Currencies and shifting buyer power

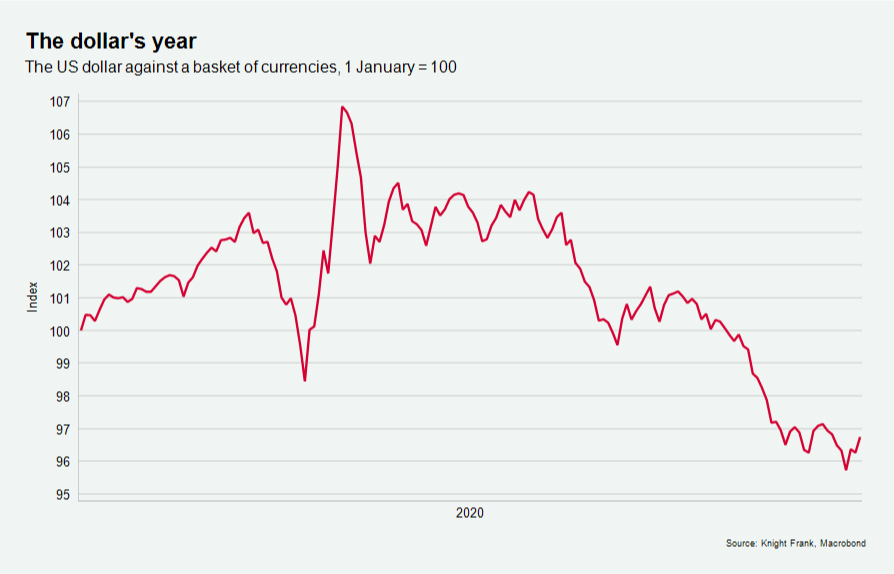

The US dollar had been riding a wave of uncertainty and at its peak in April was up 8% compared to the start of the year against a basket of currencies, but with the recent weakening form and ongoing economic woes, the advantages and potential buying power looks to be short lived.

2 minutes to read

Takeaways

- US dollar denominated and pegged currency buyers have significant advantages due to the dollar’s strength

- The limited window of opportunity for these discounts has been narrowing with the dollar losing steam in recent weeks

- Hedging benefits can have more of an impact than simple appreciation and depreciation

The buying advantages varied across markets. The 8% against a basket ranged from 13% against the British Pound to 4.5% against the Euro. US dollar denominated investors, or those with currencies pegged to the dollar, saw a significant increase in their buying power. That applies to other currencies that have outperformed, such as the Swiss Franc. As an example, due to currency movement and price declines US dollar buyer would benefit from 40% reduction in prime central London since the peak in 2015.

However, with relative interest rates in the US falling, and the ongoing rising case numbers, we have already started to see the dollar lose steam. The dollar is now down around 10% from its peak, and 3% down on its 2020 opening, against the same basket of currencies. Further weakening would see the window of opportunity narrow further, UBS found that 44% of global investment leaders from the fund management industry expect the dollar to weaken.

Currency movements not only increase or decrease relative buying power they also provide opportunities to diversify income to allow for hedging. Hedging benefits for US dollar-denominated investors into the UK and the eurozone have been around 1.09% per annum on a five-year basis. Two years ago, this was around 1.5% - depending on the investor, hedging benefits can have more of an impact than simple appreciation and depreciation.

Jason Mansfield, who looks after residential sales in the US for Knight Frank, notes that “for a number of years we have seen US buyers targeting the London market given the significant discounts they could achieve based on the strength of the US Dollar against Sterling. However, the pandemic led to a wave of action as Sterling hit a 35-year low in March. For example, a large American private equity investment firm contacted us to say that they wanted to diversify their real estate investment portfolio and expand into the UK while the Dollar was exceptionally strong.

However, the tide is beginning to turn given the recent weakening of the Dollar. The pandemic has encouraged people to reassess where they live, so I am now starting to see an uptick for those looking towards the US. This is particularly strong among buyers who may have family there who think now is the time to act.”

Main photo by Ethan McArthur on Unsplash