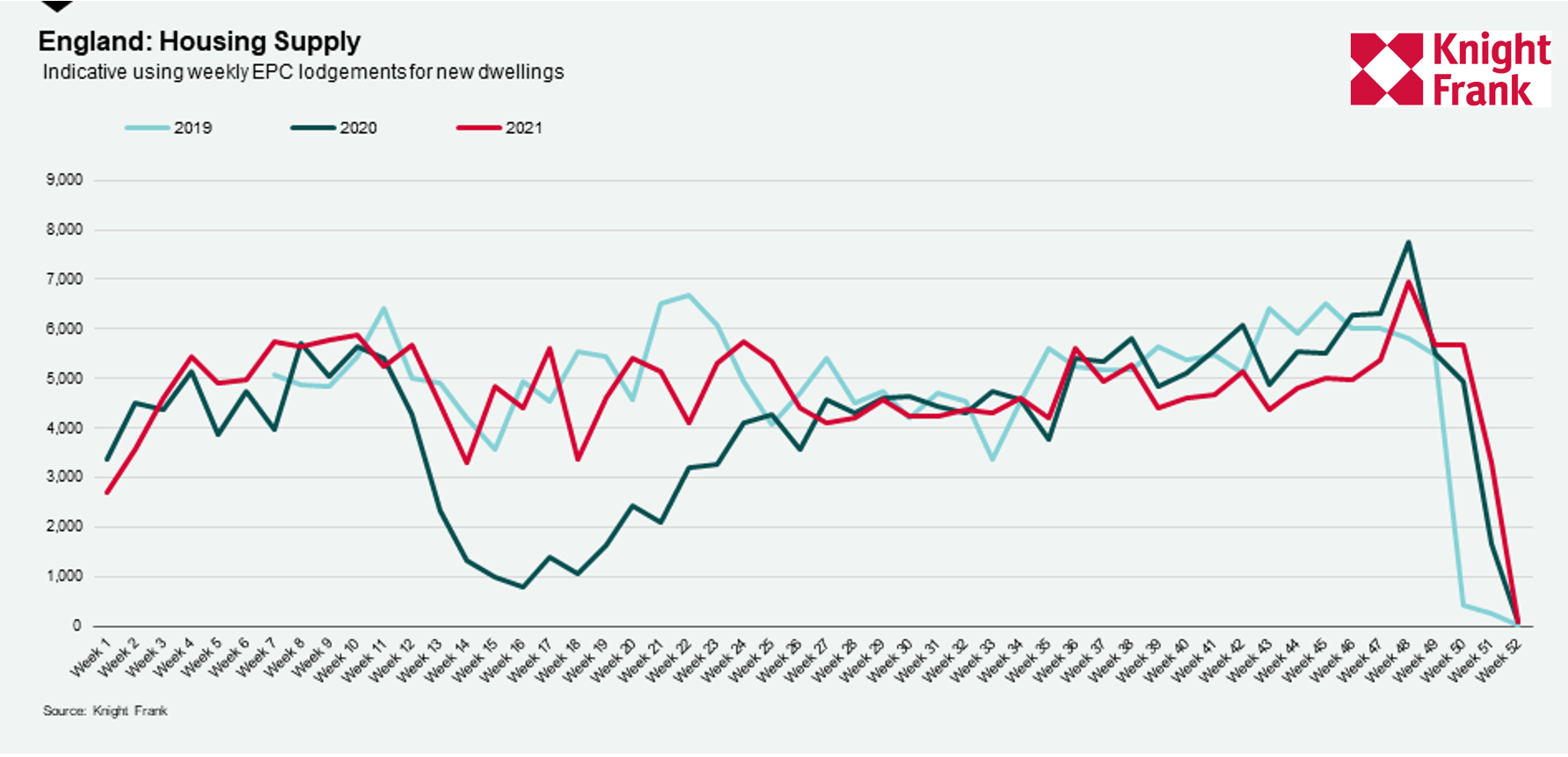

Since then, looking at the start of the 2021/22 financial year, EPC records in Q2 2021 at 59,625 were more than double that of Q2 2020 when the housing market was effectively shut down. In Q3 2021, supply chain troubles impacted the market and overall output was a little lower than in 2020, evident from the slight dip in output towards the end of last year in this graph below.

Residential development survey

Overall, over half of respondents to our latest fourth quarter survey of over 50 volume and SME housebuilders across England said supply chain issues and rising material costs were the number one factor adding pressure to their bottom line.

But with the effects of omicron currently waning and demand for housing still high, how far away are we from returning to pre-pandemic levels of delivery?

In total, we have seen just over 195,000 new EPCs granted to new homes since the start of the 2021/22 financial year up until the end of January, so the pace of delivery for the rest of the first quarter will be interesting to watch.

Our data shows the number of new prospective buyers in the UK in the final two months of 2021 was 63% higher than the average between 2015 and 2019, which is encouraging for developers of new homes.

Supply challenges

But what about returning to pre-pandemic delivery levels of over 240,000 homes? Despite the relatively resilient rates of housing delivery throughout the pandemic, the housebuilding sector continues to face numerous challenges on the supply side.

Notably, this includes the ending of key government support for the housing market. The stamp duty holiday, which began June 2020, was already brought to a close in September 2021 after being phased out over the summer. Housebuilders will also be preparing for the end of Help to Buy in March 2023, which was originally introduced in 2013 to encourage buyers to purchase new build homes.

Furthermore, we have seen a sharp increase in build costs due to supply chain issues, while housebuilders also face extra costs relating to fire safety and net zero regulation, uncertainty over planning reform and further interest rate increases.

So, while recent housing output rates appear healthy for now, the next couple of months will be a key test for the market as it enters a more challenging period.