Rural Update: The power of social media

Your weekly dose of news, views and insight from Knight Frank on the world of farming, food and landownership

7 minutes to read

Viewpoint

When Arla and its partners (supermarket chains and dairy farmers) announced a recent trial of a feed additive capable of cutting cow methane emissions by nearly 30%, it probably hoped for widespread applause from consumers. Instead, they have provoked a furious reaction on social media from critics, some of whom are worried about food safety and some who are sceptical about manmade climate change and any measures taken to mitigate it.

The lesson is that social media, as shown by the public’s support for farmers after the government’s recent Inheritance Tax reforms, can be a powerful ally. However, if the agricultural industry wants to introduce potentially beneficial innovations that have even the faintest whiff of controversy about them, it can’t assume they will be welcomed with open arms and must do a much better job of explaining what it is doing well in advance.

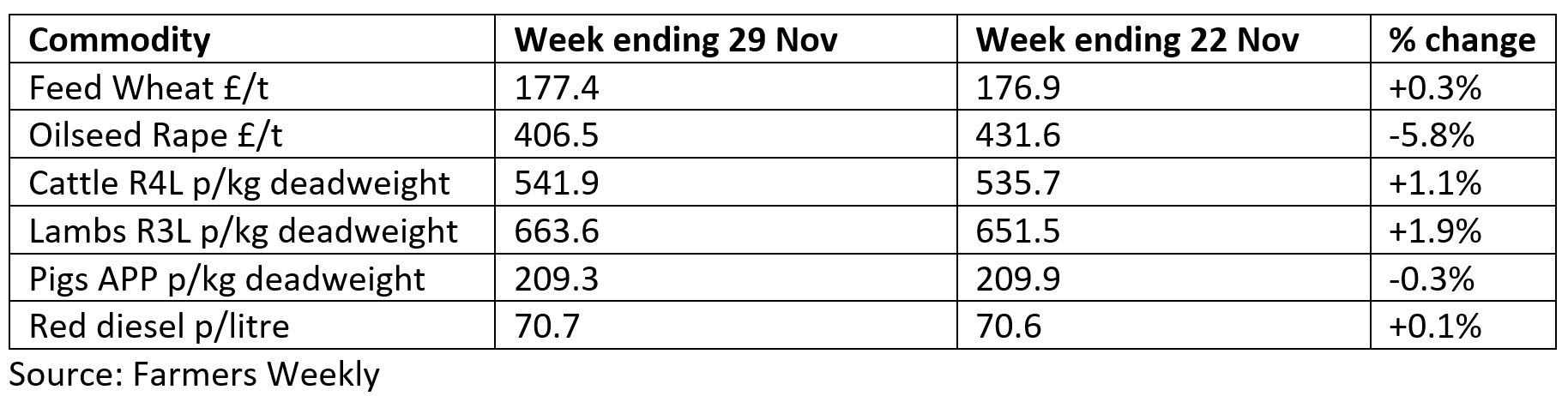

Commodity markets

Rapeseed tumble

Oilseed rape prices are now about £30/t lower than the recent highs hit at the beginning of November. The better prices brought more domestic crop onto the market as well as imports from Australia. Potential Trump and Chinese tariffs on Canadian canola could further boost the volume of imports heading towards the UK and the EU, putting more pressure on prices.

Milk price hike

The latest figures from Defra reveal that average UK farm-gate milk prices rose to 45.17p/litre in October, up almost 5% on the month and 22% year-on-year.

Cattle slump

New figures from the AHDB illustrate the cost pressures facing livestock farmers, even though beef prices continue to rise. Under its worst-case scenario, the organisation predicts that beef production in Great Britain could fall 7.5% by 2030, with suckler herd numbers sliding by almost 16%.

The headlines

Farm inheritance tax update

Around 265,000 people have now signed the NFU’s petition calling for the government to rethink its changes to Agricultural Property Relief (APR) and Business Property Relief (BPR).

Although the government has, so far, refused to back down on its Inheritance Tax (IHT) raid, the NFU’s President Tom Bradshaw, who met Keir Starmer privately last week, says he detects a more “conciliatory tone”.

Meanwhile, pressure continues to grow on the government to help older farmers, who may not have time to put in place alternative succession plans, such as gifting the farm to a son or daughter.

In a note published last week, The Institute for Fiscal Studies, although broadly still in favour of the reforms, says the government could make lifetime gifts of agricultural property made before a certain future date IHT-free, regardless of the timing of the death. Usually, the person making the gift has to live for seven years for it to remain tax free.

Cornwall Council also passed a motion last week condemning the changes, claiming they represent “an existential threat to a way of life integral to Cornwall’s identity”. Following a Freedom of Information Request, it transpires that the government has not yet conducted an impact assessment on the economic consequences of slashing IHT reliefs on farming businesses.

Grants cut without notice

Farmers and their advisors were taken by surprise last week when Defra announced that it was pausing offers for 76 standalone Countryside Stewardship capital grants “due to overwhelming demand”. Mark Topliff of our Agri-business consultancy team says the move will only add to the uncertainty about the future of government support for agriculture.

“I have a number of clients who submitted their applications for grants up to six weeks ago who now don’t know when their applications will be considered. I understand that there has been a surge in demand for these grants, but you would think there would have been a better solution to the problem than just stopping offers without any notice.”

Please contact Mark if you need help with any grant issues.

News in brief

Look beyond APR

Although the changes to APR discussed above have grabbed all the headlines, there were plenty more announcements in Rachel Reeve’s Autumn Budget that could have greater near-term impacts on farming businesses, says Simon Britton, our Head of Agri-consultancy. “It is understandable the industry is dwelling on IHT, but don’t let it distract from more imminent dangers.”

Read more of Simon’s thoughts on this and some of the other issues discussed at the recent CLA Rural Business Conference, which was sponsored by Knight Frank.

Milk methane uproar

Arla Foods, the Scandinavian dairy co-op, which is the UK’s biggest milk processor, has provoked a social media storm by announcing that it is trialling a new feed additive in the UK that can significantly cut the amount of methane burped out by dairy cows. However, despite Bovaer being widely used in other countries and there being no evidence it passes into a cow’s milk or meat when used as intended, critics have claimed that they should not be forced to drink unlabelled milk from cows fed with the supplement.

Danish carbon tax

Meanwhile, in Denmark, politicians, farmers and environmental groups have finally reached an agreement on a new methane tax. From 2030, farmers will have to pay a levy of 300 kroner (around £34) per tonne of methane on emissions from livestock including cows and pigs. The tax will rise to 750 kroner in 2035. The country also plans to plant 250,000 hectares of new forest and restore 140,000 hectares of currently cultivated peatlands to help benefit nature.

Tree-planting taskforce

To get the UK planting more trees, Foresty Minister Mary Creagh launched a new Tree Planting Taskforce last week. The Taskforce, chaired by the forestry ministers from England, Scotland, Wales and Northern Ireland, will oversee the planting of millions of trees to help the UK meet its collective net zero targets and help make the UK a “clean and green energy superpower”. The announcement comes after a commitment in the Budget to provide up to £400 million in England across the next two years for tree planting and peatland restoration.

Greenfield development guide

The government has pledged to build 1.5 million new homes over the next five years. To hit these targets many will have to be built on greenfield sites, which could provide significant opportunities for farmers and estate owners. The planning and development process, however, can seem daunting. To help, Jonathan Wish of our Development and Planning team has put together this seven-point guide on how to navigate the complexities of greenfield development.

The Rural Report – Out now

The latest edition of The Rural Report, our flagship publication for farm and estate owners, looks at the numerous opportunities and challenges arising in the countryside following the election of the new government. Find out more or request a copy

Property of the week

Suffolk stud launch

This week, we focus on a recently launched property that is sure to appeal to equine lovers. Martley Hall at Easton, near Woodbridge, is a 220-acre state-of-the-art stud farm, parts of which date back to the time of the Domesday Book. In addition to the moat-enclosed six-bed main house, there are four separate ensuite guest rooms located around an Italian courtyard, four cottages and a large indoor leisure complex. The equine facilities include an Olympic-sized indoor arena, 24 boxes, four heated foaling boxes, an outdoor arena, a horse walker and three all-weather turnout paddocks. The guide price is £9 million. For more information, please contact Georgie Veale.

Property markets

Country houses Q3 – Market waits

Discretionary buyers held back from a new country house purchase pending Labour’s first budget on 30 October. Offers from potential buyers were down 10% in the three months to August, according to the latest results from the Knight Frank Prime Country House Index. However, the slide in average values has slowed with prices dropping by just 1.2% in the 12 months to the end of September - the lowest annual fall since Q1 2023 - points out Head of UK Residential Research Tom Bill. He predicts a total average price slide of 2% this year, dependent on the outcome of the Budget.

Farmland Q3 – Prices flatline

The farmland market in England and Wales was also on budget alert, judging by the latest results from the Knight Frank Farmland Index. Average values for bare land nudged up by just 0.2% in the third quarter of the year to £9,351/acre. This was the smallest increase for several years. For more insight and data please download the full report.

The average value of greenfield land values in England rose 3% in the third quarter of 2024, according to the latest instalment of our Residential Development Land Index. However, brownfield and prime central London prices stayed flat due to thin activity, with some market participants taking a “wait-and-see” approach ahead of the Budget, says the report’s author, Anna Ward. Housebuilders are also sceptical that it will be possible to deliver the 1.5 million new homes pledged by Labour over the next five years. Download the full report for more insight and data.