The shift in private wealth’s preference for property types

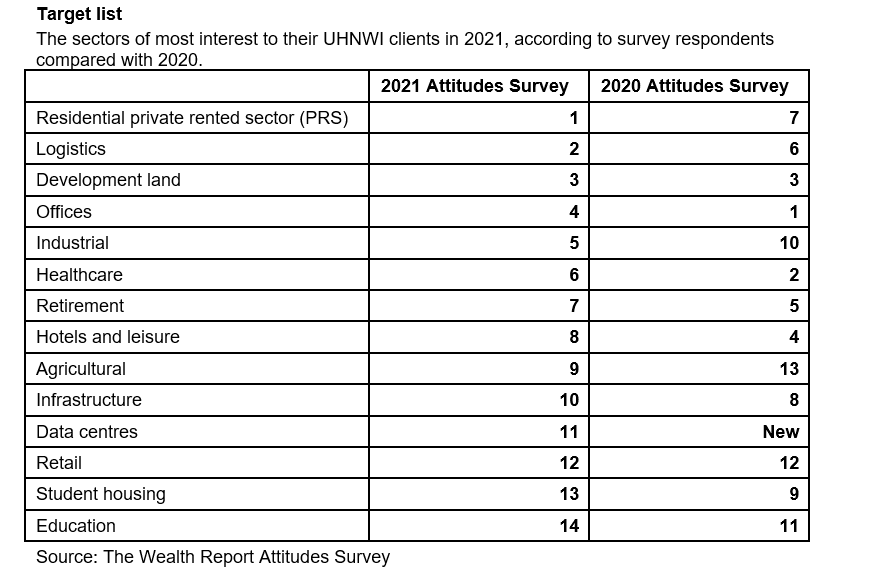

Our Attitudes Survey reveals that the property sectors in the eyeline of UHNWIs have shifted in the past year with the private rented sector (PRS) and logistics rising to the top, while offices have dropped in favour. We speak to some of our experts to offer insight on these trends.

3 minutes to read

PRS has taken the top spot from offices on the shopping list of UHWNI real estate investors, according to our Attitudes Survey. Already forming the largest part of UHNWI commercial property portfolios - on average 23% - the sector is now also the most in demand.

In 2020, 38% of the US$232 billion of private capital that was invested into global real estate targeted ‘apartments’ with 26% buying up offices, the same pattern as seen in previous years, according to data from RCA. However, as we highlight below, what 2021 has in store seems to be a change in preference.

Oliver Knight, Head of Residential Development Research explains why PRS has an ever-growing appeal for UHNWIs.

“Part of the appeal is the non-cyclical nature of the rental sector during times of economic stress. The sector is generally more insulated from external forces compared to other commercial investment assets - making it increasingly sought-after in periods of economic downturn.

“Assets are viewed by investors as offering a secure income stream with good medium-term growth prospects. In the UK, our monthly income survey suggests rent collection rates have averaged 96% since March 2020, notably higher than other property sectors during the pandemic. Additionally, demand for rental property tends to rise in periods of economic uncertainty, as people feel less secure about their future finances and mortgage lending for house buyers becomes stricter.”

Second highest on the agenda for private investors is logistics, up from sixth in The Wealth Report 2020, with industrial in fifth place, up from tenth last year. Claire Williams, of our Commercial Research team, shares her thoughts on why.

“Appetite for logistics and industrial property remains strong amongst investors, particularly those seeking secure long incomes. The sector has recorded a strong performance in recent years, with returns outpacing those on offer across other sectors and asset classes.

“The structural shift towards online retail and favourable occupier market dynamics have delivered rising rental incomes for landlords and are encouraging investment into the sector. Large-scale institutional investors are increasing their exposure and adjusting their allocation strategies in favour of logistics, which is driving competition for assets as well as price growth.

“The lack of stock means investors need to look harder at opportunities. Optimising assets to suit occupiers' needs, or selecting locations benefiting from strong population growth or new transport infrastructure, could offer scope to add value and drive rental growth.”

Offices, having fallen slightly out of favour going from top to fourth, Victoria Ormond, a partner in our Capital Markets Research team, spoke about how the sector is faring in face of the pandemic. Faisal Durani, who heads our London Commercial Research team, also highlighted that there is the opportunity to look differently at offices and add value to ‘older offices’.

New this year is data centres reflecting the changing world. With working from home having become the default over the past 12 months and the gather pace of e-commerce globally the need for data centres is growing rapidly. Darren Mansfield, Partner in our Commercial Research team offers insight into the sector.

“Even before Covid-19, the unrelenting incursion of technology into every aspect of daily life was serving to elevate data centres as a subject of investor interest. The investment market is immature, with activity historically dominated by private equity or specialist REITS.

“The market is evolving and becoming increasingly competitive though, with sovereign wealth funds, institutional investors and infrastructure funds more active. M&A remained robust in 2020 setting a new record of US$34.9 billion globally, eclipsing the previous 2017 record of US$24.8 billion.

“Looking ahead, the societal shift to online services accelerated by the pandemic will mean demand for data, connectivity and digital products and services remain on a steep upward trajectory. The buildings and infrastructure that enable these therefore, will grow in appeal to a widening investor community.”