Sustainability Series: EVs: The Everywhere Vehicle?

Identifying opportunities and nuances within the electric vehicle changing market for real estate owners

3 minutes to read

You can find the full report here, but for the quick take and a guide of where to find the information in the report see below.

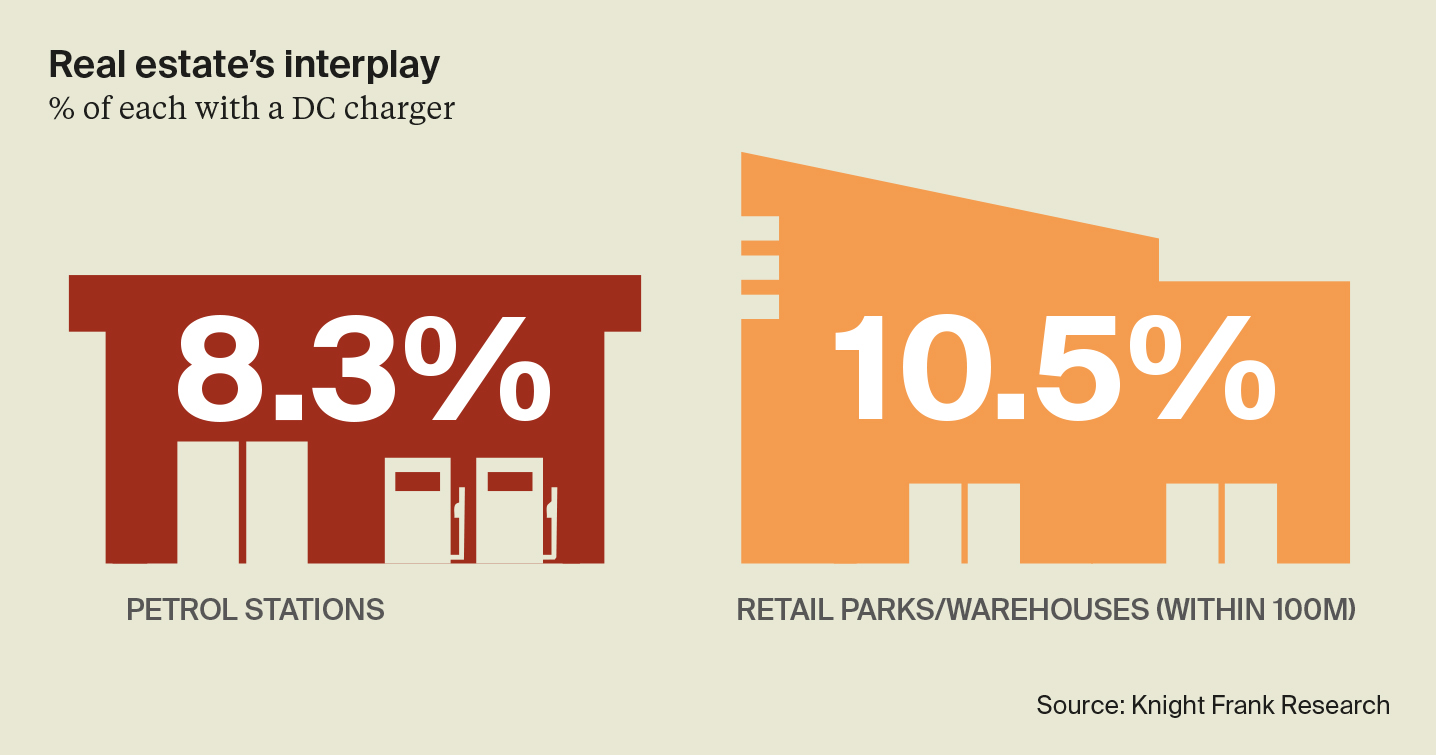

Electric vehicle (EV) adoption is on the rise, driven by the renewed Labour manifesto pledge of a 2030 phase-out of internal combustion engine sales. Charging infrastructure, particularly rapid and ultra-rapid charging points, will be critical to enabling this transition, and asset owners are likely to be well-positioned to capitalise on opportunities within this space

10x growth in EV ownership

In the last five years, UK private EV ownership has surged over tenfold, with more than 1.6 million EVs now on UK roads, including 766,000 privately owned (see page 3). EVs make up just 2.5% of private cars owned, but this share will grow as internal combustion engines are phased out from 2030, with hybrids potentially allowable until 2035. Page 4 dives deeper into the market potential and the role of property owners in expanding public charging options.

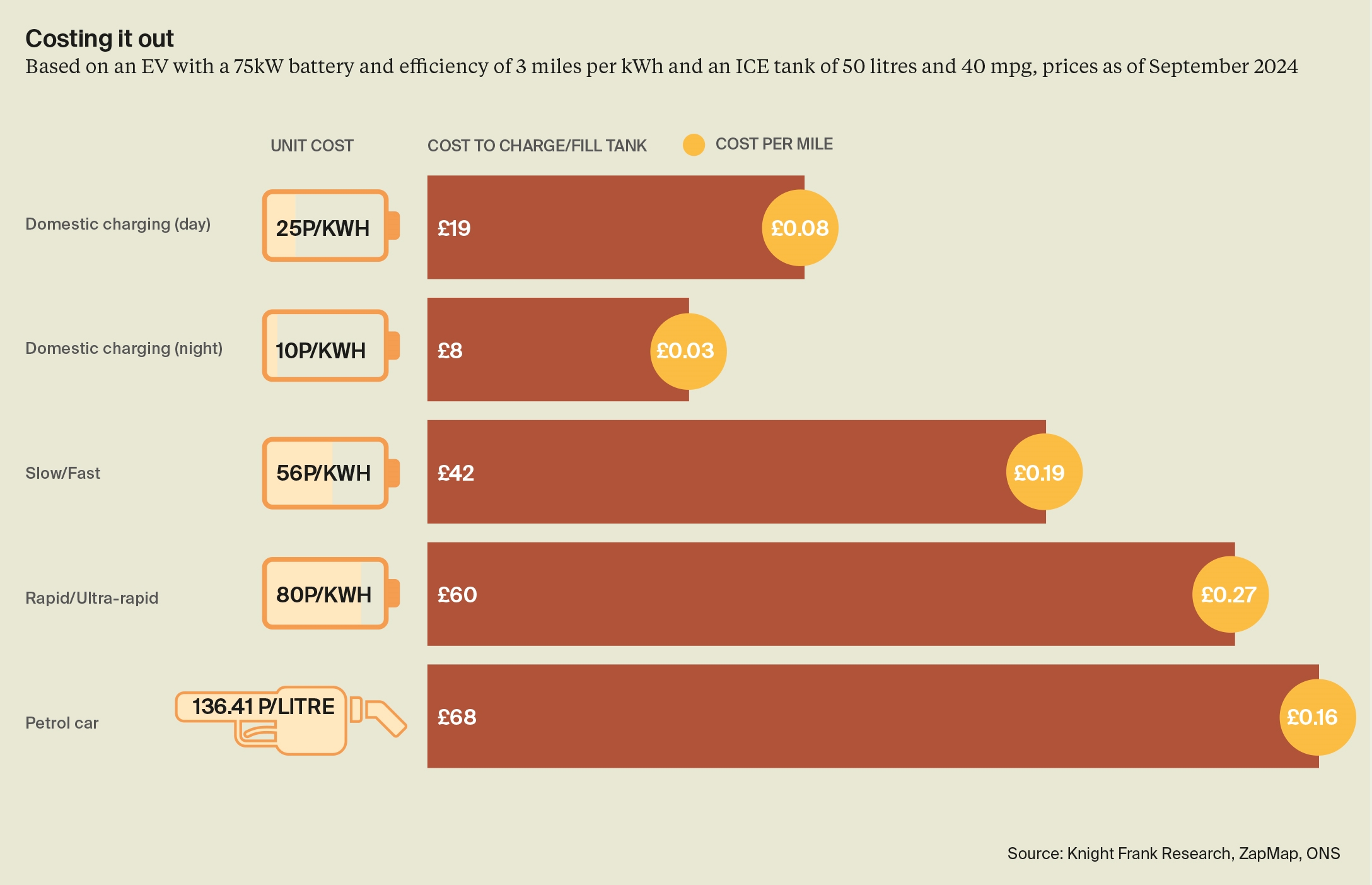

17% rapid charging coverage

A considerable gap remains in the availability of rapid and ultra-rapid direct current chargers (or DC chargers), which represent just 17% of the UK’s 62,500 public chargers. Key barriers to broader EV adoption include cost, limited infrastructure, range concerns, and long charging times. The previous government had a stated aim to increase motorway rapid chargers to 6,000 by 2035, up from just under 800 DC chargers in early 2024 (see page 4). See page 6 for a breakdown of types and costs to consumers, highlighting how property owners can help close the gap.

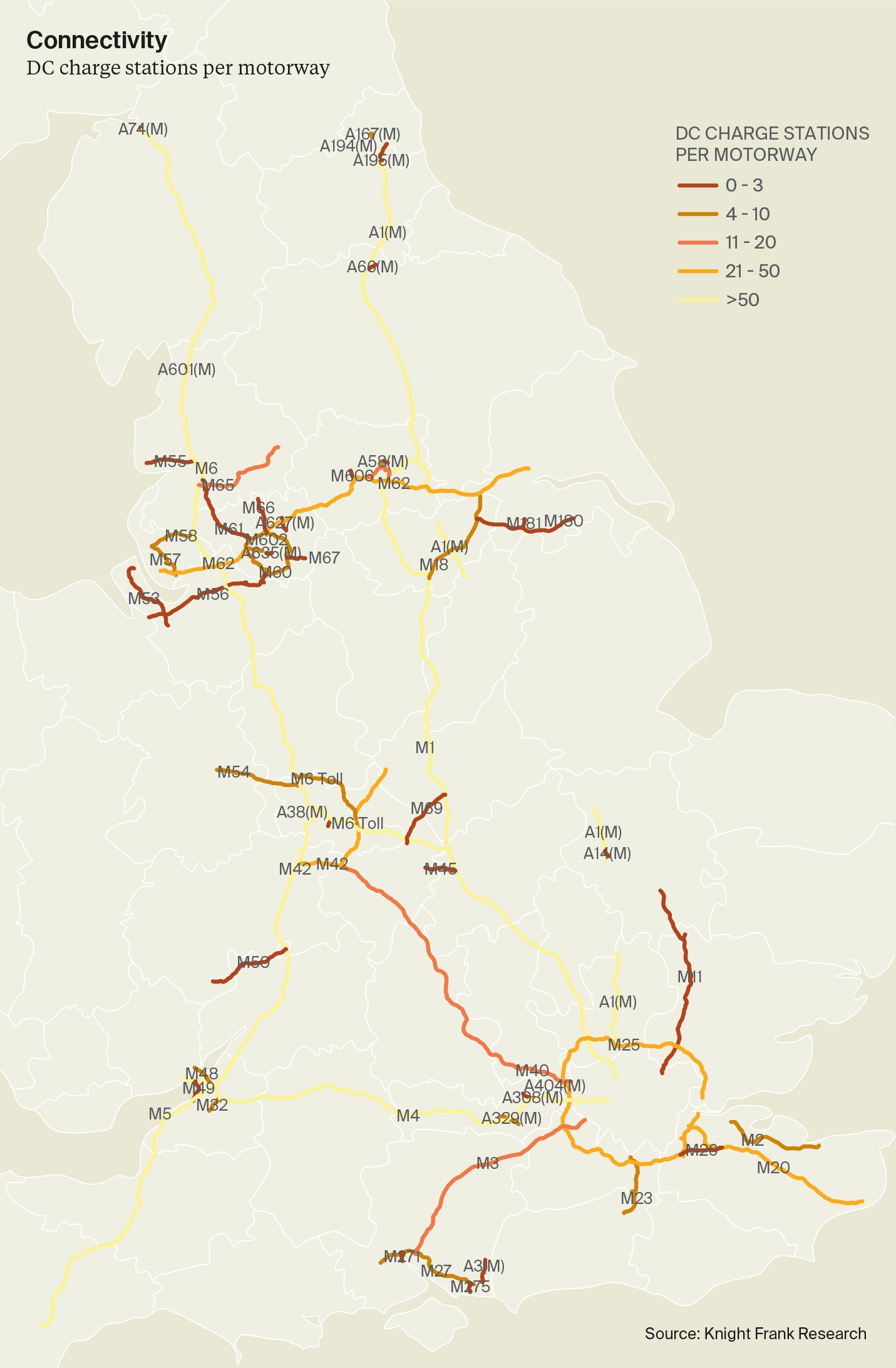

30% of key roads lack DC charges

High-traffic areas like motorways and trunk roads offer prime opportunities for property owners to meet the demand for rapid charging. Among the top 1% of the UK’s busiest areas (cars and taxis), 60% lack DC chargers within five minutes, and 10% have none within 10 minutes (see page 12). Additionally, 30% of the 572 road networks analysed have no DC chargers within 500 metres. By targeting these gaps, property owners can ease range anxiety, tap into a growing market, and support net zero goals.

£2.5k-£6k in revenue potential

Installing EV chargers provides asset owners with new revenue streams. Whether in retail centres, workplaces, or residential developments, EV charging solutions can enhance property value, attract high-value tenants, and generate consistent revenue. Charging fees alone can yield between £2,500 and £6,000 per bay per annum, though market conditions remain fluid (discussed in detail on page 11).

30TWh demand increase by 2050

Property owners need to consider grid capacity for EV charger installations. Reforms like the “first ready, first connected” policy have streamlined grid connections. With EV growth expected to add 30 terawatt-hours (TWh) by 2030 (compared to 300 TWh in 2020), page 13 offers further insights on staying competitive in the EV market.

Trafford an area for AC growth

A strategic, blended approach to charger types is essential to future-proof assets. Rapid and ultra-rapid chargers suit hightraffic zones like motorways and retail parks, while slower AC chargers are better suited to residential areas. Our analysis on page 10 spotlights Trafford In Manchester, an area with significant potential for AC growth. A strategy combining AC and DC chargers based on traffic and EV uptake, supports grid management and maximises customer satisfaction, extending dwell times and enhancing property appeal.