The Rural Update: Greening the food chain

Your weekly dose of news, views and insight from Knight Frank on the world of farming, food and landownership

9 minutes to read

Viewpoint

Farmers reading the WWF’s new report, which looks at how the UK’s big supermarkets are delivering on their environmental pledges, might start to feel a little uneasy as they plough through the publication. Most people will probably agree with targets to help cut the destruction of tropical forests, but many will feel nervous that the pressure being applied to the likes of Tesco to cut carbon emissions from its supply chain will land heavily on farmers.

And WWF calls for supermarkets to do more to promote meat and dairy alternatives on their shelves will go down like a lead balloon. Arla’s clumsy PR around the introduction of Bovaer, a methane-reducing enzyme for dairy cows, has seen a social media boycott of its products, while research consistently shows that some plant-based alternatives can be worse for the environment and human health than farm-produced food. It’s also worth noting that England’s uplands, which could deliver many of the environmental benefits being demanded, are falling through the cracks when it comes to government support. As ever, more joined-up and strategic thinking from all parties is required.

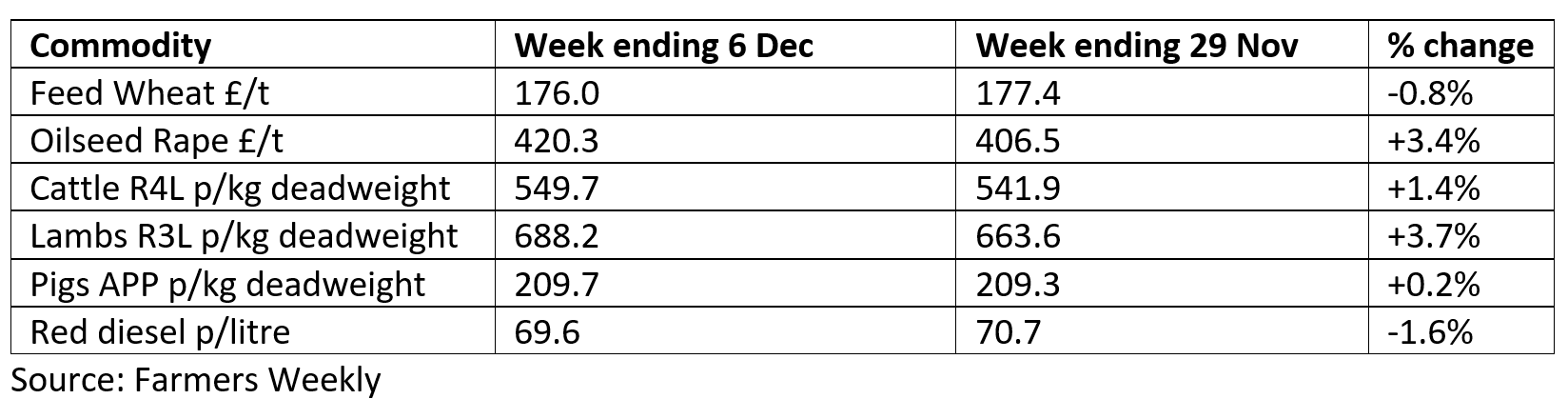

Commodity markets

Ukraine fertiliser dilemma

Fertiliser orders are lagging 15% behind their usual levels, which could have implications for farmers who leave ordering until the last minute, reports trader Frontier. Nitrogen supply is already limited but could get even tighter in the New Year when the current gas transit agreement between Ukraine and Russia ends on 1 January. It’s hard to believe, but half of Russia’s gas exports to the EU still flow through Ukraine with the fees paid accounting for 0.5% of Ukraine’s GDP, according to an analysis by thinktank Bruegel. Natural gas is a key component in fertiliser production.

The headlines

Supermarkets rapped

The UK’s biggest food retailers are making slow progress on their environmental pledges, according to a new report from WWF. What’s in Store for the Planet 2024, which assesses the grocery market’s environmental impact, shows that retailers are lagging on goals related to deforestation, greenhouse gas emissions and food waste.

In 2021, major UK supermarkets committed to WWF’s ‘Basket’ initiative, requiring them to ensure key commodities like soy, beef, palm oil and cocoa are deforestation-free by 2025. Currently, however, only 4.5% of soy entering the UK food supply chain is verified.

The report also notes a failure to fully address emissions from supermarkets’ supply chains. Although most have net-zero targets, much of the data used is based on estimates, and emissions from farming are not being properly accounted for. This makes it unclear how much progress has been made in reducing emissions across the entire food supply chain.

Another issue, says the report, is the over-reliance on livestock protein in supermarket sales. Retailers are selling double the amount of meat and eggs recommended by WWF’s ‘Livewell diet’, which aims to reduce the environmental impact of food. Supermarkets should encourage consumers to shift towards alternative protein sources to reduce the demand for meat, “which drives environmental harm”, WWF urges.

Upland farmers losing out

A newly published report from the Energy & Climate Intelligence Unit warns that upland farming businesses and England’s green aspirations face an uncertain future under the current farm support scheme. Despite accounting for 15% of English farmland and having the potential to deliver the greatest climate and environmental benefits, upland farms receive only 8% of payments from the Sustainable Farming Incentive (SFI), which is more targeted at lowland units. Hill farmers have instead relied on the higher tier of the Countryside Stewardship Scheme, but delays to the latest iteration of this are creating huge amounts of uncertainty. For help with any grant applications, please contact Henry Clemons.

News in brief

Scotland’s eco-spending plans

The Scottish government has just released its draft 2025-26 budget, which includes £4.9 billion of “action on the climate and nature crises to lower emissions and energy bills, protect the environment, and create new jobs and opportunities”. More than £162 million is proposed to scale offshore wind supply chains, up from around £10 million in the 2024-25 budget. Elsewhere, the budget details £200 million for climate adaptation, £35.5 million for peatland restoration and £53 million for woodland creation, which the policymakers claim will support 11,000 ha of new woodland and help restore 15,000ha of degraded peatland.

Planning reform soon

The National Planning Policy Framework is due to be updated this week as part of the government’s plans to build 1.5 million houses during this parliamentary term. Deputy Prime Minister Angela Rayner has already claimed that the changes will speed up the delivery of new housing and infrastructure projects, such as prisons, by removing the ability of planning committees to veto projects that satisfy local development plans.

Oatly loses milk battle

Oatly, a Swedish oat drink brand, has just lost the right to label its products sold in the UK as milk after losing a long-running legal tussle. Last week, in a case brought by trade body Dairy UK, the UK’s Court of Appeal agreed that only traditional milk derived from animals can use the word “milk,” not plant-based alternatives like those produced by Oatly. The case is just one of many ongoing battles around the world that concern the labelling of plant-based products using terms typically associated with meat items such as sausages or burgers.

Pulses best meat alternative

Meanwhile, a new study from researchers at the University of Oxford has revealed that traditional crops such as peas and beans are the best replacements for meat and dairy in terms of nutritional value, reducing mortality rates and cost. Cultured meats scored poorly, while almond “milk” had a worse environmental footprint than real milk. The research also noted that many plant-based food products, while scoring well based on its three criteria, would be considered ultra-processed, which might reduce their benefits.

CLA conference AI catch-up

If you missed the CLA’s recent Rural Business Conference, sponsored by Knight Frank, this 20-minute AI-generated discussion contains a summary of the highlights, including Defra Secretary Steve Reed’s keynote speech and discussion with CLA President Victoria Vyvyan. It’s also an interesting example of the rapidly growing capabilities of AI, some of which will undoubtedly have a significant impact on the agricultural sector.

New Zealand carbon crackdown

The New Zealand government has announced it is putting in place limits on how much farmland can be converted to forestry for the purpose of “carbon farming.” Between 2017 and mid-2024, there were 260,000ha of whole-farm conversions, resulting in the loss of 2.5 million livestock units from the rural economy, says farm body Beef & Lamb New Zealand. In future, conversions on the land type most commonly used by livestock businesses (LUC6) will be limited to 15,000ha per year.

Australia signs up for natural capital

Natural capital, however, is increasingly becoming a significant factor in Australia’s rural real estate market, says Jason Oster, Head of Agribusiness, Valuations and Advisory. “There has definitely been a corporate increase in demand for assets such as low-rainfall pastoral grazing, which has the potential to sequester carbon.” Read more of Jason’s thoughts on farmland and ESG.

Bluetongue update

Following the identification of new cases in cattle, the bluetongue restricted zone was extended on 7 December to cover all or parts of the ceremonial counties and unitary authorities of Bedfordshire, Berkshire (additional part), Buckinghamshire, Cambridgeshire, City of Kingston upon Hull, City of York, East Riding of Yorkshire, East Sussex, Essex, Greater London, Hampshire (additional part), Hertfordshire, Isle of Wight, Kent, Leicestershire (part), Lincolnshire, Norfolk, North Yorkshire (part) Northamptonshire, Nottinghamshire, Oxfordshire (additional part), Suffolk, Surrey, Warwickshire (part), West Sussex and Wiltshire (part).

The Rural Report – Out now

The latest edition of The Rural Report, our flagship publication for farm and estate owners, looks at the numerous opportunities and challenges arising in the countryside following the election of the new government. Find out more or request a copy

Properties of the week

NZ livestock unit

We’re back in New Zealand this week with a scenic beef and sheep business on the country’s North Island. Punawai Station is 45km from Napier and its 557ha of easy-to-medium hill ground, with a small area of steep “sidings”, is split into 55 paddocks. There is also good red deer stalking, an airstrip and two four-bed homesteads. For more information, please contact Georgie Veale.

Australian options

Sticking in the Southern Hemisphere, Knight Frank’s team in Australia, along with its partner McGrath, has a pair of exciting agricultural and lifestyle options to choose from. Mylora is an 8,000-acre livestock and arable farm with ample water in the Binalong district of New South Wales. It comes with a rare 1850’s Bluestone homestead. In Tasmania, a slice of wild trout-fishing heaven is up for grabs. London Lakes, a 4,942-acre wilderness in the Central Highlands, includes 935-acre and 563-acre fly-fishing lakes plus luxury guest accommodation. The guide price is AU$30 million.

Property markets

Country houses Q3 – Market waits

Discretionary buyers held back from a new country house purchase pending Labour’s first budget on 30 October. Offers from potential buyers were down 10% in the three months to August, according to the latest results from the Knight Frank Prime Country House Index. However, the slide in average values has slowed with prices dropping by just 1.2% in the 12 months to the end of September - the lowest annual fall since Q1 2023 - points out Head of UK Residential Research Tom Bill. He predicts a total average price slide of 2% this year, dependent on the outcome of the Budget.

Farmland Q3 – Prices flatline

The farmland market in England and Wales was also on budget alert, judging by the latest results from the Knight Frank Farmland Index. Average values for bare land nudged up by just 0.2% in the third quarter of the year to £9,351/acre. This was the smallest increase for several years. For more insight and data please download the full report.

Development land Q3 – Greenfield sites up

The average value of greenfield land values in England rose 3% in the third quarter of 2024, according to the latest instalment of our Residential Development Land Index. However, brownfield and prime central London prices stayed flat due to thin activity, with some market participants taking a “wait-and-see” approach ahead of the Budget, says the report’s author, Anna Ward. Housebuilders are also sceptical that it will be possible to deliver the 1.5 million new homes pledged by Labour over the next five years. Download the full report for more insight and data.